Author: Ryan Grace

May 30, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

Finally we’ve got some sun here in Chicago and the bulls are chirping… Something like that.

I was on the road again this week, this time at the Stablecon Conference in New York, and let me tell you, every time I go to one of these gatherings, I come back even more bullish. It’s not because there’s a bunch of people talking about why or how high the number is going to go up, no, it’s because of who’s in the room and what they’re building. You get a sense of truly how early it all still is. You also get a sense the dam is about to break… Soon, though it probably follows pending legislation in DC, which presumably happens this year. Everyone is hopeful, and when it does, I predict there will be a sea change in the digital assets space. You’ll likely see some of the biggest global financial institutions embrace blockchain tech through payments, in another boon for crypto adoption.

So, the institutions are building and stablecoins are the backbone of a digital payments evolution. Why does this matter for crypto?

The Unsung Heroes of Crypto

Stablecoins are tokens on a blockchain like Ethereum or Solana which are pegged to a fiat currency such as the US dollar. They’re essentially dollars on chain, powering activity across use cases from payments to DeFi. This allows users to participate and hold balances on-chain in a nonvolatile (stable) asset without having to transfer assets back and forth between the blockchain and their bank account. Making stablecoins a systemically important adoption driver of blockchain technology as they power activity and provide practical utility.

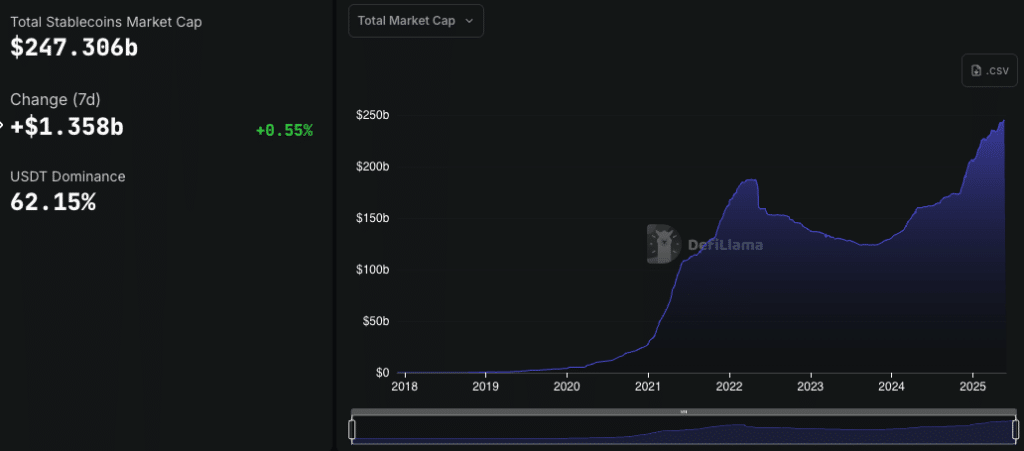

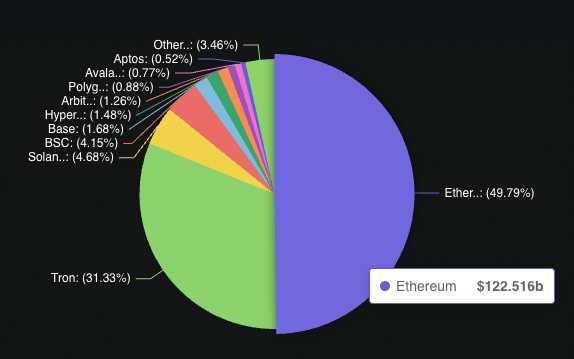

Today, the market cap of stablecoins across all blockchain networks has grown to almost $250 billion, representing about 8% of the total cryptocurrency market ($3.3 trillion). Tether (USDT) and USDC alone account for 86% of this, underscoring their dominance, while stables on Ethereum and Tron are 80% of the market.

Their role is multifaceted:

Everyday Transactions: Stablecoins like USDC enable seamless payments, with platforms like Stripe supporting them across 70+ countries for fast, low-cost cross-border commerce.

Trading and Liquidity: On exchanges, stablecoins serve as a safe haven, allowing traders to park funds without exiting to fiat, boosting market liquidity through popular trading pairs.

DeFi Fuel: In DeFi, stablecoins underpin lending, borrowing, and yield farming on protocols like Aave and MakerDAO’s DAI, driving significant transaction volume.

Emerging Markets: In regions facing inflation or currency devaluation (e.g., India, Nigeria), stablecoins offer wealth preservation and efficient remittances, outpacing traditional systems.

Mainstream Bridge: Institutions like Visa and Standard Chartered are embracing stablecoins, with initiatives like tokenized asset platforms, signaling their integration into traditional finance.

Stablecoins play a growing and significant role in the broader crypto ecosystem, but do they have any influence on crypto prices? Well, the relationship is nuanced.

A growing stablecoin market cap often signals capital inflows, as investors convert fiat to stablecoins to trade or invest, reflecting market enthusiasm. However, direct correlation with prices is low as studies show stablecoin market cap has minimal direct impact on BTC or altcoin prices (-0.0261 and -0.0006 correlations, respectively). Instead, stablecoins act as a liquidity enabler, supporting markets through arbitrage and trading volume.

