Both gold and Bitcoin (BTC) serve as excellent hedges against inflation. Mining activities and discoveries influence gold’s supply, while Bitcoin’s supply limit of 21 million coins cannot be altered. Bitcoin’s volatility is much higher than that of Gold.

Written by: Anatol Antonovici | Updated April 1, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Bitcoin and gold are robust store-of-value (SOV) assets, but which is a better investment? Let’s find out!

Table of Contents

🍒 tasty takeaways

Hedge Dynamics: Both serve as hedges against inflation, but differ in stability and volatility, with gold offering long-term preservation and Bitcoin showcasing short-term gains.

Investment Profiles: Gold offers stability and traditional value, whereas Bitcoin appeals with high potential returns and modern utility.

Contrast in Legacy and Form: Gold’s timeless value and physical nature contrast with Bitcoin’s digital, innovative nature, marking a new era in assets.

Price action: The prices of both gold and Bitcoin hit record highs at the beginning of 2024.

Summary

| Aspect | Gold | Bitcoin |

|---|---|---|

| Inflation Hedge | Long-term stability | Short-term responsive to inflation |

| Investment Profile | Stability and traditional value | High potential returns, modern utility |

| Legacy and Form | Timeless value, physical | Digital, innovative era |

| 2024 Record Highs | Yes | Yes |

| Supply Influence | Mining activities/discoveries | Fixed limit of 21 million coins |

| Volatility | Lower | Higher |

Brief History of Gold

When you think about gold, you think about wealth, power, and influence. Indeed, the precious metal has been used for centuries as a measure of wealth, although its utility has changed dramatically.

For thousands of years, gold was used as a currency across all continents, but the emergence of fiat currencies as a more convenient means of exchange has left the metal with a secondary role. In the 20th century, gold gained the status of a safe haven asset, being a good refuge during major crises and geopolitical tensions.

Is Gold a Good Hedge Against Inflation?

Contrary to popular belief, the precious metal hasn’t historically been a great inflation hedge in the short and medium term, although it can preserve wealth in the longer term.

Jason Porter, senior investment manager at Scottish Heritage SG, told Forbes:

“A hedge against inflation would typically increase in value in line with the sharp rise in consumer prices. However, during some of the most recent, extreme moments of inflation in the U.S., gold has produced a negative return for investors.”

