Seasonality shines as crypto continues its climb higher 📈

November’s crypto market update highlights a strong performance, with Bitcoin’s 11% gain and a 127% year-to-date increase, driven by clearing regulatory challenges, increasing institutional participation, and a potentially favorable shift in Federal Reserve policies.

Written by: Ryan Grace | Updated December 1, 2023

Reviewed by: Mike Martin

Fact checked by: Laurence Willows

Table of Contents

🍒 tasty takeaways

Bitcoin posted an 11% gain in November, contributing to a 127% year-to-date increase, outperforming many other assets with comparable market caps.

The rally is attributed to the clearing of regulatory uncertainties, the potential approval of a spot Bitcoin ETF increasing institutional participation, and open interest in bullish Bitcoin futures hitting all-time highs.

With inflation showing signs of slowing and the possibility that the Fed might stop hiking rates, a more neutral monetary environment could emerge, benefiting Bitcoin, especially with the upcoming halving event and the SEC’s decision on spot Bitcoin ETFs.

Bitcoin's November Rally: Seasonal Trends

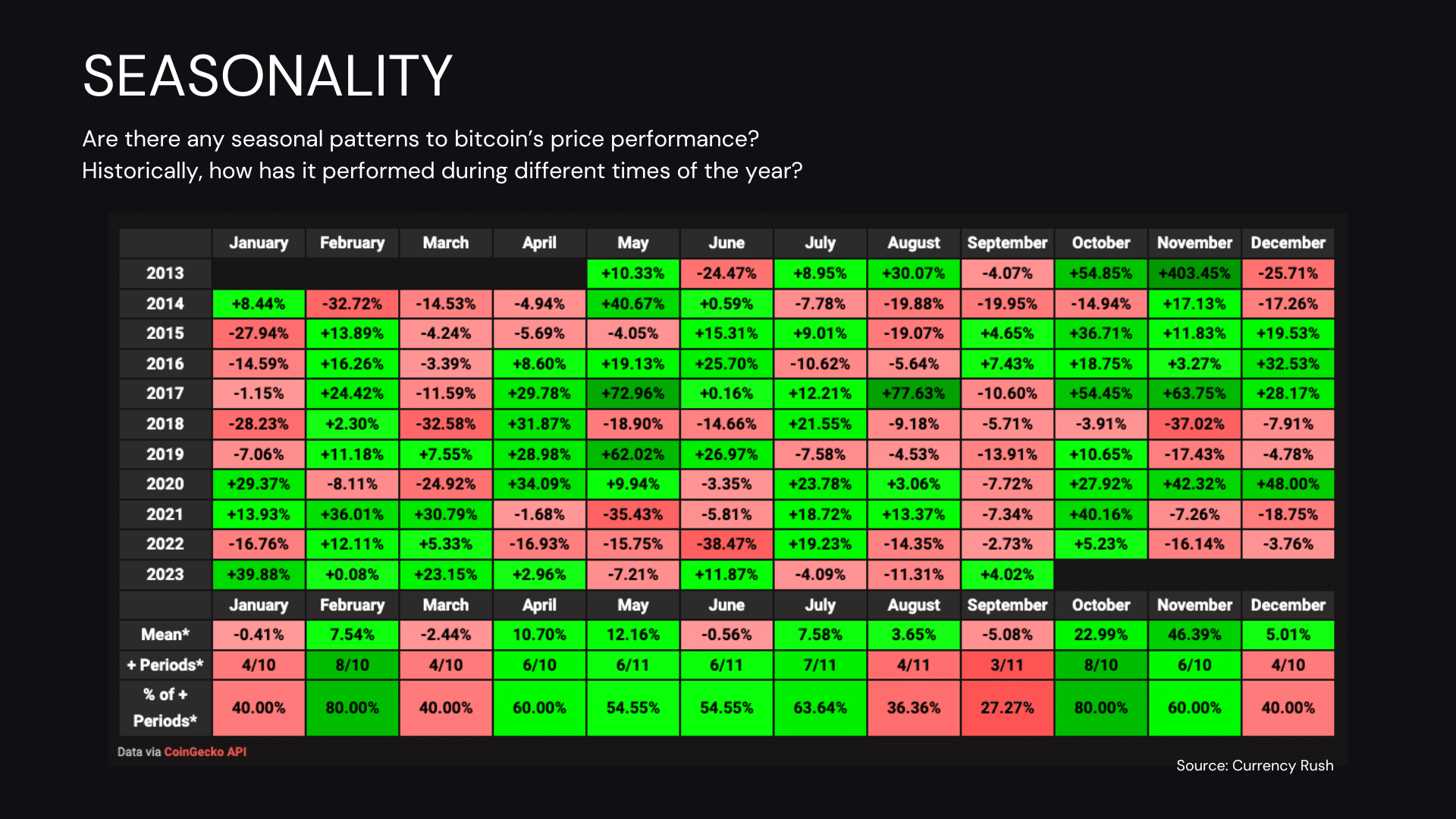

