A crypto bubble occurs when speculation, hype, and psychological factors lead to a surge in cryptocurrency prices far beyond their actual and rational values.

Written by: Anatol Antonovici | Updated March 18, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

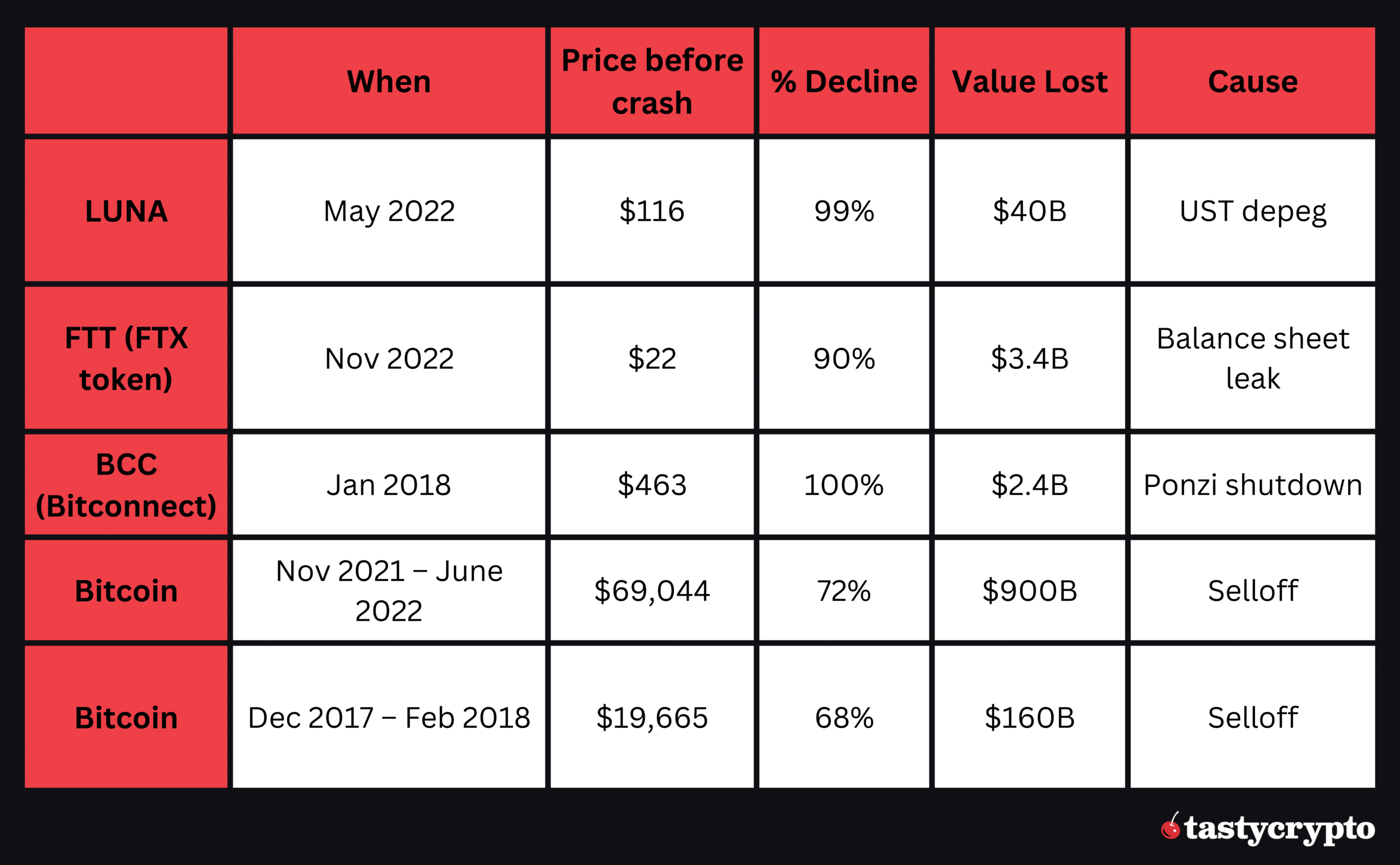

This article discusses 5 major crypto bubbles, notably LUNA, FTX, Bitconnect, and Bitcoin.

