Author: Ryan Grace

Uptober 3, 2025

Hello my tasty friends, I hope you’re all having a wonderful start to your weekend.

It’s been a minute. I’m sorry. I had a kid, and in stepping away to care for this “little potato” as my wife affectionately refers to him, I’ve neglected my tasty friends. Again, apologies. Daddy’s back now.

And what a time it is to return to the market. Right on time we got the rip. But, are you all that surprised? It is UPtober after all.

Quick update on the market below and then let’s have some fun looking at bitcoin seasonality and what might be in store for price action as head into year-end.

From Wednesday’s note:

“I think you want to stay long crypto and other risk assets here given the setup, and the potential for crypto market seasonality to come into play.”

“On the macro side, we’re seeing signs of acceleration across growth and inflation with durable goods +2.9% m/m after two months of declines, while CPI increased from 2.7% to 2.9% last month. We’ll get more relevant ISM data this week too. Should these numbers confirm a further acceleration, it signals a supportive environment (growth up, inflation up) for crypto investors. As we’ve discussed previously, crypto, like many long duration assets, tends to benefit when the rate of change of economic growth and inflation are accelerating.”

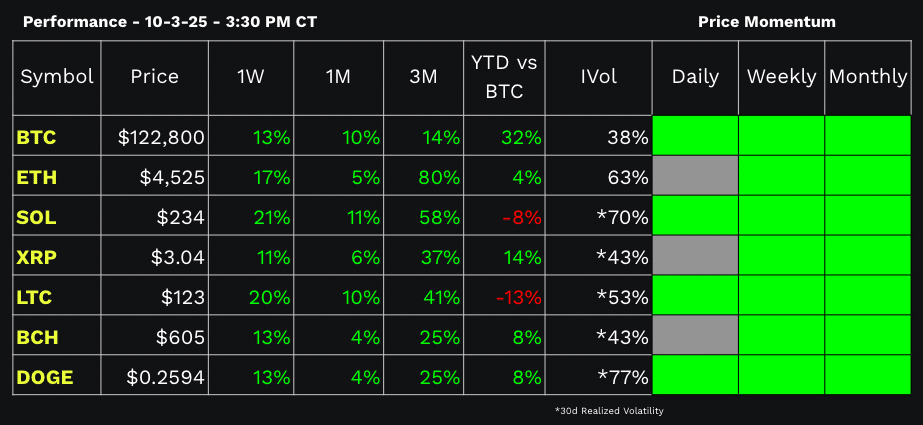

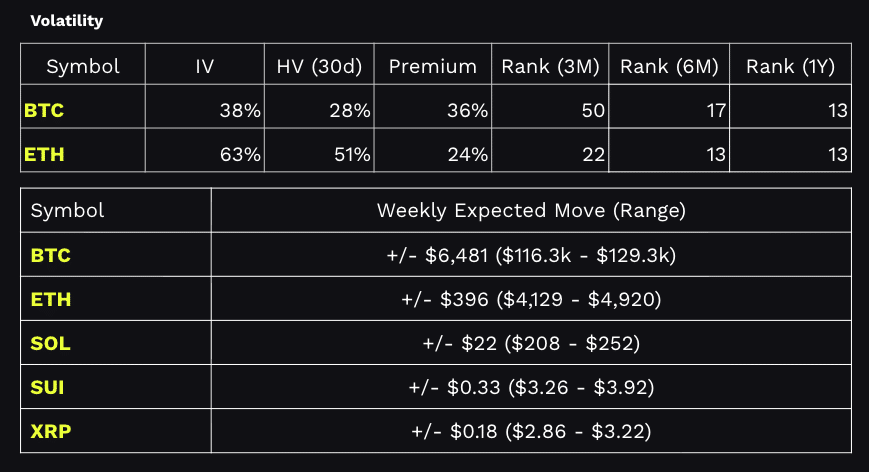

Performance Dashboards

UPtober

Generally speaking, a buy and hold bitcoin strategy has performed pretty well over the long run.

Hindsight is 20/20, but a quick check of performance shows us BTC +100% over the last year, +534% over a three-year period, and if you go back 10 years it’s up something like 50,000%. God tier investment performance. Nothing else really comes close to BTC. As we also know, it’s extremely volatile at times, or at least it has been historically. So again, a buy and hold strategy has generally been the best way to approach the coin. Certainly helps the mental state to put it away, turn off the screens, and not over-trade.

As my Dad always told me… Everything in moderation.

But, let’s say… Maybe every once in a while you like to get a little crazy and try timing the market. Sometimes it feels good to time the market.

Bitcoin Market Seasonality

Let’s take a look at what has historically been the best period of the year for bitcoin.

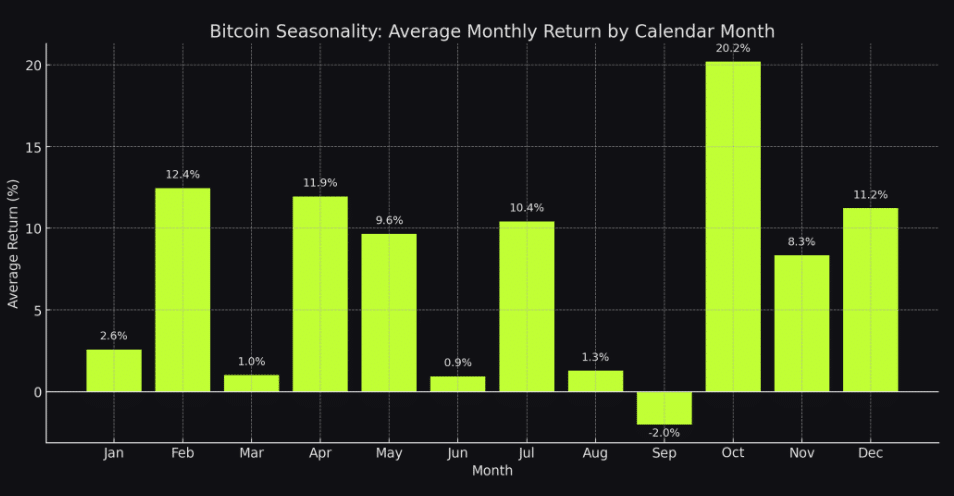

Looking back over the past 10-years of monthly price performance, the fourth-quarter and October in particular has been one of the best periods for bitcoin prices, with +40% average aggregate returns during the quarter.

Now, a ten-year look back includes some massive moves and we have to consider the price of bitcoin was much lower at certain points in history compared to its six-figure value today. Taking this into account, let’s zoom in on the past 5 years.

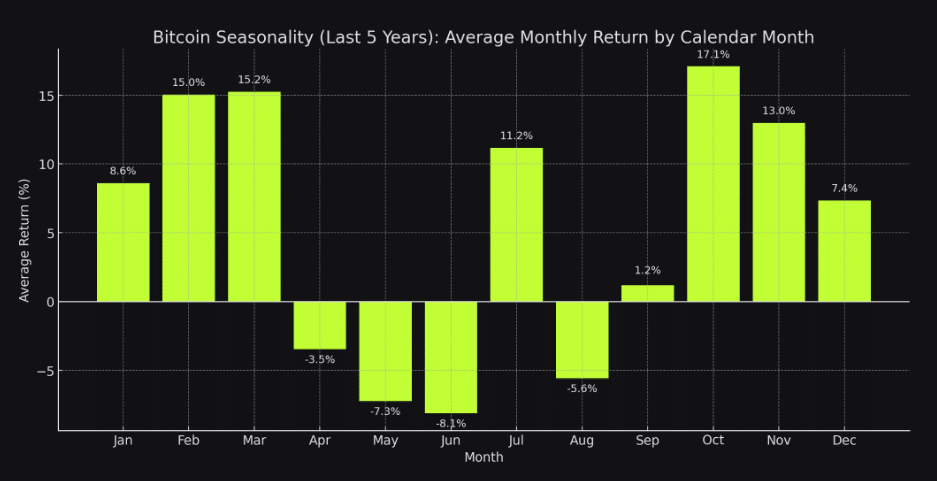

A closer look at the last 5 years shows us a slightly different view of performance, but it’s clear the fourth-quarter has been good to the coin and again, October has been the best performing month for BTC prices over the last 5-years.

BTD, but when?

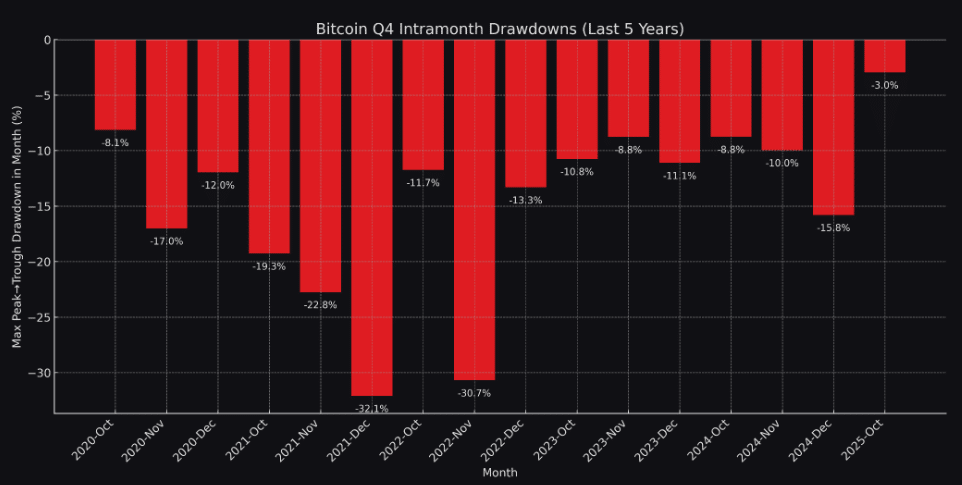

While the last three months of the year have been positive, volatility remains a constant. To set expectations, the largest intra-month drawdown during the fourth-quarter has been around 30% with standard corrections coming in around 10-15%.

Higher Highs

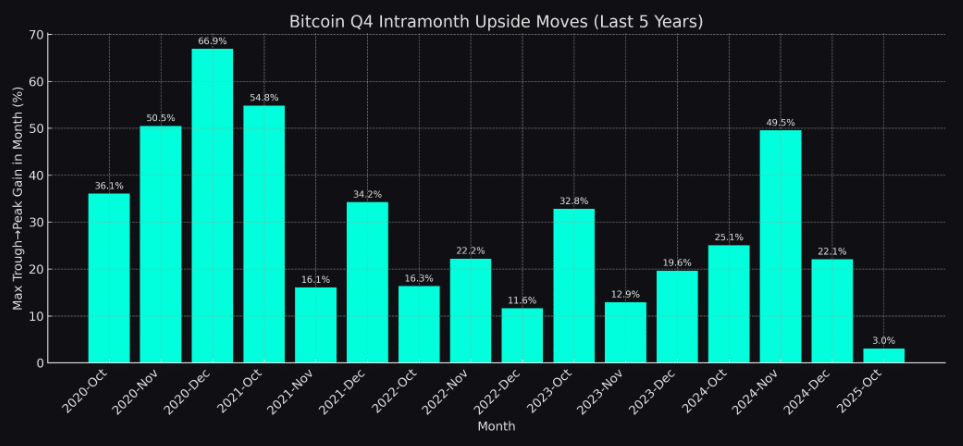

On the flip side, it’s also important to put context around the magnitude of upside moves. While Q4 performance has generally been positive, there’s a time to take profits and realize the gains. When looking at monthly upside moves during the fourth quarter, we might expect returns in the 15-20% range, though there have been times where BTC was in straight blast off mode. Most recently, +49% during November 2024.

As of writing, we’re 3 days into October, and so far, BTC is up about 8% to start the month. Coincidence? Or maybe, perfect timing.

Of course, per the standard financial disclosure, past performance is not indicative of future results. Though as many traders know, history doesn’t repeat, it often rhymes.

Keep your head on a swivel. Recognize the synchronicities.

Stay tasty,

Ryan

BEANS

🔥 Fridays are for fire.

Each week on BEANS, Shelley and Dan torch some $TC—chipping away at a planned 300M token burn.

Want in? Send $TC to the burn wallet. Jump in the Discord or X Community for more info.

Bring your marshmallows. Stay for the chaos.

Transfer XRP quickly and securely.

— tastytrade (@tastytrade) October 3, 2025

Learn more about XRP at https://t.co/GIvUV2raRr pic.twitter.com/rKxoqCwkVf

tasty Shows

🍒 Highlights