November has historically been a decent month for the bulls, with the price of bitcoin finishing in positive territory two-thirds of the time going back to 2013. Over this period the median return for bitcoin has been 7.5% and this year BTC posted a gain of 11% for the month of November.

Source: CoinGecko

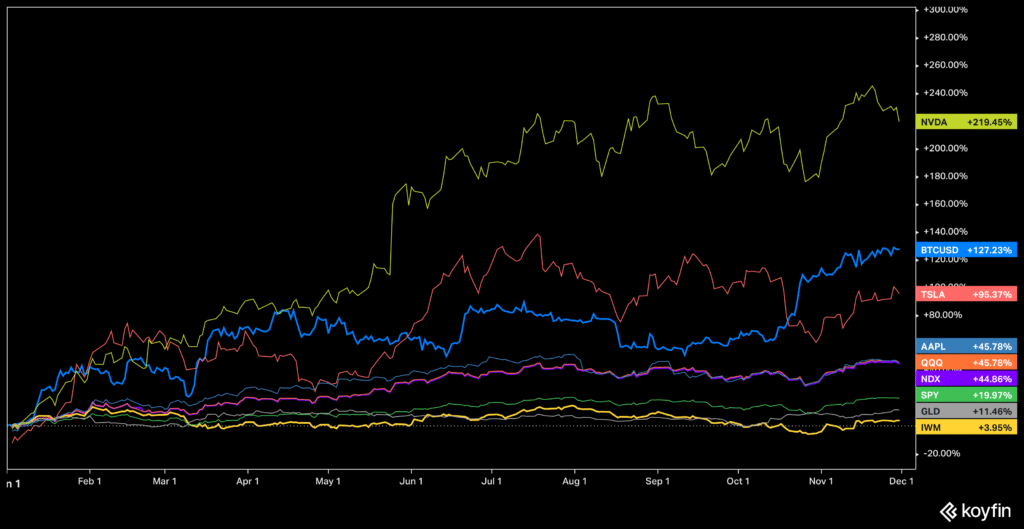

This puts the biggest digital asset up a solid 127% YTD, smashing just about anything else we can find with a market cap of a few hundred billion (eh, maybe with the exception of Nvidia).

Source: koyfin

We’re on a bullish trend, but what’s driving this rally, and will it sustain until the year’s end? Let’s next explore the top three factors!

1. The Storm Clouds Are Clearing

This time last year, the price of bitcoin dumped about 20% as the market started to comprehend the reality of the collapse of FTX. Since then, justice has been served. We’ve also seen the other shoe drop, in the form of criminal charges levied against Binance to the tune of billions.

Arguably the forced selling pressure and fears of an all-out collapse are now over. The industry still faces regulatory uncertainty and enforcement measures from the anti-crypto side of the U.S. government, but largely we’ve moved on and can look past FTX and Binance.

What matters?

2. Institutions Are Participating

There’s been heavy focus on the SEC finally approving a spot bitcoin ETF; we’re closer than ever.

