Author: Ryan Grace

Uptober 24, 2025

Hello my tasty friends. I hope you’re all having a wonderful start to your weekend.

There are a lot of distractions in the market at the moment. It’s a chop fest out there. Which, don’t get me wrong, as liquidity providers, the boys on the FX desk and I love the chop. But, sometimes you need to zoom out, take a breather, and appreciate the big picture. Today I want to offer that view, and cover some catalysts on the radar. To reach the stars, we can’t be distracted with what’s happening on the ground.

But first, let’s recap…

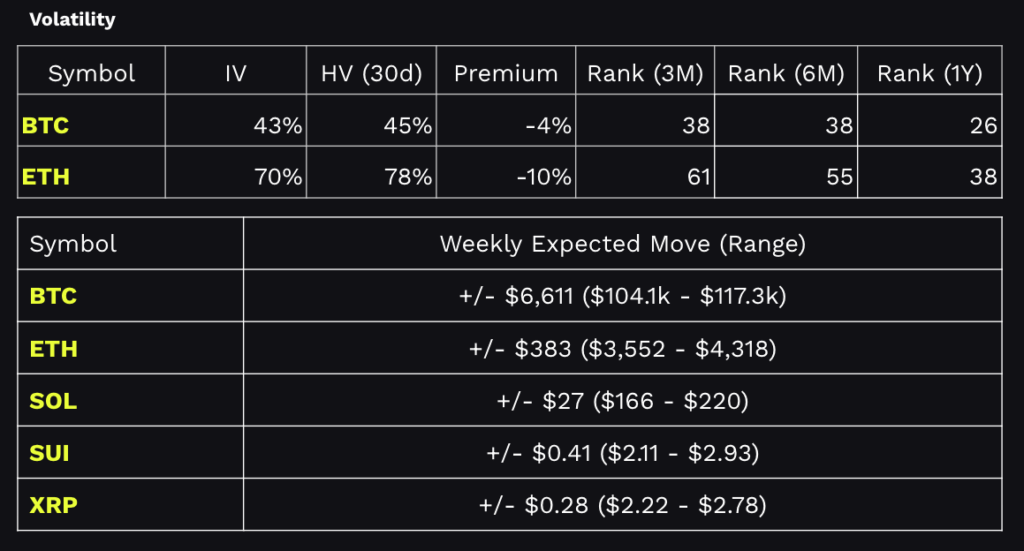

Last week we discussed some of the relevant macro drivers and threw out levels to watch like 3,800 ETH, and 108k BTC. – Holding at the time of writing, and a quick check of the performance dashboard has BTC +2% on the week. Breathe in, breathe out. You can almost feel the energy building.

Exploding in Silence

In no particular order, here are some reasons why I’m still bullish. Let’s run through it.

Federal Reserve Accounts For Crypto Firms

During its first Payments Innovation Conference this week, the Fed floated a new kind of “payment account” for non-bank innovators like stablecoin and crypto payments firms which would let these companies plug directly into Fed payment rails. They’re calling it a “skinny” account vs a traditional master account with the Fed.

An account with a Federal Reserve Bank matters for crypto companies in that master accounts let you settle directly on Fed rails (Fedwire Funds, FedACH, etc.), hold balances at the Fed, and if you’re a full-privilege bank, access interest on balances, and the discount window. These accounts for crypto firms will likely be limited versions of what the big banks have, but regardless, a direct connection with the Fed cuts out intermediaries and improves the overall settlement process.

More so, the Fed is embracing blockchain technology and stablecoin flows within the US financial system is… Bullish to say the least.

Tokenize Everything

“Tokenization” is just Wall Street’s way of saying put real assets on 24/7 rails. This means putting a token wrapper on Treasuries, money-market funds, credit, or other securities, so they can move, settle, and be collateralized instantly.

I think this will be one of the dominant drivers of “crypto” adoption going forward, specifically for institutions. We’re already seeing this with tokenized dollars (stablecoins) and T-bills, but this is just the start. Equities and eventually all securities are next, and I believe it’s going to happen a lot faster than people think. Again, if there’s a single reason to be bullish, especially from a macro/adoption/flows perspective, this is it. This is the demand engine.

