Author: Ryan Grace

Uptober 10, 2025

Hello my tasty friends. I hope you’re all having a wonderful start to your weekend.

We are in it. BTC hit a new all-time high this week and then we got a quick 5% pull back. And then by Friday… Trump hit em with the tariff threats. LOL. Fool me once, fool me twice… It can’t be this easy, right?

If you’re bullish like your boy over here, I’m looking at this recent move as an opportunity to BTFD. We’ve traded into the low end of our volatility estimated range from the start of the week, which was at $118k.

That range has now updated given the change in spot price and implied vol, but price is behaving as we might expect given what the BTC option’s market was pricing in at the beginning of the week.

If we slip under $115k (90 day SMA) and stay there, I’m rethinking my bullishness short term and would play dips more patiently as you could see a bigger move back to 110-108 quickly.

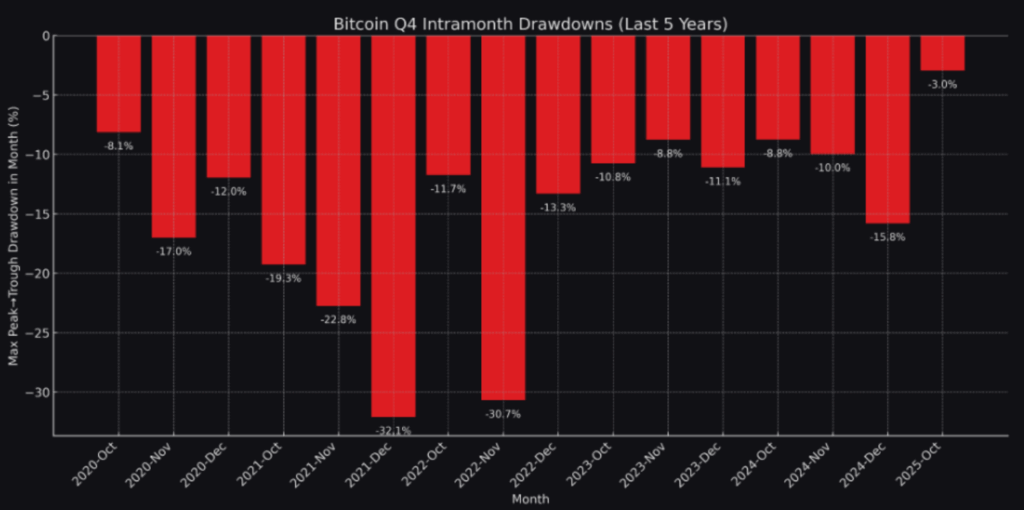

For what it’s worth, last week we showed the drawdowns we might come to expect, even during historically bullish periods such as Q4/“Uptober” – 10%-15% pullbacks are common, with a 15% correction from the ATH taking us to about $108,000.

Seasonality check: Intramonth drawdowns during the historically bullish Q4 period

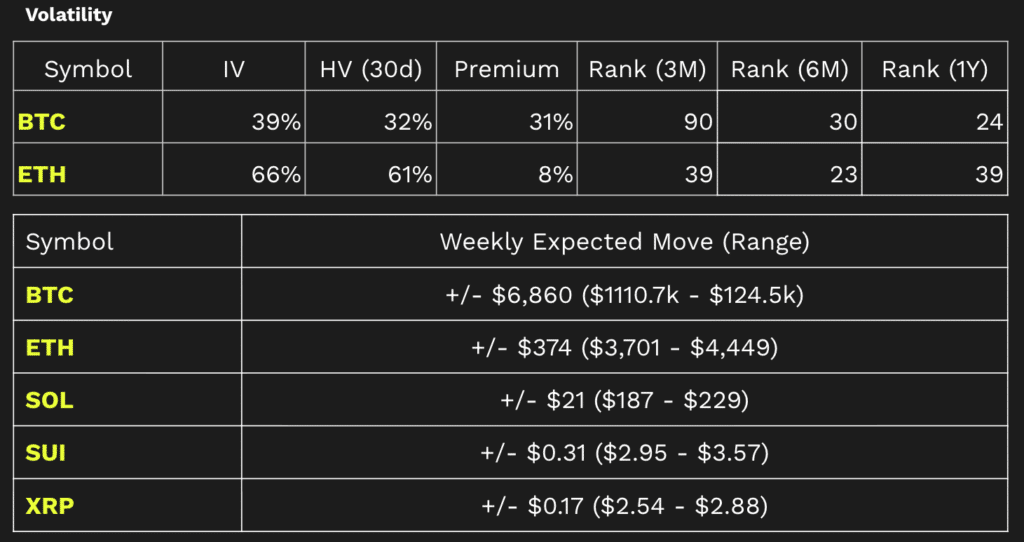

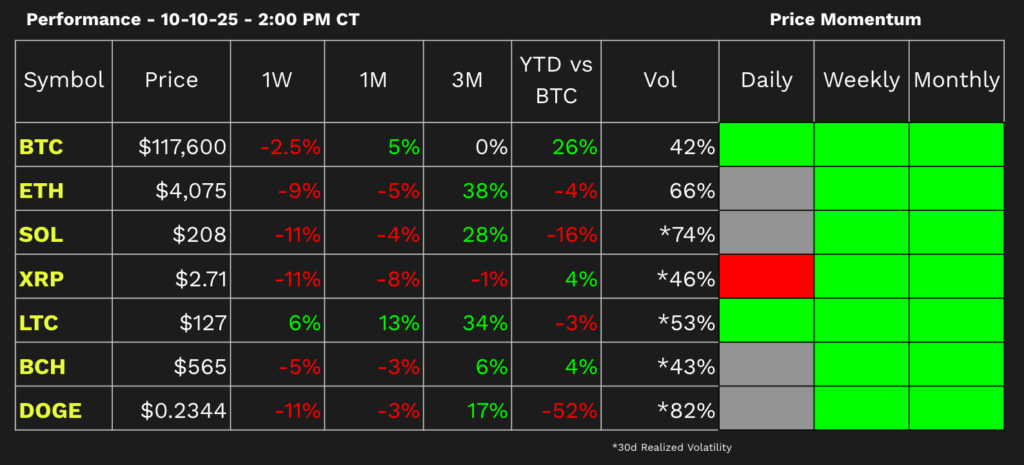

Volatility Dashboard & Weekly Trading Ranges

How much time do we really have?

It’s been 540 days since the halving.

Previously, following halvings, BTC has topped out around 550 days in. After the 2016 halving, we topped around $20k in 525 days. The last cycle took us to $69k in 550 days. Today, we’re 540 days post-halving (April, 19 2024) and BTC just kissed $126k.

By this measure alone, we might be close, but first consider… There have only been three halvings, and we peaked at 360 days the first time. If you were trading through the rear view during the second cycle, you missed the monster run. So, while I think it’s important to be aware of, it’s less relevant when ETFs are sucking up billions, gold just smashed through $4,000, and there are whispers the people’s faith in fiat is cracking.

Don’t miss the monster.

Other Observations

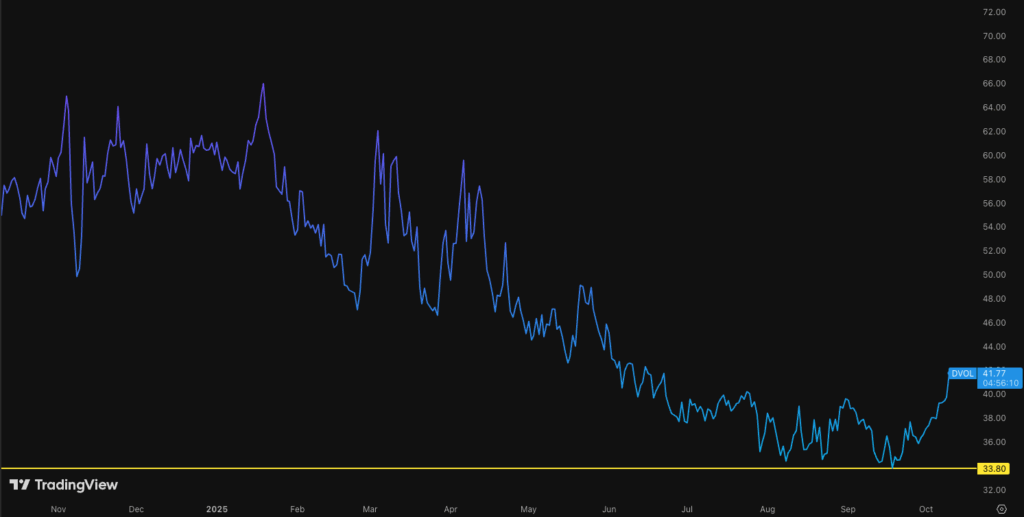

BTC price momentum remains bullish across all timeframes we track. The short-term ETH and SOL trends have shifted from bullish to neutral, though I’m not seeing any signals that’d make me think differently at this moment. I still think markets trade higher this month/quarter.

Also, BTC and ETH implied vol appear to have bottomed, right on time. This is encouraging given the positive correlations we often observe between price and volatility.

BTC Implied Volatility: 1 Year

ETH Implied Volatility: 1 Year

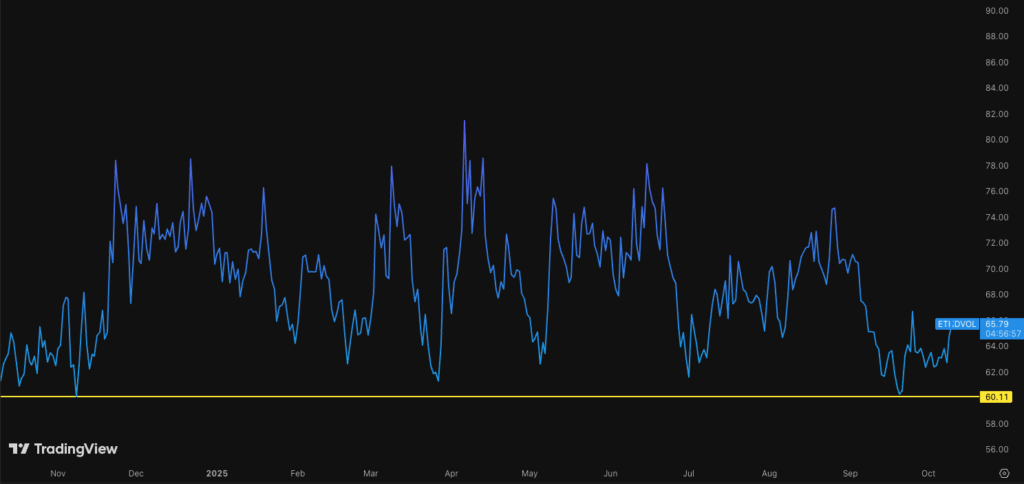

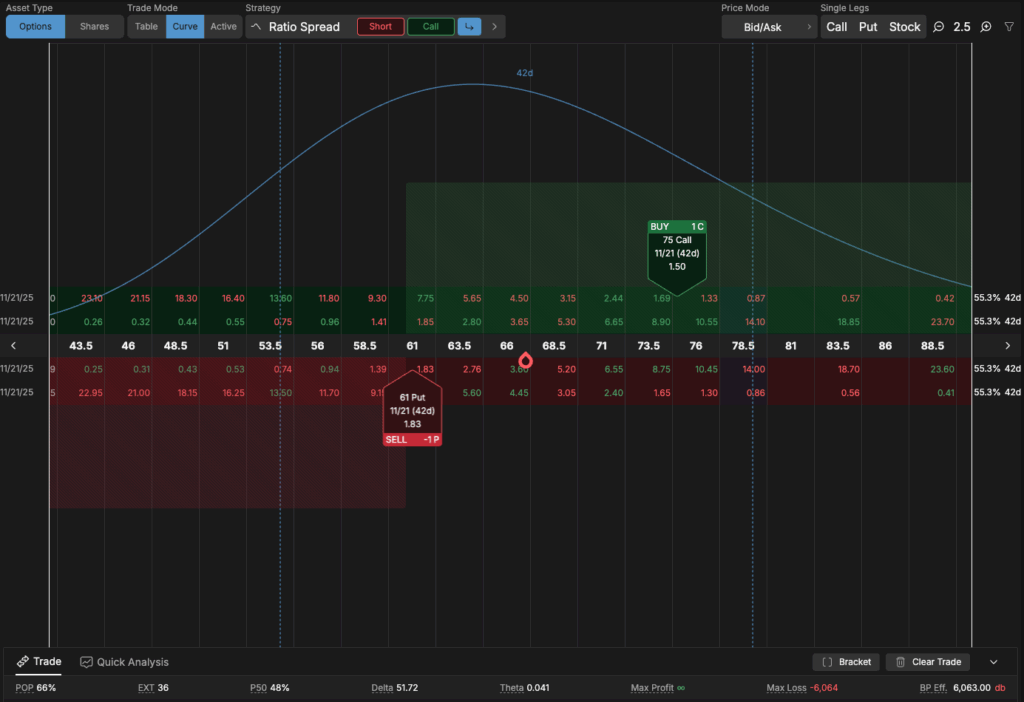

Sell puts, buy calls?

Our good friend Greg Magadini from Amberdata joined us on tastylive again this week to discuss a compelling trade idea he’s seeing in the market, where the setup might be right for a risk reversal as IBIT put options appear relatively rich, versus calls, on a relative basis.

Greg talks us through the trade idea, selling a 25 delta put to buy a 25 delta call. A trade that could certainly benefit if bitcoin grinds higher over the next two months. Watch it all here.

IBIT Risk Reversal Trade Idea Example

That’s it for now. Let’s see what develops over the weekend following the Friday TARIFF THREATS. Until then, keep your head on a swivel and as always… Stay tasty.

Peace.

Ryan

BEANS

🔥 Fridays are for fire.

And this week I (Ryan) made my deput on the show. Jump in the Discord or X Community for more info.

Bring your marshmallows. Stay for the chaos.

Automate your crypto buys with recurring purchases.

— tastytrade (@tastytrade) September 29, 2025

Learn more at https://t.co/EwpQn7g1iE pic.twitter.com/NP8rfNNokf

tasty Shows

🍒 Highlights

🍒 Are you in the $TC X Community?!

🍒 Other crypto emails worth a sub

🍒 Yesterday was an opportunity 🫳🎤