Table of Contents

🍒 tasty takeaways

A cryptocurrency bubble occurs when the current price of a digital asset(s) greatly exceeds its hypothetical actual value.

The Terra (LUNA) and FTX (FTT) crashes, along with the collapse of the Bitconnect (BCC) Ponzi scheme, represent significant crypto bubbles in which the assets were completely wiped out.

Bitcoin and Ethereum consistently recover post-bubble bursts, unlike many others coins.

Summary

| Bubble | Summary |

|---|---|

| LUNA & FTX | Cryptos that plummeted to zero post-bubble burst. |

| Bitconnect | Collapsed Ponzi scheme wiping out its value. |

| Bitcoin Cycles | Despite bubbles, Bitcoin has always recovered. |

| What's a Crypto Bubble? | Prices far exceed intrinsic value due to speculation and hype. |

| Avoiding Bubbles | Conduct research and understand underlying fundamentals. |

What Is a Crypto Bubble?

In economics, a bubble occurs when asset prices, or the prices of an entire asset class, significantly exceed their intrinsic value. This can be due to a buying frenzy that spirals out of control or because the market is misled about the assets’ fundamental value.

In crypto, defining a bubble is trickier because Bitcoin and many altcoins don’t have intrinsic value. They were designed as a form of virtual money backed by a blockchain network. Assessing the valuation of a house or a stock is not like assessing the valuation of a house or a stock.

We can define crypto bubbles as exaggerated bullish markets that defy the logic of long-term fundamentals.

Pump and Dump Schemes

Crypto pump-and-dump scams are mini bubbles related to scams. These groups coordinate efforts via social media to hype and artificially inflate prices, aiming to attract and eventually defraud unsuspecting investors. Then, they sell the token at its peak, leaving token holders outside their group with significant losses.

Such schemes were especially popular during the initial coin offering (ICO) craze in 2017-2018 and the non-fungible token (NFT) frenzy in 2021.

According to Chainalysis, about 24% of the coins launched in 2022 were potentially pump and dumps.

It’s important to really understand a crypto project’s whitepaper before investing.

Major Crypto Bubble Collapses

Given the speculative nature of cryptocurrencies, significant bubbles have emerged. We will first cover the cryptocurrencies that plummeted to zero after their bubbles burst. Then, we’ll examine Bitcoin’s two major bubble bursts. This distinction is crucial as Bitcoin has consistently recovered from its downturns, unlike other fundamentally failed assets.

1. Crash of Luna

In May 2022, the sudden crash of the Terra network triggered the crypto winter, causing Bitcoin to pull back over 60% from its 2021 peak.

South Korean Do Kwon led the Terra ecosystem. It included the terraUSD (UST) stablecoin, which was meant to maintain a $1 peg, and a sister coin called LUNA, which was designed to stabilize UST’s pegging mechanism.

However, the algorithmic stablecoin model proved unfeasible. After a certain trigger—many believe it was a malicious attack—the bubble exploded. UST’s $18 billion and LUNA’s $40 billion market capitalization values were eliminated entirely. Do Kwon was later arrested.

2. Collapse of FTX

Source: WSJ

The bankruptcy of FTX, once the second-largest crypto exchange after Binance, might have been delayed or even avoided if not for the LUNA collapse, so the two events are related to some degree. The crash of FTX was the last punch that knocked out the crypto market.

Like Binance, FTX had a native coin, FTT, which had a $3 billion valuation before the collapse.

The issue with FTX stemmed from its CEO, Sam Bankman Fried, and his team improperly using FTT tokens for crypto trading through Alameda Research, a supposedly independent sister company.

