Author: Ryan Grace

August 8th, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

Crypto is a beautiful market. Last week we were freaking over the economy and no one partying in Las Vegas. This week, crypto in retirement accounts. What a week.

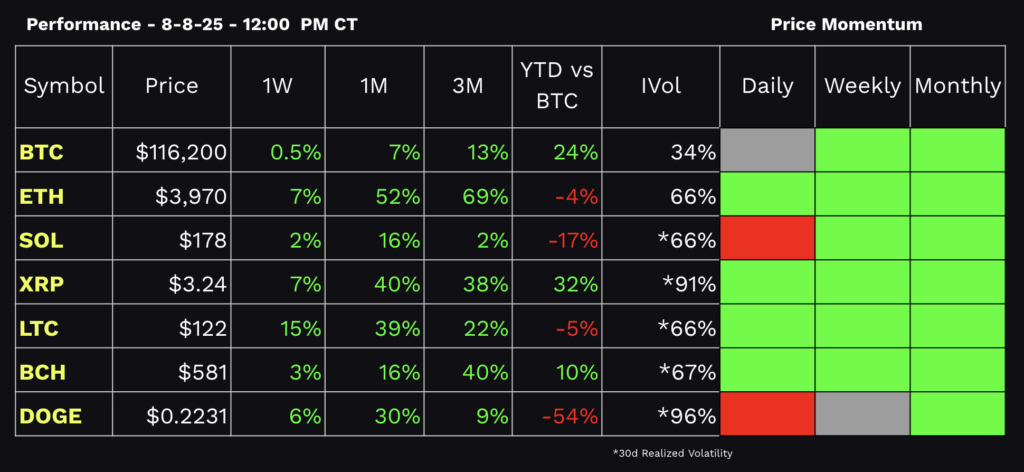

Performance Dashboard

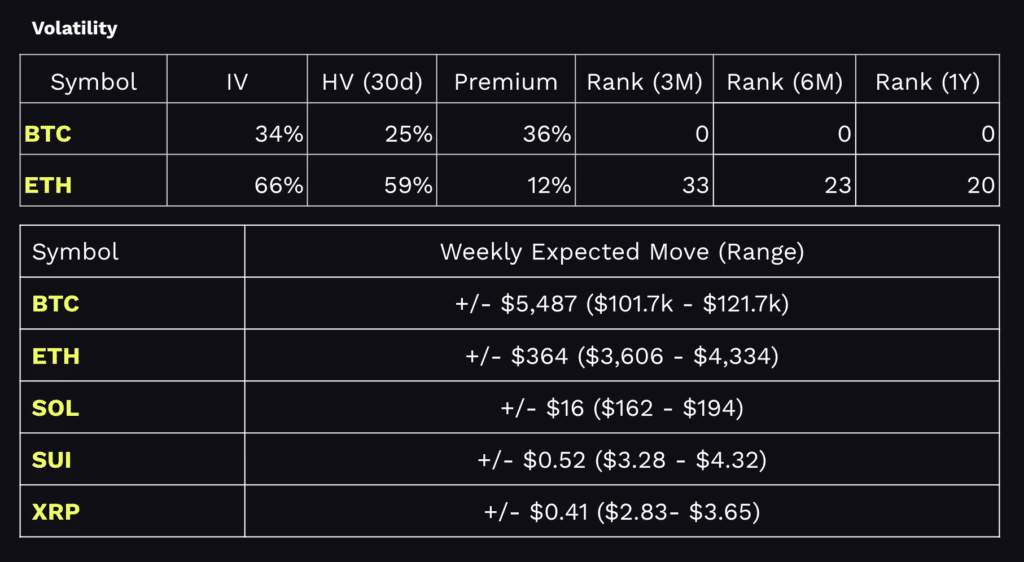

Still bullish, rate cuts upcoming, low vol. Not much else to say. Vol could easily creep lower throughout August. I’m still adding on dips in this environment and using the trading ranges. Downside weekly implied move is $110k and $120k on the upside.

Also make sure to check out the tastycrypto show from Wednesday with Greg Magadini. A lot of trade ideas in COIN, IBIT, and MSTR.

Infinite Bid

Trump just signed an executive order opening the door for 401(k) retirement plans to invest in “alternative assets” aka crypto. Let’s just say, this wasn’t exactly encouraged by the government before. Now, the professionally managed funds used for 401(k) investments will be able to offer “alternative” buckets which presumably will allocate a small percentage of total capital to Bitcoin and Ethereum ETFs, as well as private equity.

Right now there’s about $9 trillion of 401(k) assets, but it’s hard to say what % would end up in crypto. The easy way to think about this is to just attach a tiny % to the big pile of $.

If we assume 0.25% of current 401(k) assets, then it’s around a $20 billion allocation, over time of course. The pile of money is growing over time too. U.S. 401(k) contributions are estimated around $500 billion per year. So we could get a total value of 401(k) assets closer to $12 trillion by 2030. Big pile.

Assuming $20 billion goes into BTC. Does this move the needle?

US spot BTC ETFs have realized about $50 billion of inflows since launching in 2024. A $20 billion 401(k) allocation is approximately a 40% increase in current inflows. It wouldn’t be immediate, but certainly supportive on the margin. Typically, average daily net flows are in the low-hundreds of millions. Flows are over $1B on the big days, and we also have days where it’s flat or money is going out.

It’s tough to predict how much, but this creates a mechanical structure for capital to flow into crypto. Every paycheck, money goes into retirement accounts which invest in passive market cap weighted indexes. The rebalancing algorithms are programed; money in, buy stocks. Since the allocations are market cap weighted, when the market cap increases, more capital gets allocated. Infinite bid. This arguably exists in equites and it could be coming for crypto, or at least BTC, and maybe ETH.

This doesn’t change prices today but it could probably shift the market’s floor higher over time. I’d also assume 401(k) driven inflows, especially during dips, could lead to lower volatility in the future too.

In my view, the biggest beneficiary to this announcement is BTC & ETH, but again, it’s not immediate. It’s the potential flow that matters. As I wrote about going back to the launch of BTC ETFs; these are huge, frictionless conduits for capital to move into BTC, and 401(k) contributions create a similar dynamic. Seemingly very bullish for long-term investors of an asset with a limited supply of 21 million.

In a world of unlimited fiat, there’s not enough bitcoin for everyone.

Stay tasty,

Ryan

Should you buy the dip?

— tastycrypto (@tastycrypto) August 5, 2025

Join the one and only @Truth_Dan_C on @CRYPTO101Pod Rundown to find out! https://t.co/nNh4XBhU0x

Web3 Word of the Week (W3WOW)

tasty Shows

🍒 Highlights:

🍒 Should you Buy the Dip?

🍒 ETH Still Dead?

🍒 AI Agents talk to the Blockchain

🍒$43 Billion Raised to Buy $BTC & $ETH