Scottish Heritage SG

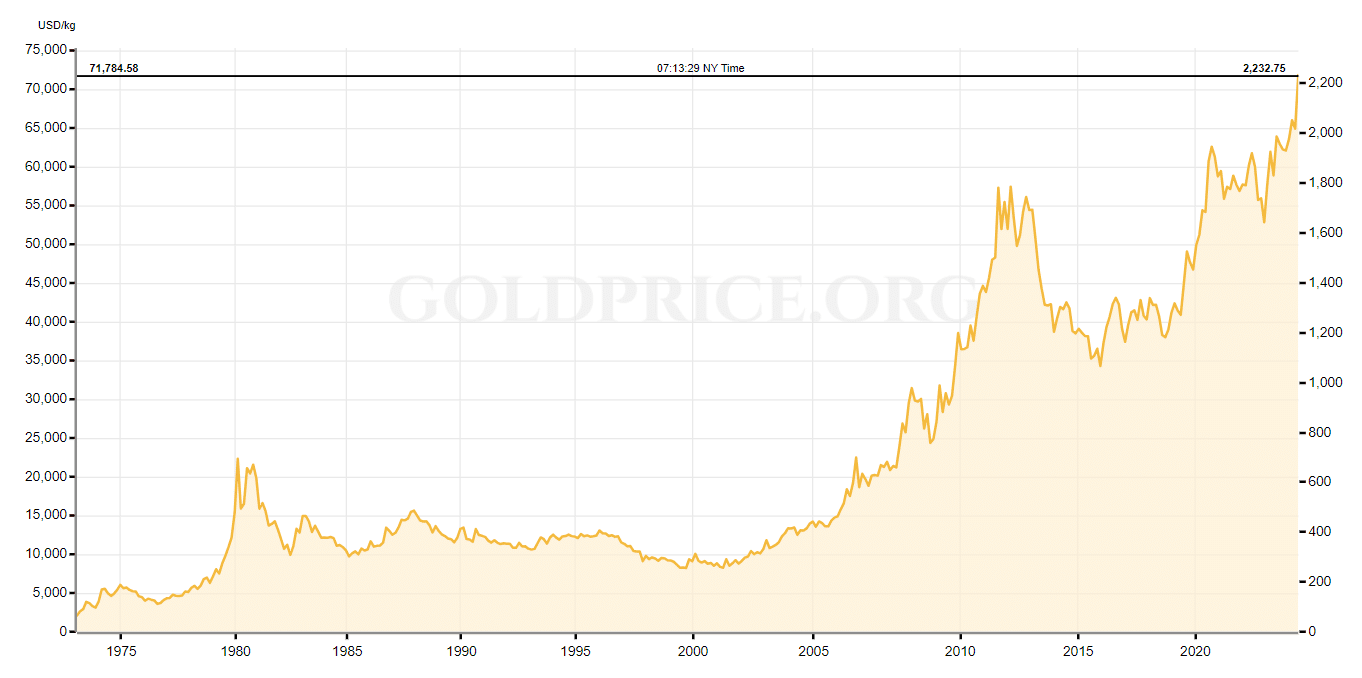

Nevertheless, the metal can store value in the long term. Since the ‘Great Inflation’ in the 1970s, the price of gold has increased from less than $80 an ounce to the current record level of over $2,200, gaining more than 2,600%. Of course of this same duration, the purchasing power of the US dollar has plummeted.

Source: GoldPrice.org

Brief History of Bitcoin

Bitcoin (BTC) is a digital currency that leverages blockchain technology. The digital asset was unveiled in 2009 by Satoshi Nakamoto, a pseudonymous figure. This innovation catalyzed a $2.5 trillion sector, challenging conventional finance in its brief 15-year existence.

Bitcoin’s application has transformed over the years. Conceived as an alternative to the US dollar, it has since emerged as a significant store of value (SOV) asset.

🍒 Bitcoin (BTC) Price Prediction: 2025, 2030, 2040 & 2050

Is Bitcoin a Good Hedge Against Inflation?