While there’s no direct correlation between stablecoin issuance, market cap growth, and the price performance of more volatile crypto assets, stablecoins are a bridge between the crypto world and traditional finance. Adoption is still in the early stage and I wouldn’t be surprised to see the total stablecoin market cap at $1 trillion before the end of the decade.

Oh, and by the way, Circle, the company behind USDC, has just filed to go public.

Market Update

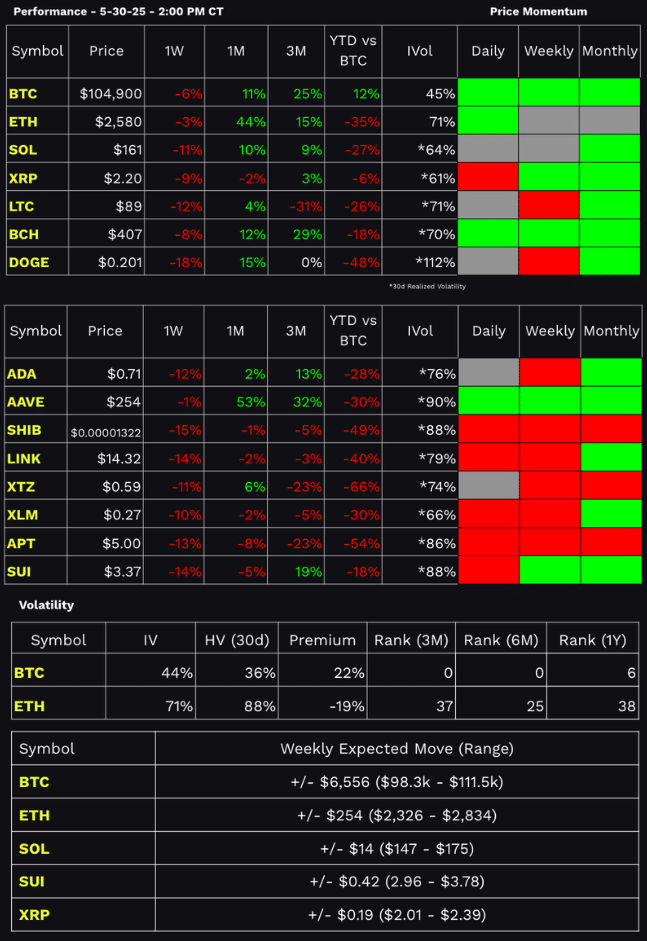

Holding 100k and heading higher. This is my call for now based on what we’re seeing directly in front of us.

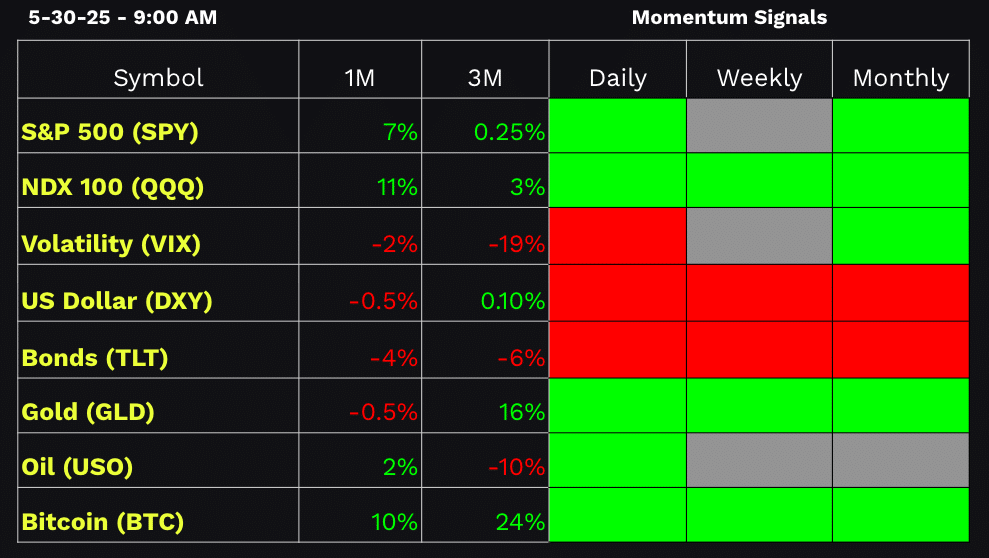

No recession, with the worst of the growth scare behind us! Instead, I think there’s a good chance and growing evidence we see an environment that’s certainly more positive on the growth and inflation side over the next couple of months. When looking at the broader markets and across assets, there are signs.

Liquidity In the Driver’s Seat

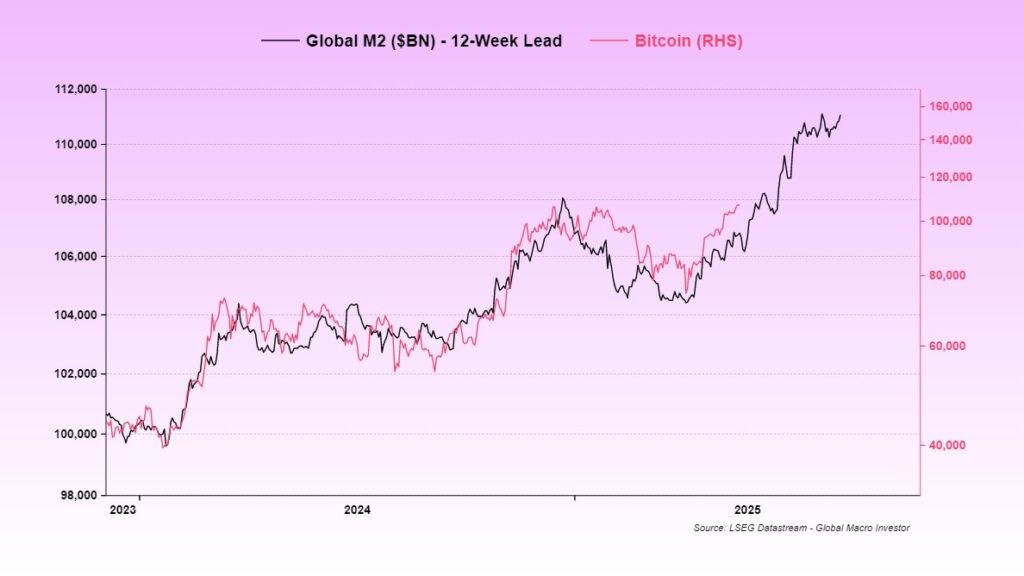

Let’s also revisit Raoul Pal’s chart that’s been making its way around X. Here’s an updated version, which at first glance, maybe the broader liquidity dynamic is all that really matters on the margin. I’d argue that economic conditions influence price action, but if bitcoin’s correlation with global liquidity as measured by M2 on a 90 day forward basis continues to hold, then 100k and higher is the path forward. Silence the noise, and find the signal.

ETH is starting to get a little smokey

Elsewhere, where there’s smoke, there’s fire, or at least a few embers starting to burn a bit brighter. Is our sleeping giant about to wake up? ETH has my attention with its weekly price momentum shifting to neutral after a prolonged bearish period. This is a start. Remember narrative follows price, and price is starting to come back from the dead. Looking at levels, I want to see a break of $2,800 and a ETH/BTC ratio above .025 before I start screaming buy ETH, but if you’ve been riding it out through the chop fest, you just might be rewarded.

Sometimes it goes up even faster than it goes down.

Web3 Word of the Week (W3WOW)

Dan's Stone Cold Crypto Pick of the Week

Each week we try to give you one new idea from the world of decentralized finance to take a look at.

Dan’s pick for this week: Worldcoin ($WLD)

Website: https://world.org/

Worldcoin is a blockchain-based protocol designed to become the world’s largest privacy-preserving human identity and financial network. The project, founded in 2019 by OpenAI CEO Sam Altman, focuses on providing universal access to the global economy through its World ID system and $WLD token. Users can earn or obtain Worldcoin by using the World App, a wallet that allows users to earn Worldcoin by scanning their eyes with an Orb, a small device that uses facial recognition technology.

Key Info

- As of April 2025, there are 26 million total network users worldwide, with 12 million biometrically verified.

- World App Growth: 10 million total users, 2 million DAUs, and over 70 million unique wallet transactions.

- Available in over 160 countries.

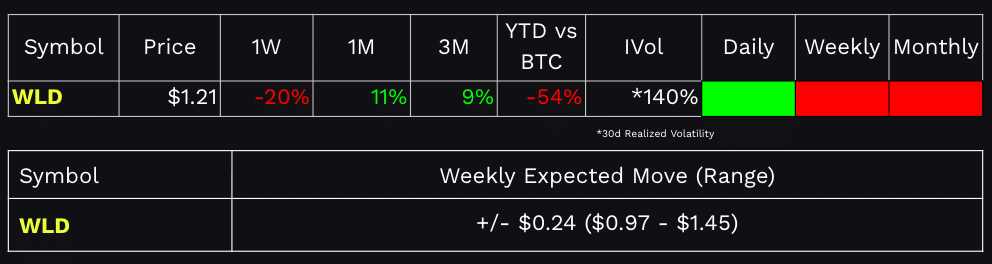

Key Trading Stats: (*As of 5/30/2025)

Market Cap | $1.8 Bil |

Fully Diluted Valuation | $12.1 Bil |

24-Hour Trading Volume | $310 Mil |

Circulating Supply | 1.5 Bil |

Total Supply | 10 Bil |

Total Holders | 46,319 |

Conclusion:

Worldcoin is an ambitious project aiming to tackle global digital identity and verification in the age of AI. The project has substantial backing, raising over $115 million in Series C funding and major partnerships with payment providers like Visa and Circle (USDC). While technically sound, the project’s long-term success will depend on maintaining user growth and addressing global regulatory challenges.

World App – https://world.org/world-app

Documentation – https://whitepaper.world.org/

Chart – https://www.tradingview.com/chart/PISdw9IP/?symbol=BINANCE%3AWLDUSD