The collapse was triggered by a balance sheet leak to CoinDesk, followed by significant actions from Binance, leading to the dramatic fall of the entire FTX empire.

3. Bitconnect Ponzi

Source: Forbes India

Bitconnect (BCC) was a cryptocurrency connected to an investment platform that promised high returns. However, it was, in fact, a Ponzi scheme—the system used incoming funds to pay earlier investors.

The scheme operated from 2016 to 2018, when the intensifying regulatory pressure led to its collapse.

BCC’s value soared from $0.17 to an all-time high of $463 in December 2017, placing it among the top 20 largest coins.

The SEC alleged that Bitconnect defrauded US investors of $2.4 billion.

Secure Your Crypto With Self-Custody

When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

Bitcoin Bubble Cycles

Bitcoin has undergone two major bubble cycles, neither caused by fraud. Economic bubbles can affect even the most solid markets—think about the housing bubble in 2008.

2022 Crypto Winter

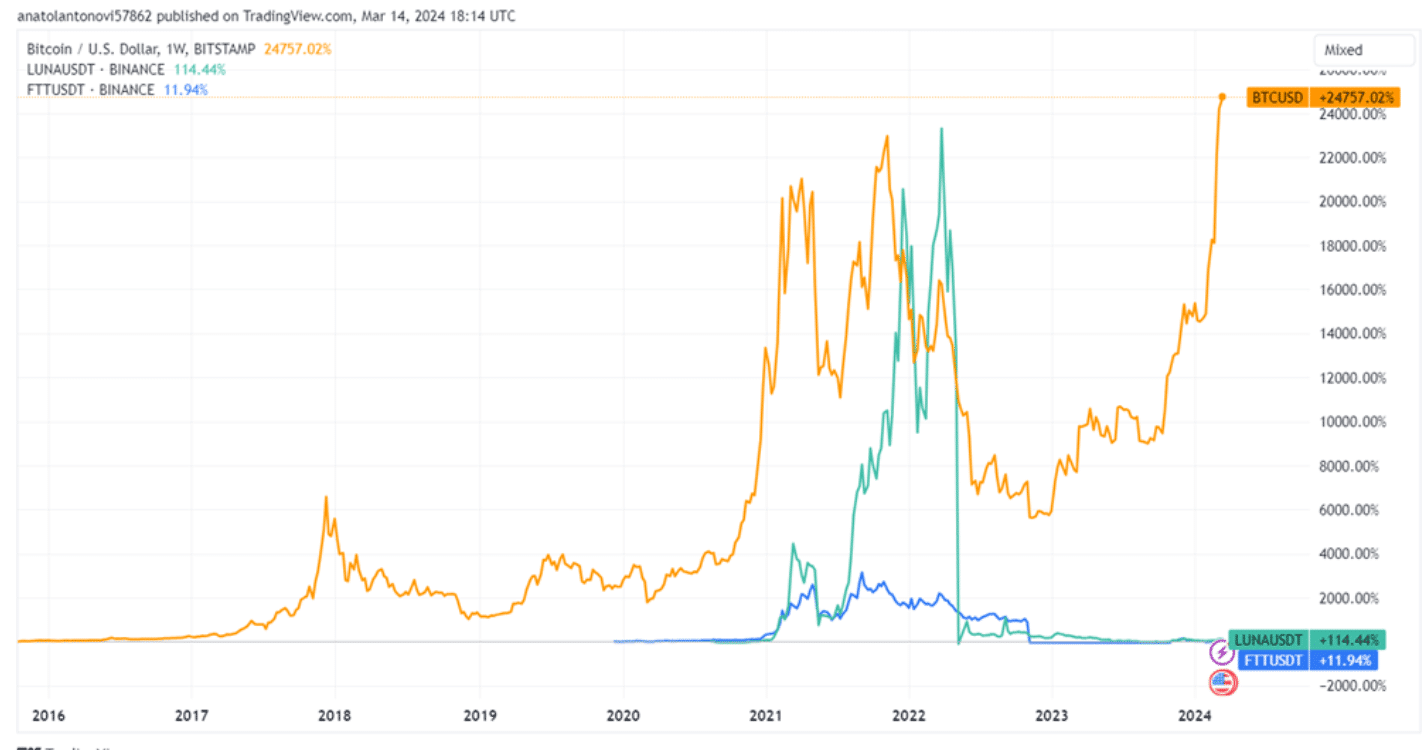

In November 2021, Bitcoin reached a new record high before experiencing a pullback. Initially seen as a standard market correction, this downturn stretched over several months. The crash of LUNA thwarted attempts to recover in April and May.

In the end, Bitcoin fell from over $69,000 in November 2021 to about $19,000 in June 2022.

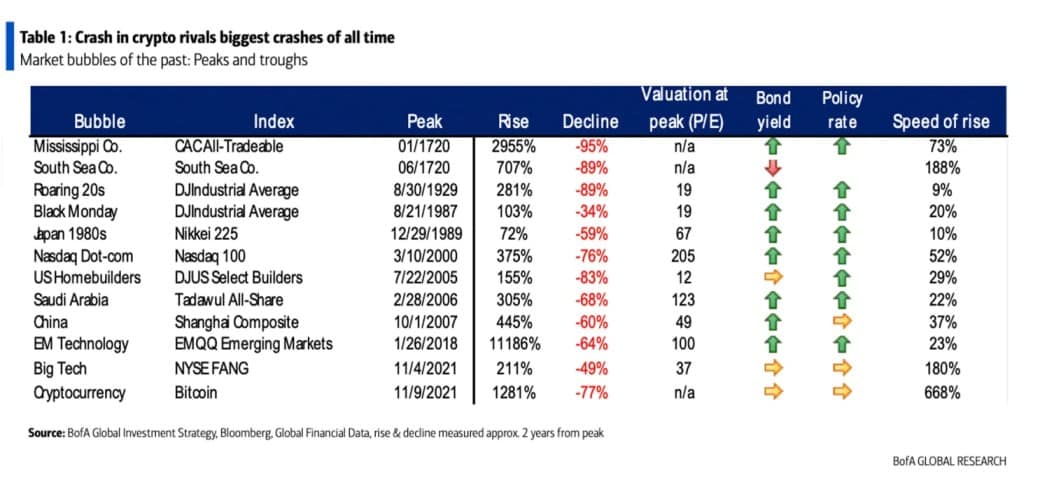

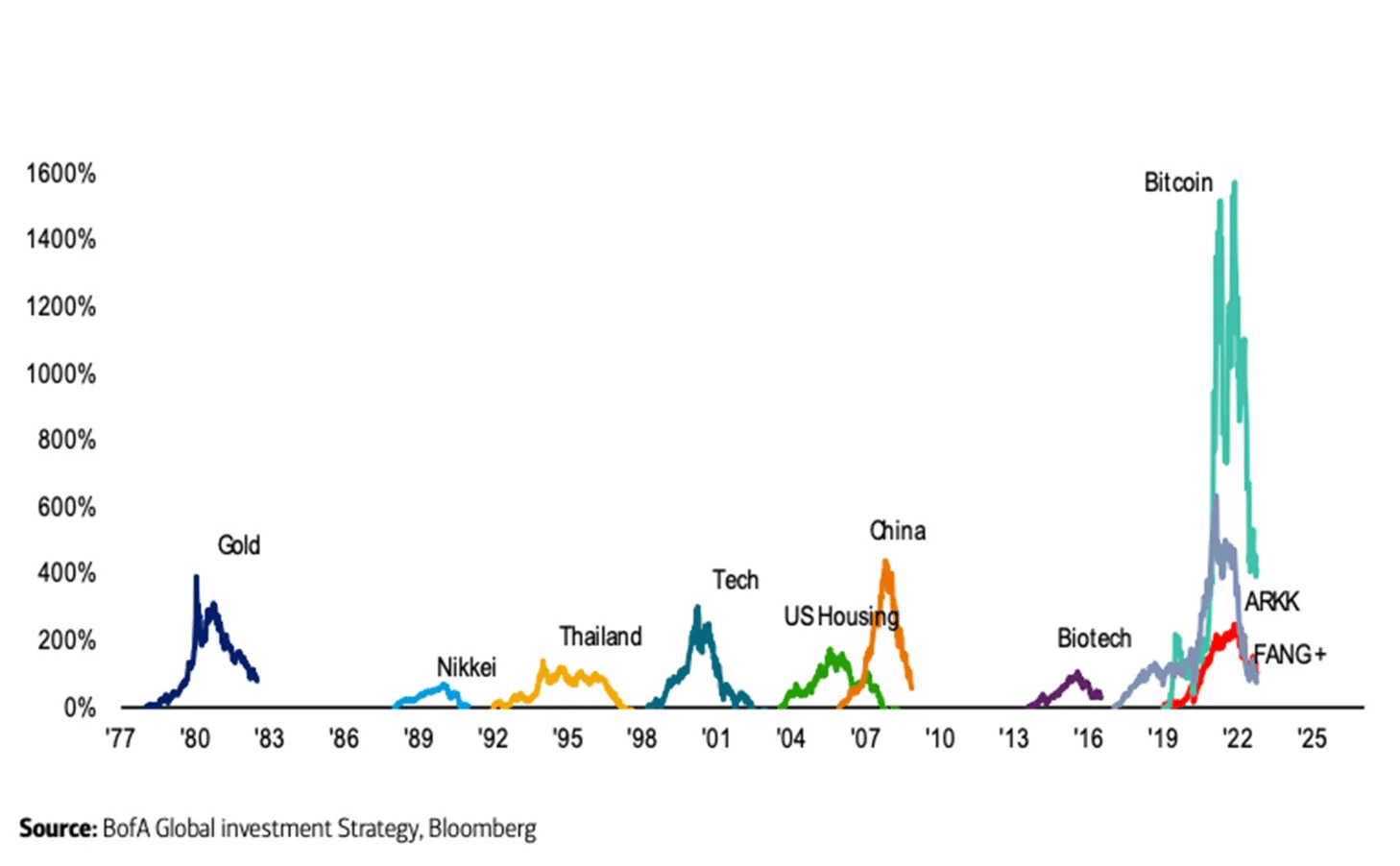

According to Bank of America, Bitcoin’s selloff was the fifth-largest wipeout ever. 👇

Source: Fortune

Here’s how it compares to other economic bubbles during the last few decades:

Source: Fortune

The last crypto winter affected the entire cryptocurrency market. Like Bitcoin, other digital assets, including Ethereum (ETH), lost more than 50% of their value.

2018 Selloff

The crypto bull run from late 2017 was the first to hit mainstream media and catch the attention of Wall Street. The intensifying hype drove BTC to over $19,500 in December 2017. However, the overbought market started to lose traction. In less than two months, Bitcoin was trading below $7,000.

Crypto skeptics were sure they witnessed the end of crypto.

Here is the price performance of Bitcoin, LUNA, and FTT:

Source: TradingView

Do We Have a Bubble Today?

With Bitcoin close to its all-time high as I write this, we cannot exclude that we’re experiencing another bubble forming. Still, while Bitcoin has the chance to form a long-term bull run, Dogecoin-like meme coins are definitely in a bubble because of two simple reasons:

- Their prices are growing too fast.

- They have no utility.

Meme coins are currently a $60 billion market, trading at levels not seen before the 2022 crypto winter.

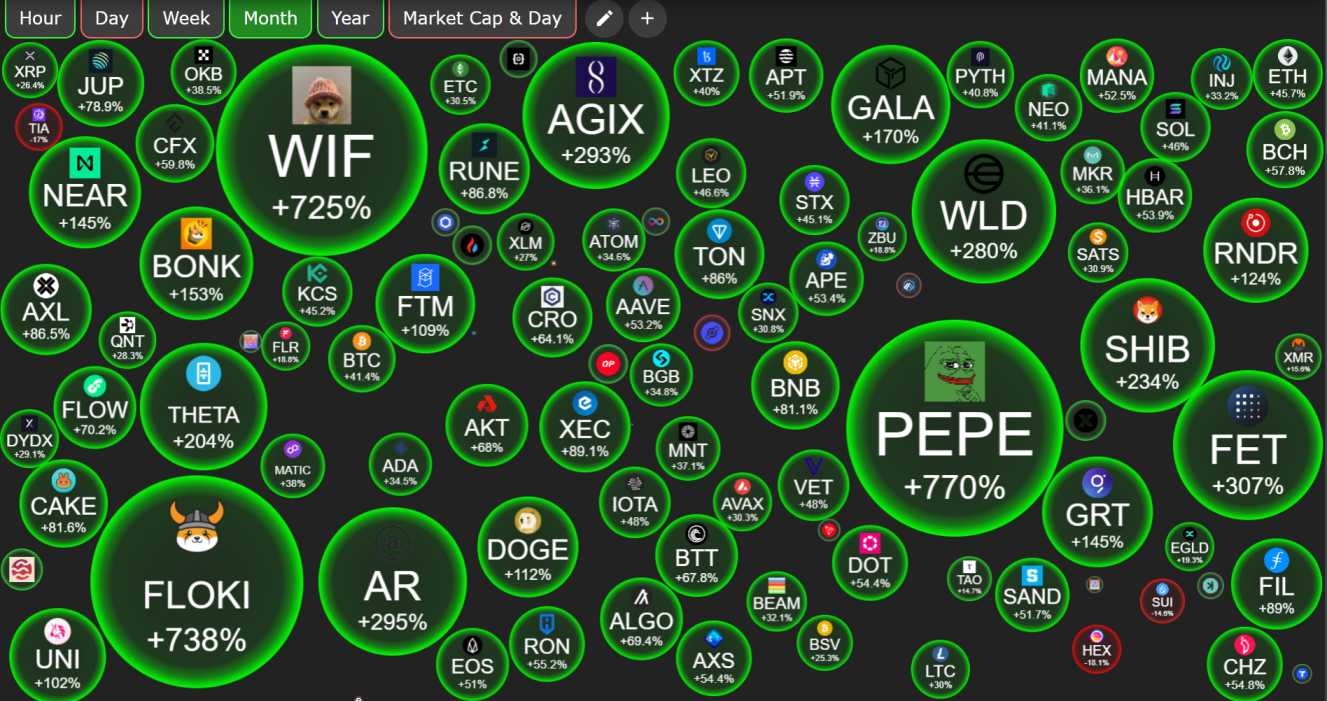

A great resource for identifying potential bubbles is cryptobubbles.net.

Source: cryptobubbles.net

FAQs

A crypto bubble occurs when the price of a crypto asset increases rapidly due to irrational exuberance, driven by the fear of missing out (FOMO) and defying market fundamentals.

To avoid crypto bubbles, you should conduct thorough research and due diligence before investing in a crypto asset. You should also ensure the current market value corresponds to underlying fundamentals.

Even large cryptocurrencies, such as Bitcoin, can form bubbles. The best approach is to use stop-loss orders to avoid unexpected losses. Elsewhere, ‘hodlers’ prefer not to react at all, leaving their assets untouched for many years to gain from long-term growth.

Bitcoin has recently updated its all-time high, so it may be forming another major bubble. However, we can define a bubble after it bursts, so we cannot know for sure whether we’re witnessing another bubble.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com