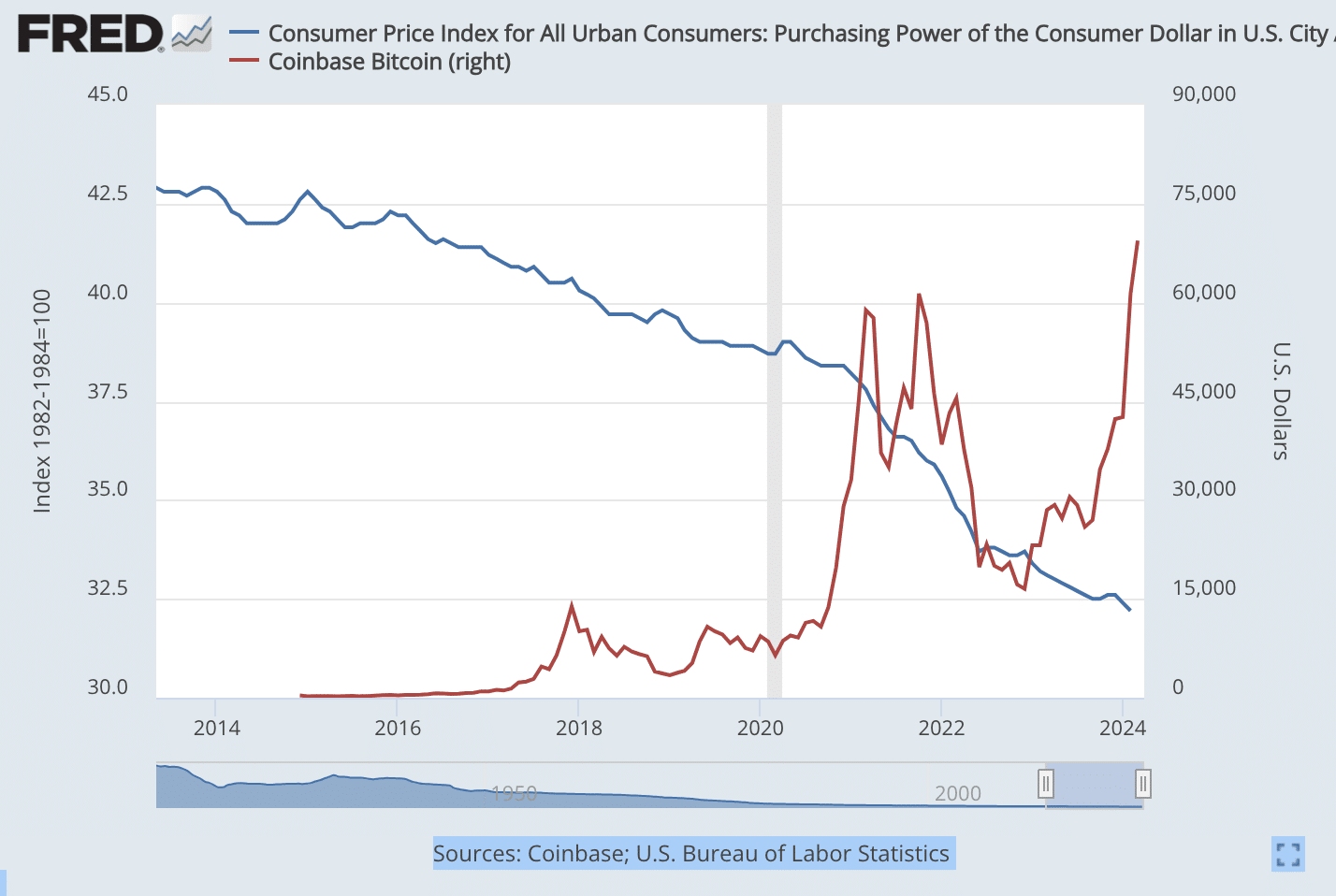

Source: St. Louis Fed

Given Bitcoin’s pronounced volatility, views vary regarding its value as an inflation hedge. The cryptocurrency has weathered at least two significant bubble bursts and continues its search for a stable valuation.

However, extreme volatility is normal for a new asset class representing a tech novelty. Bitcoin’s limited supply is supporting its inflation hedge potential for the short and medium term. The crypto coin’s track record is too short to prove its longer-term capabilities, but its fundamentals align with an inflation hedge asset.

The US Consumer Prices Index (CPI) has increased by a cumulative 20% since 2020, while Bitcoin has surged over 700% and is currently hovering above $70,000.

🍒 Bitcoin Adoption: Rates, Charts, and 2024 BTC Prediction

Bitcoin vs Gold: Similarities

| Feature | Gold | Bitcoin |

|---|---|---|

| Scarcity | Finite supply, precious | Capped at 21 million coins |

| Inflation Rate | Stable at ~1.7% | About 1.7%, decreases with halving events |

| Stock-to-Flow Ratio | 62, indicating scarcity | 58, indicating high scarcity |

| Status as SOV | Stable store of value | Emerging digital SOV |

| Resistance to Fraud | Difficult to counterfeit | Cryptocurrency's blockchain security |