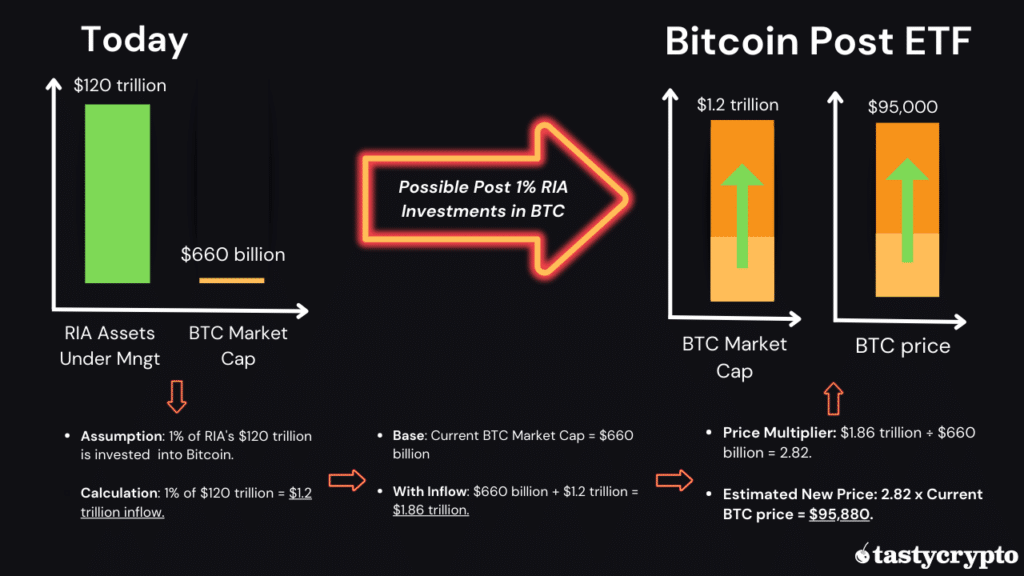

While I’d caution it’s certainly not a sure thing, an ETF would create a much larger conduit for future capital flows into bitcoin and make it easier for institutions to gain investment exposure. This matters given the relatively small size of crypto as an asset class today versus alternative assets traditionally viewed as a store of value.

For example, we estimate that if 1% of the roughly $120 trillion managed by RIAs found its way into BTC, we could see a spot price of around $90,000.

I’m not saying a spot bitcoin ETF sucks up a trillion dollars. Still, the point is, more vehicles for crypto exposure are bullish from a flows perspective over the long run and their arrival seems almost inevitable.

Whether the industry gets its ETF is still up for debate. Regardless, asset managers are building bullish positions. According to The Block, open interest in long (bullish) bitcoin futures just hit an all-time high.

Participation in U.S. listed derivatives markets continues to climb across both bitcoin and ethereum, with the BTC forward curve shifting into contango, resulting in a widening premium between spot and future prices. This is another positive sign and creates a setup where traders can collect a positive spread or carry by going long spot BTC and selling futures against the position to collect the premium.

3. Inflation Slowing; Fed May Be Done

Yes, crypto has done well this year, but this follows one of its worst periods on record. It’s easy to go up a lot year-over-year after falling more than 60% the year prior.

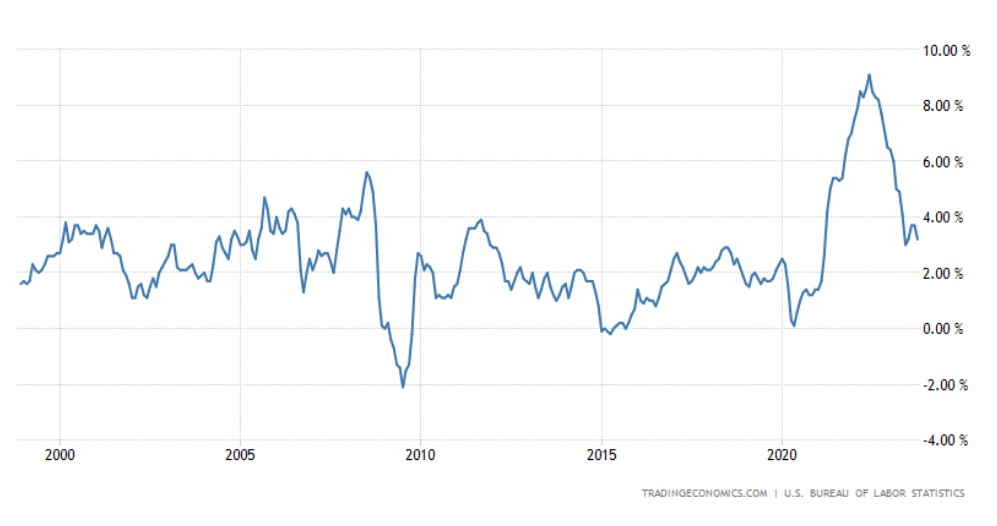

We’ve moved past the crash catalysts that have reshaped the industry, but crypto still faces monetary policy headwinds in the form of the U.S. Federal Reserve’s balance sheet reduction, a 5% Fed Funds rate, and global central banks that have tightened policy at one of the fastest paces on record, all to combat the inflationary dynamics they were also in some ways responsible for post-COVID.