Every tokenized Treasury that’s used as collateral needs a stablecoin or on-chain cash component. Every on-chain fund needs wallets, custody, compliance, and analytics, which pulls traditional investors into the crypto stack. This leads to more users, more wallets, more use cases, more activity on chain. Presumably a massive tailwind for what are effectively the macro assets in this system, i.e. Ethereum and Bitcoin.

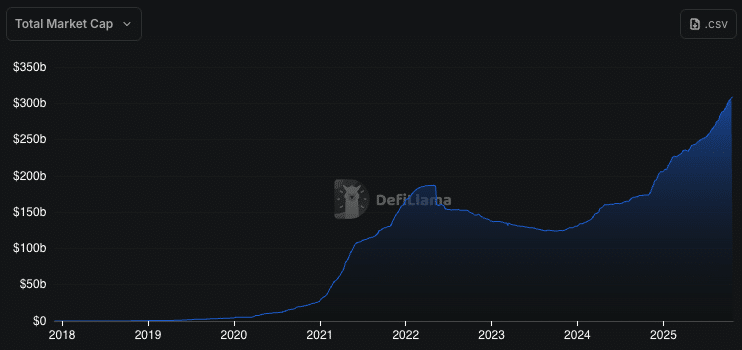

Stablecoin Market Cap Update

Total stablecoin market cap is now $308 billion. Not much else to say here. We want to see this continue climbing across multiple blockchain networks. I think we will get to $1 Trillion by 2030. – Probably sooner.

Same Game, Different Players

We’re starting to get more questions and comments about where we are in the cycle and whether this time is different. We’re now over 500 days post-halving and which has been around the time when we’ve topped out historically.

Given the price action we’ve witnessed recently, I wouldn’t fault you for thinking this time is any different. But, are there any differences? In my opinion, one important distinction is who the marginal buyer is. In past cycles, and for the majority of Bitcoin/crypto history, price discovery was dominated by OG whales and crypto-native funds. Now, the marginal buyer is institutions, primarily in the form of ETFs, IRAs, and brokerage platforms. Custody is shifting towards the big banks too. These are massive pools of capital, but more importantly, their investment approach is more passive, and tends to be long-term in nature. Think buy and hold for multi-year periods compared to an active management approach. Given this profile, if their capital is sticky relative to the past participants that dominated price action, we could see an extended cycle. It could be longer in duration and it could be less volatile over time.

Rate Fuel

The market is pricing Fed Funds at between 3.25% – 3.50% by the end of January 2026, compared to 4% today. Now, a lot can happen between now and then, but this path forward could see capital flow from money market funds into other pockets of the market, farther out on the risk curve. – To this end, BTC/crypto/risk could benefit from capital seeking higher returns in this environment.

A US-China Trade Truce This Month?

I think the potential impact of this outcome is being overlooked. We’ve become fatigued by the ongoing trade tensions and the constant tweets, but let’s imagine for a moment.

Let’s imagine we get a roll back of the 100% China import duties, there are concessions made, and we see a revival of global trade that unlocks liquidity flows in markets. I think risk assets such as Bitcoin could catch a bid as capital has been sidelined.

Maybe I’m too bullish, or maybe I’m not bullish enough.

We could go on about upcoming ETF decisions, the crypto market structure bill, and the since forgotten crypto executive order related to a national bitcoin reserve, but we’ll save that for another time.

Until then, trade the ranges and take some positions off when you can, not when you have to.

Keep your head on a swivel.

Stay tasty,

Ryan

BEANS

🔥 Fridays are for fire.

Dan is back! Jump in the Discord or X Community for more info.

Bring your marshmallows. Stay for the chaos.

BEANS Ep 41: ODDS & INDEXES $tc + LIVE Giveaways https://t.co/fISjq800lh

— tastycrypto (@tastycrypto) October 24, 2025

tasty Shows

🍒 Highlights

🍒 Are you in the $TC X Community?!

🍒 Did you buy the dip?

🍒 Stay on the RIGHT side!