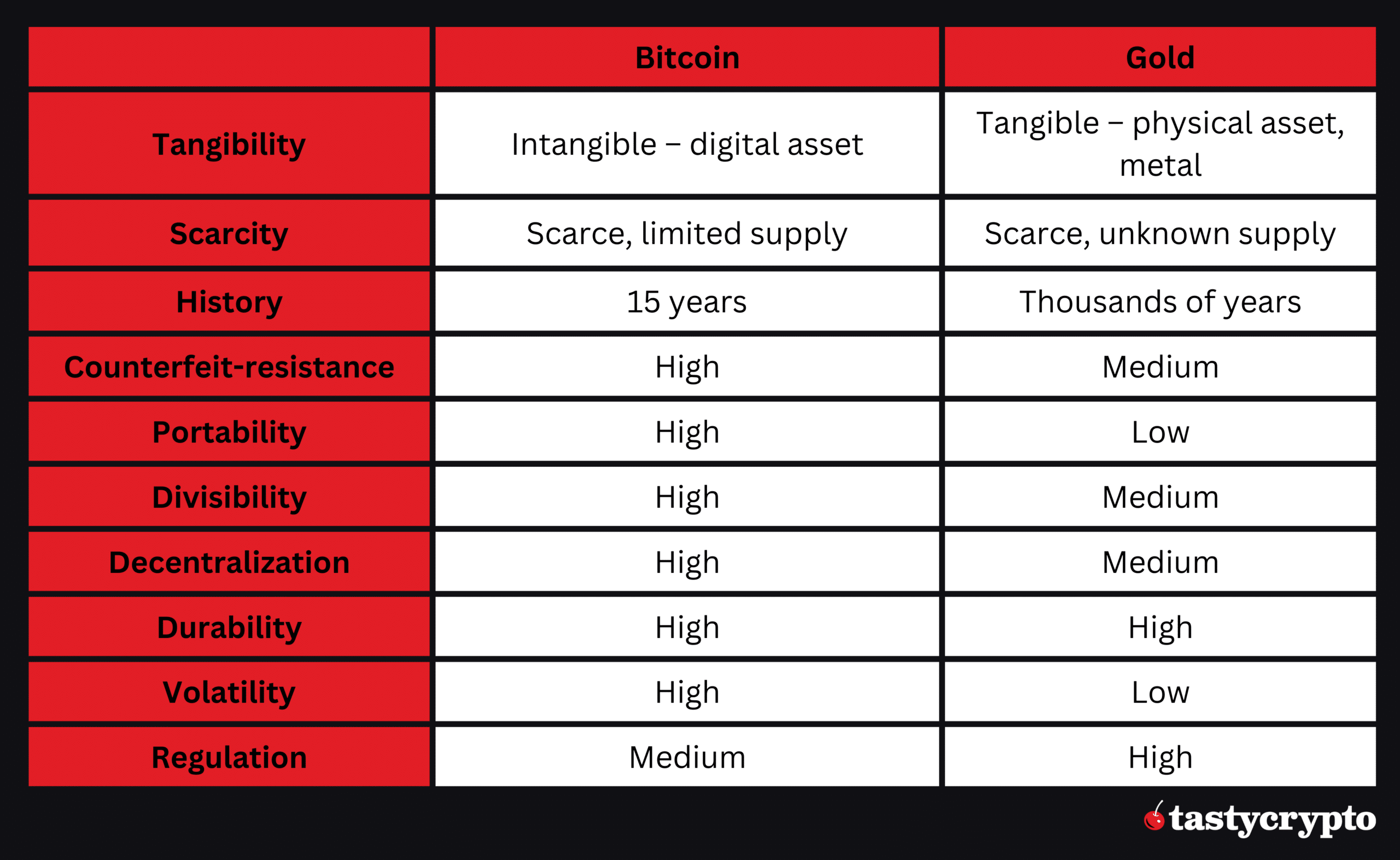

Bitcoin vs Gold: Differences

| Feature | Gold | Bitcoin |

|---|---|---|

| Tangibility | Physical metal, tangible asset | Digital currency, intangible |

| History | Centuries as a measure of wealth | Modern, 15 years of history |

| Divisibility | Traditionally less divisible | Each unit divisible into 100 million satoshis |

| Volatility | Less volatile, more stable | Notably higher volatility |

| Risks & Returns | Considered low-risk with moderate returns | Characterized by high risk and potential for high returns |

| Liability to Confiscation | Can be confiscated by governments | Decentralized nature reduces confiscation risk |

| Adoption and Growth | Long-standing asset, accepted globally | Quickly adopted with increasing liquidity and investment products |

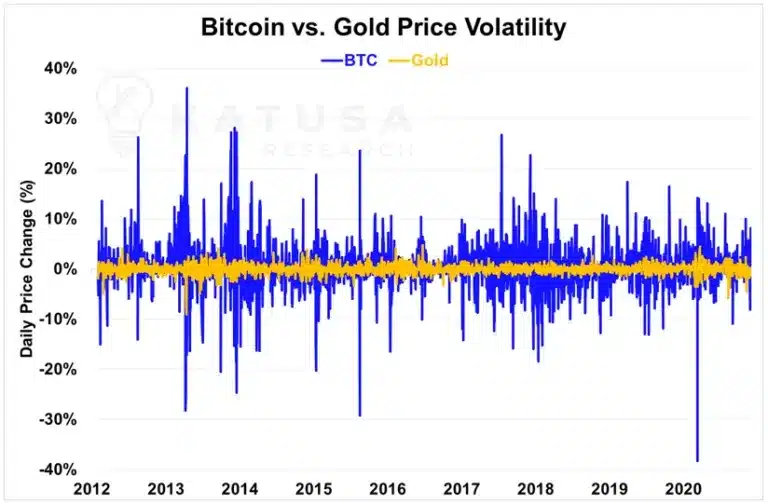

Bitcoin vs Gold: Volatility

As we can see from the image below, Bitcoin is much more volatile than Gold.