The prospect of parking cash in short-term treasury bills and collecting 5% has likely deterred capital from participating in digital assets on margin and DeFi activities, relative to an environment where the Fed buys hundreds of billions in Treasury bonds and pins rates close to zero.

I’m not calling for the Fed to reverse course, but the prospect of sticky inflation and further rate increases seems be less likely following the reaction to recent economic data.

Source: Tradingeconomics.com

Neutral Rate Environment Ahead?

History has shown that periods of elevated CPI are the outlier versus periods of persistent disinflation and on-going currency debasement. The type of environment in which bitcoin’s price has historically shown to benefit.

I think we’re moving towards a more neutral environment where the Fed is done hiking and some of the pressure of higher rates abates and this helps the bull case for bitcoin.

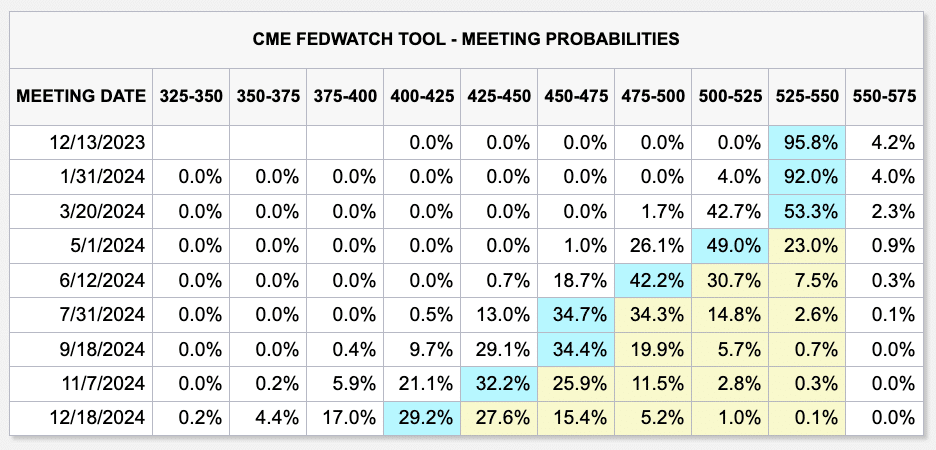

I’m not going to pretend I know what the Fed is going to do but when looking at policy expectations via the CME’s FedWatch tool, the market is no longer pricing in additional hikes, with the added potential for possible rate cuts to occur towards mid-2024.

Coincidentally mid-year cuts would align with the Bitcoin network’s upcoming halving event and deadlines around the SECs decision on spot Bitcoin ETFs.

Source: CME Fed Watch Tool

Navigating Economic Uncertainties

We’ve got momentum around year-end price action, signs of continued institutional participation, and the possibility Fed policy could be less of a head-wind going forward.

What could go wrong?

If we shift back to the economic front for a moment, a lot could go wrong. I worry the catalyst with the biggest macro influence on crypto, the Fed policy/liquidity cycle, requires a much worse environment and economic slowdown than we’re currently experiencing.

It would need to get pretty ugly out there before Fed liquidity is in the driver’s seat. The money printer doesn’t go burr with the S&P 5% off its all time high. While possible, I don’t think it’s probable crypto rips while traditional assets dip. Maybe the market collectively sniffs out the reflexive nature of the policy dynamic, but I doubt it.

Conclusion: Trade Vol & Take Profits

In my view, any serious pull back in crypto e.g. -20% sets up a compelling entry to front-run what comes next from the Lords of Monetary Policy, especially if you have a long duration.

In the meantime, trade the vol (3k price moves at 60% 30d IV are to be expected), stick with the trend, and take some profits when you have them.

Ryan Grace

Role: Head of tastycrypto

Expertise: Blockchain, Cryptocurrency, Decentralized finance (DeFi), Options trading,

Macroeconomics

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences