Author: Ryan Grace

November 15, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

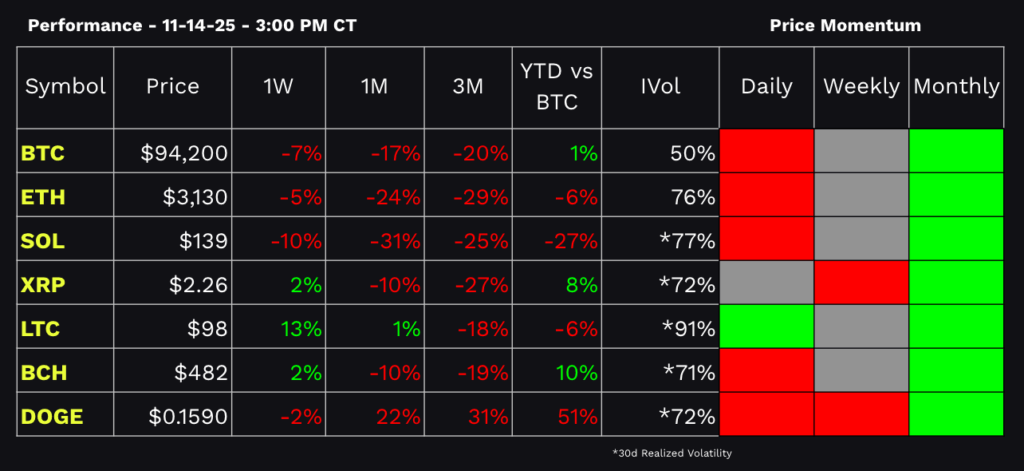

Before we get into the Uniswap Fee switch and what it means for $UNI token price, we continue to monitor the sell off in the broader crypto markets. Currently we’re below key levels with BTC trading around $95k and ETH $3,100, at the time of writing.

This puts BTC down -25% from its ATH on 10/6 and ETH down -37% from its high on 8/24. Ouch.

Daily price momentum has stayed bearish since the leverage wipeout last month, but is still neutral on the weekly timeframe.

If you take a 3-6 month view, the backdrop for crypto is still positive (regulations coming, institutional adoption, liquidity, lower rates, etc.), but we need to respect the short-term price action.

I’m not in a rush to add to my bags here, but if I’m waiting looking for levels, the first spot for me is 93-89 and if that doesn’t hold, eventually the big 75k level from the April tariff freakout. – I don’t think 75 is a high probability, but of course it’s possible.

On the flip side, we’d need to move above 112k for BTC to go back to the bullish trend.

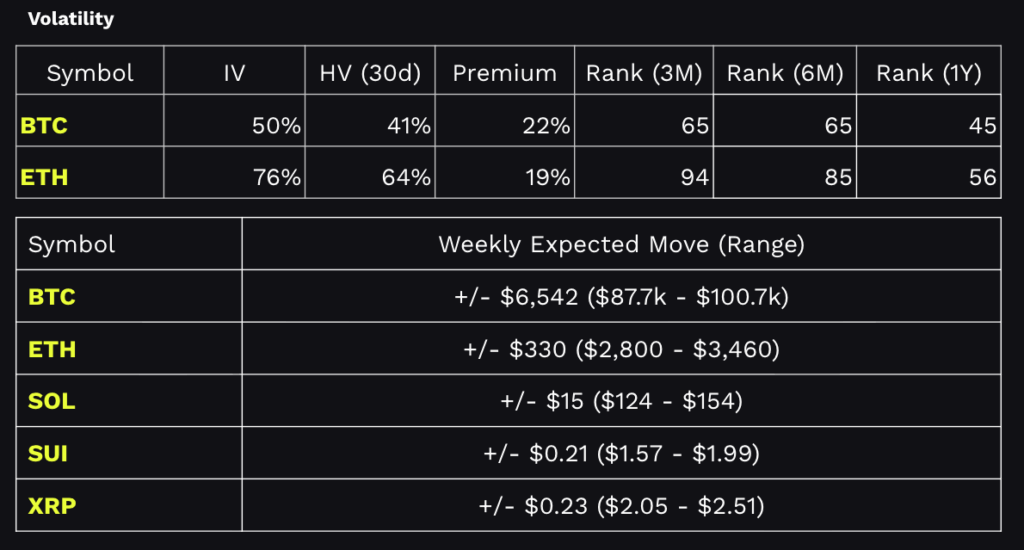

For reference, performance dashboard and implied volatility derived weekly trading ranges are below.

UNIfication - The UNI Fee Switch

Outside of the disappointing price action in the market, it was an exciting week for UNI holders with the token pumping around 50% following a formal proposal by Uniswap Lab’s CEO Hayden Adams to flip the “fee switch,” a dormant code toggle from UNI’s launch.

Uniswap, the leading decentralized exchange on Ethereum, has long generated substantial trading fees at over $5.4 billion since inception in 2018, yet revenue primarily goes to liquidity providers on the exchange and doesn’t get passed on to UNI token holders.

The recent UNIfication proposal, introduced on November 9, 2025, is looking to change this by using a portion of the protocol fees to buyback and burn UNI tokens, which would enable direct value accrual to the protocol and its governance token.

The Proposal

You can read the UNIfication: Protocol Revenue, Growth, and Ecosystem Realignment proposal here.

UNIfication centers on activating the protocol’s “fee switch,” which is a feature that’s been embedded in Uniswap’s smart contracts since the token’s launch in 2020.

The simple way to think about this is that Uniswap Labs wants to use protocol revenue to buy back tokens and reduce the outstanding supply in an effort to return value to token holders, similar to how companies buy back stock for the same reason.

Currently, all swap fees go directly to liquidity providers. Under the new proposal, a portion (0.05%) of fees from Uniswap V2 and V3 pools, and eventually V4 would be allocated to the protocol treasury. These funds would be used to purchase and burn UNI tokens, thereby reducing the circulating supply.

The proposal also extends beyond the fee-switch to conducting a retroactive token burn of 100 million UNI tokens (approximately 16% of the circulating supply) from the treasury, compensating for an estimated $800 million in historical fees that could have been captured since 2020.

The proposal was submitted on 11/9, with a snapshot vote expected in early December, resulting in potential activation in Q1 2026 if approved.

How could this impact UNI's valuation?

If the vote passes and the fee switch is turned on, here’s how we might think about UNI’s valuation. On the surface, the initial reaction is bullish, but let’s walk through it.

Let’s conservatively assume the protocol receives 15% of Uniswap fee revenue after the fee switch (based on different rates across different V2 and V3 pools).

Uniswap’s current run rate puts revenue around $1.1 billion for 2025, so this is $165 million of fee revenue available that can be used to buy and burn UNI. Including the one-time 100M UNI treasury burn at a current price of $7, this is another $700 million.

Against circulating supply of 630M UNI and a current market cap of $4.41B (fully diluted: $7B), we get an immediate supply shock and then on-going deflation from the fee backed token burns. On the surface, this could be very bullish, but let’s walk through it.

From the supply shock alone, there’s an argument that the price should re-rate about 20% higher in a bull market, which was certainly expressed in the initial move. A $700 million burn using current prices is about 16% of the circulating supply.

Beyond the initial supply shock, and more importantly, the mechanism now ties the token value to Uniswap’s commercial growth and the amount of fee revenue it’s able to generate annually.

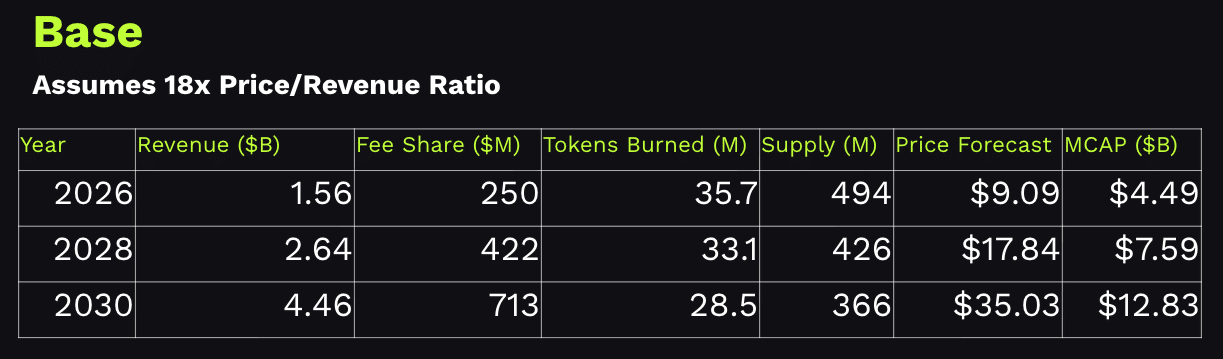

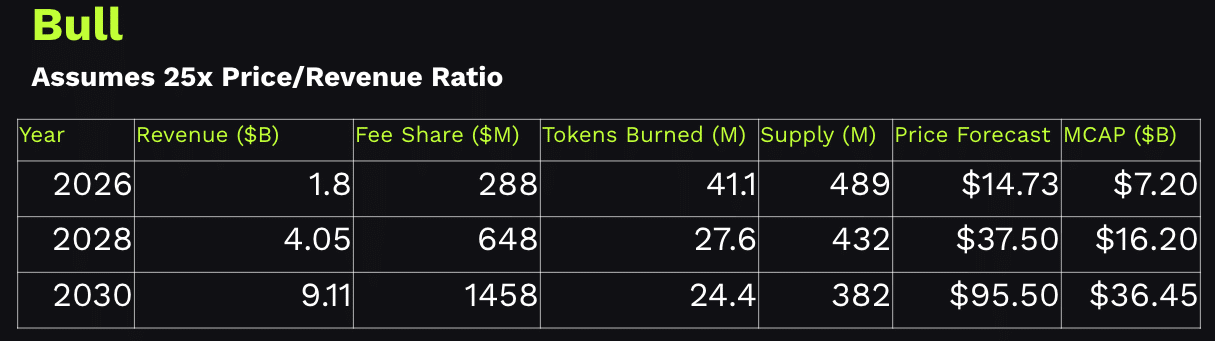

Assuming we’re bullish, let’s look at a possible base case and bullish scenario over the next 1 year, 3 years (2028), and 5 years (2030), starting from a current level of $1.2B total fee and UNI’s estimated 16% share of total fees annually. The one-time burn is baked in.

Historically, Uniswap fees have been volatile but trending higher with DeFi adoption. Fee revenue has increased from $175M in 2020 to $1.1B in 2024, with 2025 annualized at $1.3B based on the Q1-Q3 YTD pace of $796M.

Projections for DeFi overall suggest explosive potential, with the market growing from $20.5B in 2024 to $231B by 2030 (CAGR 54%). If Uniswap can maintain market share (60-70% of DEX volume) it could capture a sizable portion of this growth.

We’re assuming a lot, but here are two simple ways to look at this.

Base Case: 30% compounded annual growth rate, steady defi adoption

In this scenario fees hit $1.56 billion in 2026 (UNI gets $250 million for burn), scaling to $2.64 billion by 2028 and $4.46 billion by 2030. A tripling of revenue over five years, with UNI’s annual burn rate averaging around 7%. This can shrink supply from 530 million to 366 million by decade’s end.

At $7 to, UNI could sustain $9 by next year (a 30% pop on initial fee accrual), $18 by 2028 (assuming a price multiple of 18x trailing revenue), and $35 by 2030 using these constants. This represents a 400% total return from the current price.

Bull Case: 50% compounded annual growth rate, defi supercycle

Using the same approach we can get to $1.8 billion in fees for 2026 ($288 million for burn), $4.05 billion by 2028 and then $9.11 billion by 2030. At peak, this represents UNI accruing $1.46 billion annually with an average deflation rate of 9% and circulating supply of tokens falling to 382 million by 2030.

This gets us a price around $15 next year,$37.50 by 2028, and almost $100 by 2030, if we assign a 25x revenue multiple, assuming there’s a growth premium assigned to UNI in this instance.

Conclusion

It might seem like a stretch, but the question is essentially… With the fee switch and token burn dynamics in place, is Uniswap a $30-40 billion market cap in 5 years, assuming DeFi adoption explodes and total TVL is somewhere near $200 billion?

The UNIfication proposal represents a significant milestone in DeFi’s progress towards sustainable revenue models, and it could potentially influence other protocols like Aave and Maker to take a similar approach. I wouldn’t be surprised.

That’s all for this week. Thanks for reading.

Keep your head on a swivel.

As always, stay tasty.

Ryan