Source: Katusa

Bitcoin vs Gold: Performance

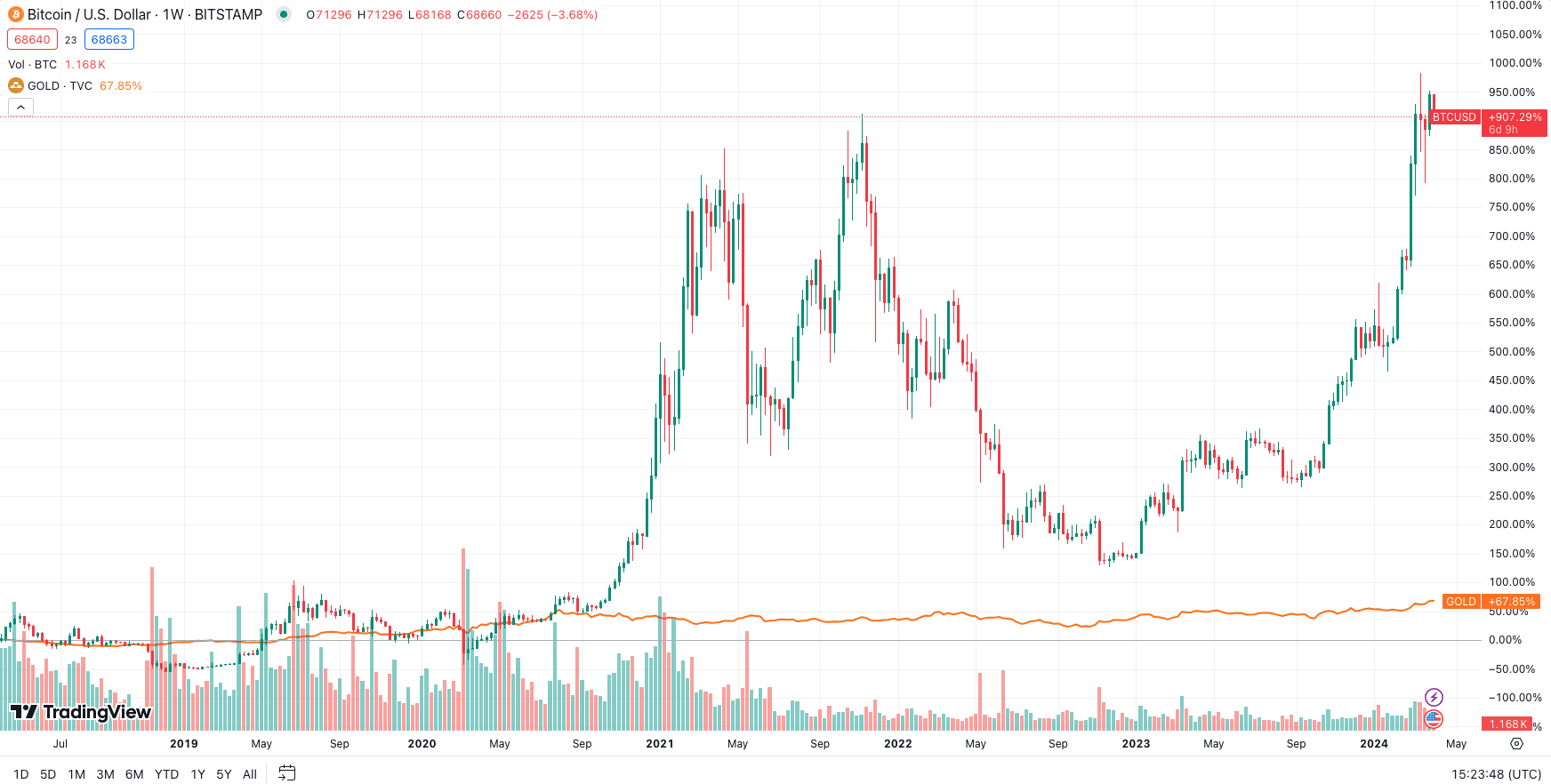

Bitcoin and gold updated their all-time high (ATH) prices at the beginning of 2024.

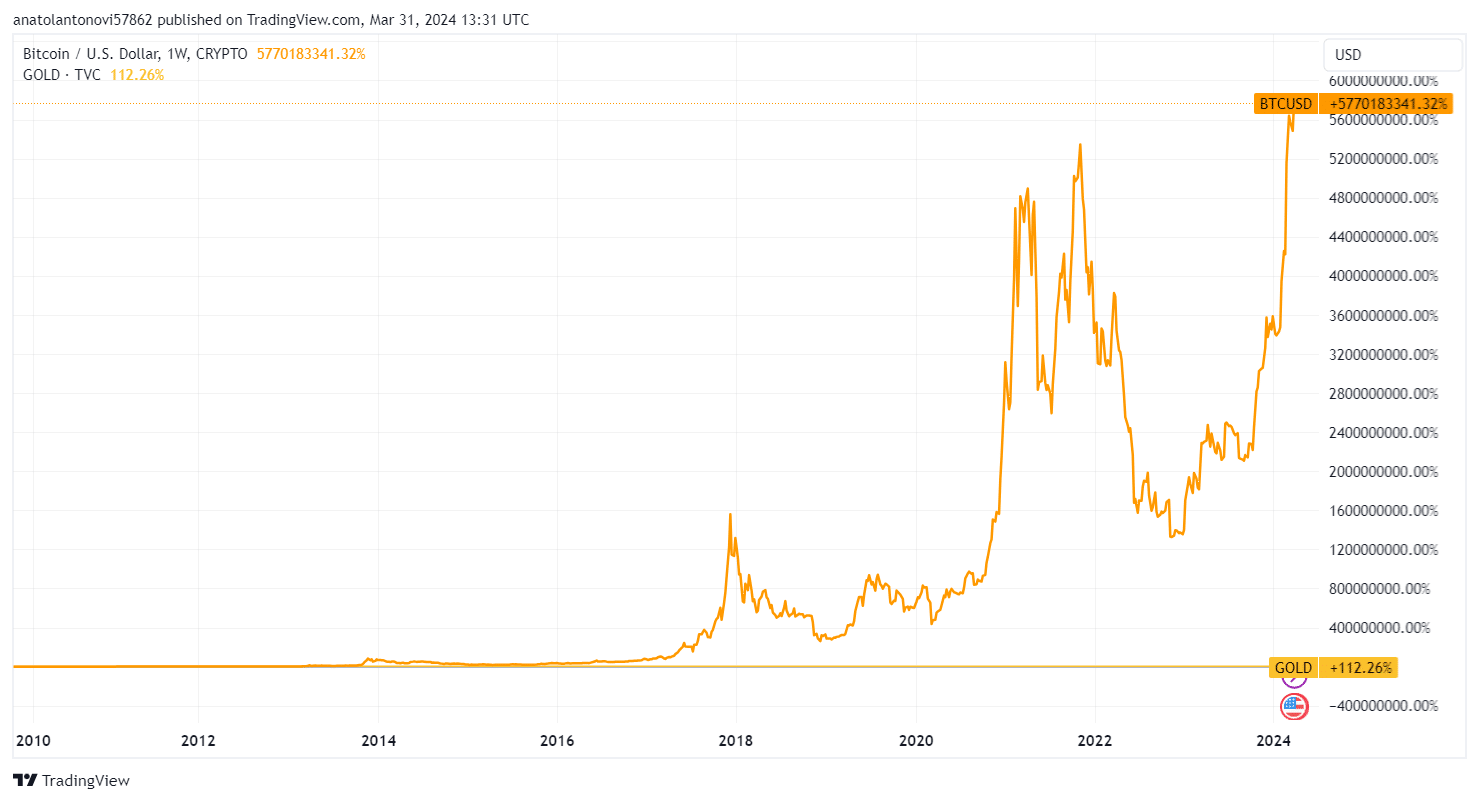

Since its launch, Bitcoin has skyrocketed from a few cents to over $70,000, translating into massive percentage gains.

Gold has increased by over 110% during the same period.

Source: TradingView

Such extreme returns are normal for a new asset quickly adopted worldwide, but the growth pace is slowing down as the crypto market matures.

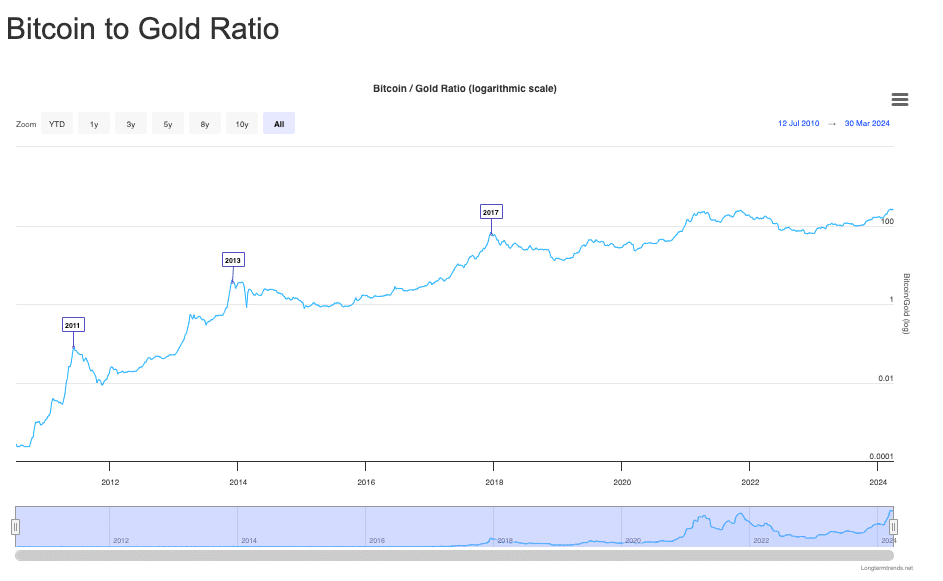

Here is the Bitcoin price expressed in gold ounces:

Source: Long Term Trends

Bitcoin vs Gold: Correlation

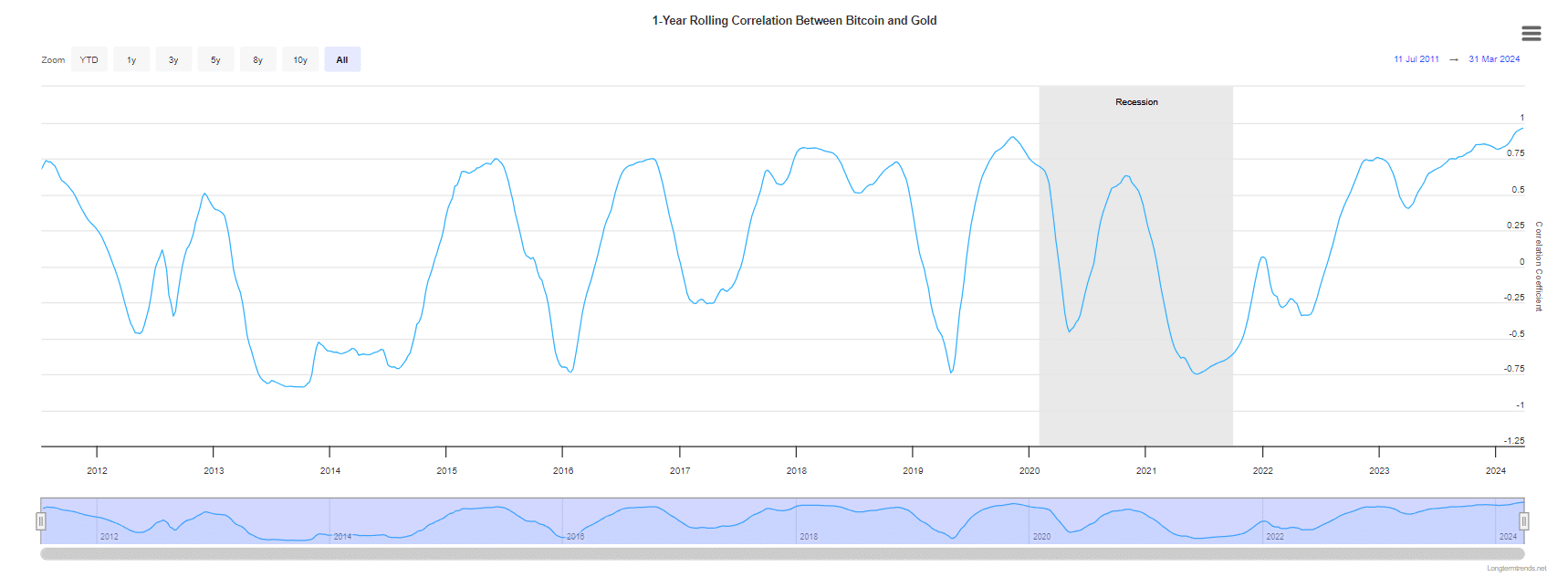

With the introduction of Bitcoin ETFs on Wall Street, the correlation between Bitcoin and Gold is at a record high.

Source: LongTermTrends

Bitcoin vs Gold: Which Is a Better Investment Option?

Choosing between the Bitcoin (BTC) and gold hinges on your investment objectives and risk tolerance. Gold is optimal for individuals prioritizing stability and long-term planning.

In contrast, Bitcoin appeals to those willing to embrace higher risks in anticipation of substantial returns. We argue that Bitcoin’s attributes—decentralization, divisibility, portability, and limited availability—render it a superior investment.

For the sake of diversification, it would be wise to have a small allocation of both assets in your portfolio.

FAQs

Why invest in gold?

Gold is regarded as a robust safe haven asset that can preserve wealth during major crises and geopolitical tensions. The metal has traditionally beaten USD inflation over the long term.

Why invest in Bitcoin?

Bitcoin is considered a store of value (SOV) and a hedge against inflation due to its limited supply and potential for high returns despite its high volatility compared to traditional assets. Compared to gold, Bitcoin is more divisible, portable, and convenient to trade.

Which is better: Bitcoin or gold?

The choice between Bitcoin and gold depends on your investment goals and risk tolerance: gold offers stability and long-term wealth preservation, while Bitcoin offers higher potential returns but with greater risk.

Is there a relationship between gold and Bitcoin?

The correlation between gold and Bitcoin was at a record high at the beginning of 2024 after the US SEC approved the first Bitcoin ETFs. Both assets are used to hedge against USD inflation.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com