In crypto, maker fees are charged when liquidity is added to a market (limit orders); taker fees are charged when liquidity is taken away (market orders). Taker fees are higher than maker fees.

Written by: Mike Martin | Updated July 26, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Many centralized cryptocurrency exchanges like Kraken and Binance divide their trading fees into two categories: maker fees and taker fees.

In this article, we’ll explain how liquidity affects these fees and show you why they differ.

🍒 tasty takeaways

In cryptocurrency markets, market ‘taker’ orders are filled immediately at current market prices.

Since trades that are filled immediately take liquidity away from the market, traders have to pay more for this.

Market ‘maker’ orders (limit orders) are set away from the market and therefore add liquidity.

Maker trades are incentivized with lower fees when compared to taker trades.

All orders that add liquidity to a market are ‘maker’ trades; all orders that take liquidity away from a market are ‘taker’ trades. Maker trades are advantageous to liquidity as they populate order books and allow for the time to cross trades. In crypto, makers are similar to traditional finance (TradFi) market makers in that they make markets.

Maker and taker fees usually vary across crypto products (e.g., standard cryptocurrencies vs stablecoins). Additionally, the fees makers and takers pay tend to decrease as trading volume increases.

🧠 Let’s go in-depth!

Market Taker Fee Explained

A ‘taker’ fee is attached to orders on crypto exchanges that are set to get filled immediately. Taker fees are higher fees when compared to maker fees as these trades take liquidity away from the market.

Market Taker Trade Example

Let’s say you want to buy bitcoin (BTC) immediately. BTC is bid at $69,000 and offered at $69,010. Your market buy order would be filled immediately at (or hopefully near) the current ask price of $69,010.

Since this order does not have time to be matched or added to a book, you are a drag on liquidity, and for this, you must pay!

Market Taker Fee Cost

The fee in the above trade example may be 0.16% of the total trade price; if this trade was placed away from the market (limit order), it would be a ‘taker’ fee, which may pay only 0.10%.

Market Taker Order Types

The below crypto order types are classified as maker trades:

Market Order: Market orders will get filled immediately at the market price, whatever that may be.

Limit Order Priced at Market: Limit orders that are filled immediately are takers.

All or None (AON): All or none says fill all of it or none of it; they are takers.

Fill or Kill (FOK): Fill it now or cancel it orders are takers.

Market Maker Fee Explained

On cryptocurrency exchanges, market ‘maker’ fees are attached to orders that are placed away from the current market price. Limit orders placed away from the market are maker orders.

Market Maker Trade Example

Let’s say you want to buy ether (ETH) at a price of $2,900. Currently, the market (bid/ask price) for ETH is $2,920 / $2,935.

If you place a limit order to buy ETH at $2,900, you will not get filled immediately. Your Ethereum sell order will be placed in a queue to be matched up with a buy order if/when the market falls to $2,900.

By not being an immediate drag on liquidity, you are an asset to this exchange, and therefore the fee attached to your order will be less than a traditional market order.

Market Maker Fee Cost

Let’s say that the price of ETH falls to $2,900 and our limit order is triggered.

Our order could be crossed with a separate market order to sell ETH. Since we are providing liquidity for this market order to be filled, our fee will be less than that of the marker ‘taker’ trade. Perhaps our maker fee will be 0.19% of the trade cost while the taker may pay 0.25% of the trade cost in fees.

Market Maker Order Types

Here are all crypto order types associated with market maker trades.

Limit Orders Priced Away From Market: Any limit order that won’t get filled immediately is a maker.

Stop-Limit Orders: Stop-limit orders are a type of order that combines a stop and a limit; the stop triggers the trade, but it will not be filled at a worse price than the limit specifies.

Let’s next compare the trading fees for popular crypto trading platforms.

Comparing Maker & Taker Fees

Let’s now look at the different maker and taker fees that major exchanges charge their users.

⚠️ There is no ‘standard’ fee in crypto as there is for stock trading; crypto fee schedules can be incredibly convoluted and complex. The exception is tastytrade, which charges a flat 1% on all trades or $10, whichever is less.

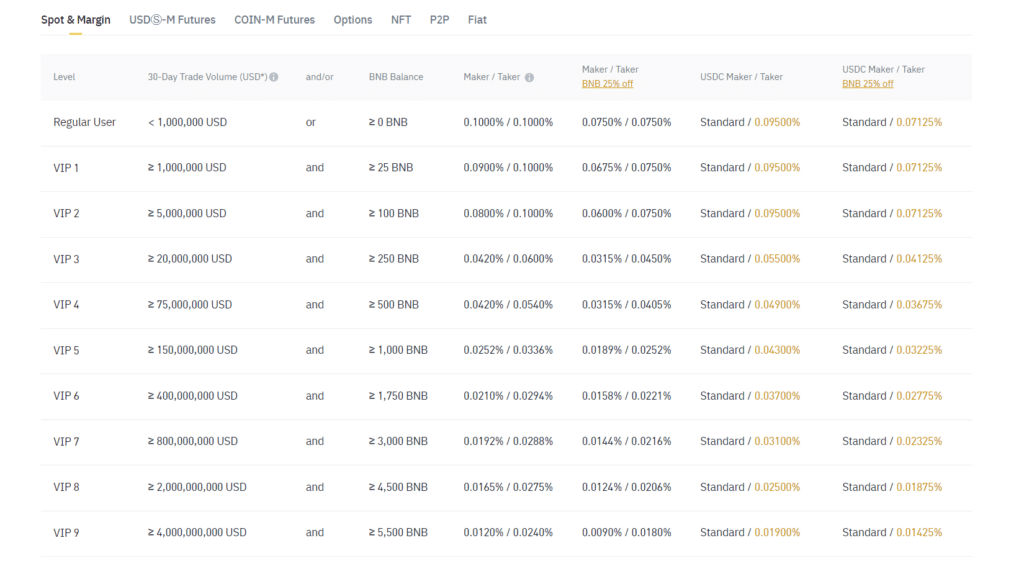

Binance Maker/Taker Crypto Fees

The below chart from Binance represents their maker-taker fees for spot trading.

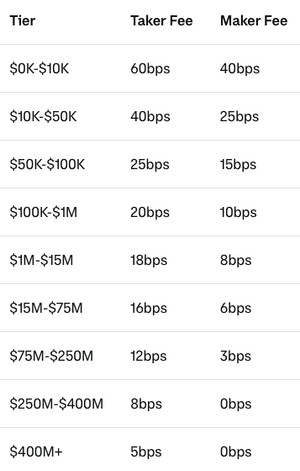

Coinbase Maker/Taker Crypto Fees

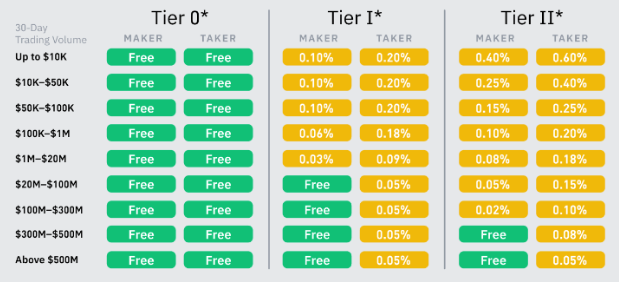

Here is the maker-taker structure that Coinbase uses for spot trading.

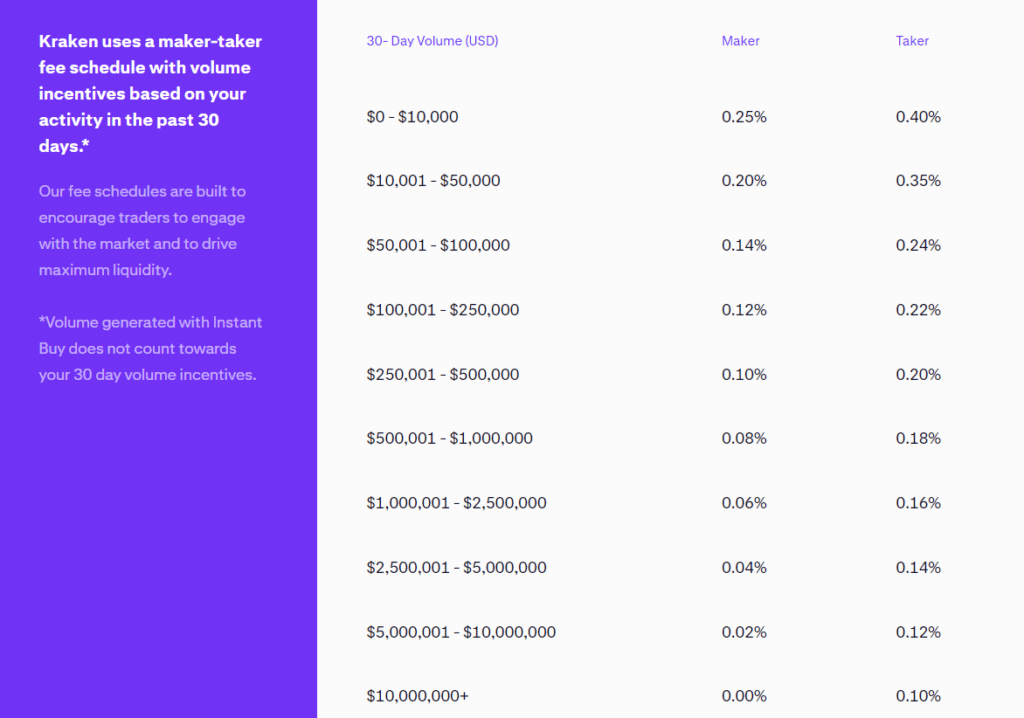

Kraken Maker/Taker Crypto Fees

Here are the maker-taker fees for Kraken.

Trading Fees on DeFi Platforms

In decentralized finance (DeFi), trading fees are structured differently. This is because decentralized exchanges (DEXs) use automated market makers, or liquidity pools, instead of traditional order books and order crossing to facilitate liquidity in the market.

These DeFi platforms are called ‘on-chain’, which means on a blockchain network. Our previous examples are all ‘off-chain’ exchanges.

On DEXs like Uniswap, anybody can contribute two or more cryptocurrencies to a liquidity pool and become a market maker. As traders buy and sell from this pool, you earn fees!

📚 Read: Liquidity Pools 101

Maker vs Taker Fees FAQs

-

Is it better to be a maker or taker?

It is better to be a market maker in crypto trading as these trades incur fewer fees than market taker trades.

-

What are examples of maker and taker fees?

An example of maker and taker fees can be seen in the below image from Binance. The maker-taker fee structure changes based on tiers and volume traded. For example, under Tier 1, a small trade for a maker taker would incur a 0.10% fee while the same trade for a maker market would be 0.20%.

What is the taker vs maker fee at Coinbase?

At Coinbase, the maker vs taker fee depends on the size of the trade. For trades with a volume of under $10,000, the taker fee is 60bps while the maker fee is 40bps, as seen below.

What is the difference between maker and taker fees on Binance?

On Binance, ‘taker’ fees are market orders that get filled immediately. These maker fees have a higher fee attached than market ‘maker’ fees, which are limit orders placed away from the market.

Do I pay both maker and taker fees?

You will pay a maker fee if you place a limit order away from the market; you will pay a taker fee if you place a market order.

Who has the lowest crypto maker taker fees?

Tastytrade offers the most cost-efficient way to trade crypto for most investors. Their crypto fees are 1% of the trade value with a $10 max, regardless of trade size.

Who is a taker in crypto?

In crypto, a taker represents any order that is immediately executed, like a market order.

Maker/Taker Fees Takeaways

Maker fees are charged when placing limit orders away from the market, while taker fees apply to immediate market orders.

Taker fees are often higher than maker fees as payment for liquidity taken from the market.

Market maker orders, such as limit orders and stop-limit orders, typically have lower fees or even rebates to incentivize providing liquidity.

Additional Reading:

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences