Author: Ryan Grace

May 23, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

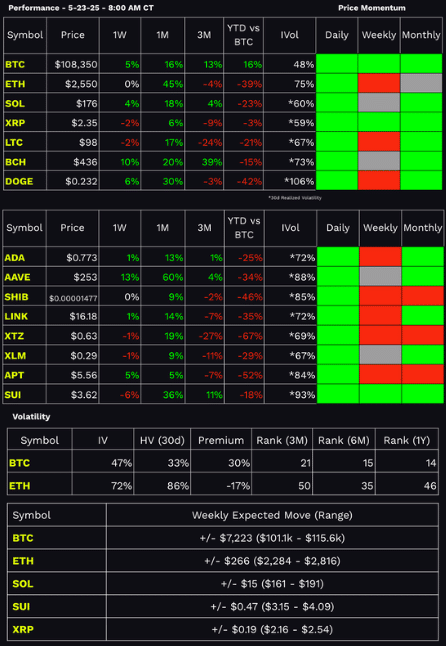

As I’m sure you’re aware, the price of Bitcoin hit a new all-time high this week. About $112,000 if my charts are correct. Volatility bounced off the lows, and the bulls are in party mode. At the time of writing, BTC +7%, ETH +4%, and SOL +9%, as the S&P and Nasdaq are both down about -2% on the week.

The narrative has certainly changed from April when the world was ending. Capital is now pouring into crypto amidst a better macro setup and there has been some progress on the regulatory front. Institutions are back to buying in size.

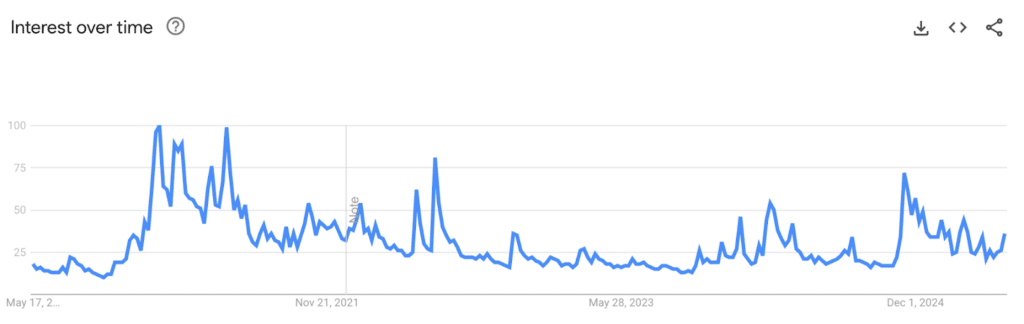

There’s seemingly a structural shift underway, but is anyone really paying attention?

Google Search Trends: BTC

IMHO

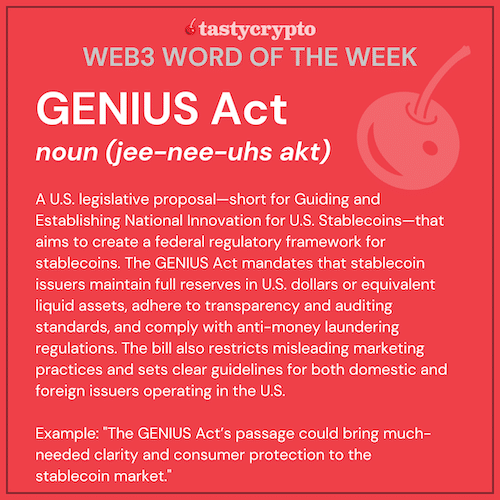

Crypto legislation is making its way through congress.

On Monday the Senate voted to move forward with the GENIUS Act which creates a framework for regulating stablecoins. I’m assuming we probably won’t get a vote until next week, but it seems likely to pass from what I’ve seen. This then sets the stage for a broader crypto market structure bill which could lead to a more comprehensive regulatory framework for digital assets. Regulatory clarity will invite additional capital into the space and further fuel crypto/blockchain adoption across the broader financial industry.

Don’t freak out.

While the market freaks on Trump’s latest tariff tweet, take a step back and look at the bigger picture. Long rates are moving higher as the market prices in a re-acceleration of economic growth and inflation on a forward basis. Growth scare and recession fear were so last month. For now, we’re in a better environment for crypto and I believe short-term volatility equals opportunity at this time.

Bid it up.

We have a better macro environment for crypto prices and regulation is moving in the right direction. We’re also seeing positive fundamentals from growing DeFi TVL to stablecoin market cap at an all-time high. There will be levels where it likely makes sense to take some money off the table, but structurally the market is bullish and is supported by some serious ETF inflows. E.g., larger institutional capital is buying.

For May, Bitcoin ETFs have recorded some monster flows, totaling $3.63 billion so far, which surpasses the $2.97 billion from last month. ETH ETFs have also had their best month of the year with $109 million of net inflow month to date vs the $101 million in January 2025. BlackRock’s spot BTC ETF (IBIT) alone now has about $70 billion in AUM. For context, GLD, the gold ETF sits at $96 billion in assets.

Chop Around

Volatility is showing signs of expanding along with positive price action, another bullish signal among the set. With higher implied vol we naturally get larger estimated trading ranges.

Looking ahead, Bitcoin’s weekly standard deviation move is pricing in a range of approximately 101k – 115k, but volatility is relatively low as measured by an IV rank of 14 on a 1-year basis.

Not much has changed since our market update email on Wednesday. The trend favors the bulls and unless something changes on the economic front and we move back into the environment we just came out of (where both the rate of growth and inflation were slowing at the same time), then we remain in a market where I’m comfortable buying dips towards the bottom of the weekly range.

Keep your head on a swivel, and remember, the tariff Tweets are not important to bitcoin.

Stay tasty,

Ryan

Web3 Word of the Week (W3WOW)

Dan's Stone Cold Crypto Pick of the Week

Each week we try to give you one new idea from the world of decentralized finance to take a look at.

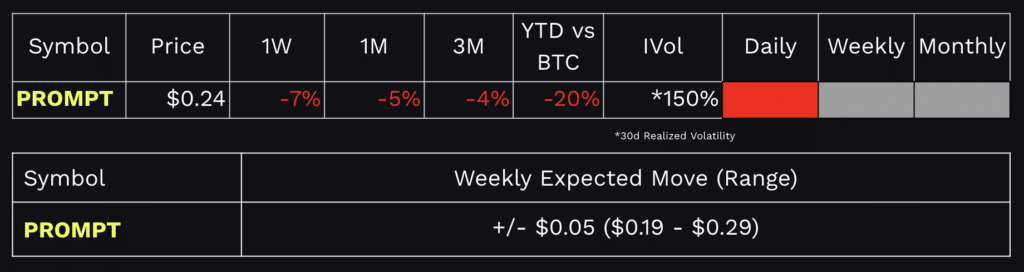

Dan’s pick for this week: Wayfinder ($PROMPT)

Website: https://www.wayfinder.ai/

Wayfinder is an AI-driven, omni-chain protocol developed by Parallel Studios, designed to empower autonomous agents—called “Shells”—to execute complex blockchain tasks across multiple networks. These agents can perform actions such as cross-chain asset transfers, smart contract deployments, and NFT minting, all initiated via natural language commands. The protocol serves as the infrastructure layer for Parallel’s blockchain game, Colony, and aims to extend its utility to broader applications in DeFi, gaming, and AI-based automation.

Token Utility: $PROMPT is used to activate Wayfinder shells, pay network fees (shared with developers), stake for path proposals, and expand agent memory. It also governs the platform’s future direction.

Note: This project is still in closed alpha phase. You may signup for early access here https://www.wayfinder.ai/waitlist

Key Info

AI-Driven Blockchain Navigation: Wayfinder enables users to execute tasks like token swaps, bridging, and smart contract deployment

Community Incentives: 45% of the token supply is allocated to community members through staking $PRIME (Parallel’s token) and airdrops, with 40% distributed via free signups and staking rewards. Airdrop Distribution of 40% of supply occurred in April 2025

Key Trading Stats: (*As of 5/23/2025)

Total $PROMPT Holders – 7,000

Market Cap | $54 Mil |

Fully Diluted Valuation | $241.5 Bil |

24-Hour Trading Volume | $117 Mil |

Circulating Supply | 223.9 Mil |

Total Supply | 1.0 Bil |

Max Supply | 1.0 Bil |

Conclusion:

$PROMPT offers a compelling investment opportunity for those bullish on AI-blockchain convergence and community-driven projects. However, investors should weigh market volatility and monitor Wayfinder’s adoption and ecosystem growth.

Wayfinder App – https://app.wayfinder.ai/portfolio

Documentation – https://paper.wayfinder.ai/wayfinder_paper_v1.pdf