Author: Ryan Grace

April 25, 2025

Hello my tasty friends, I hope you’re all having a wonderful start to your weekend. Birds are chirping, sun is shining, and crypto spring is in the air.

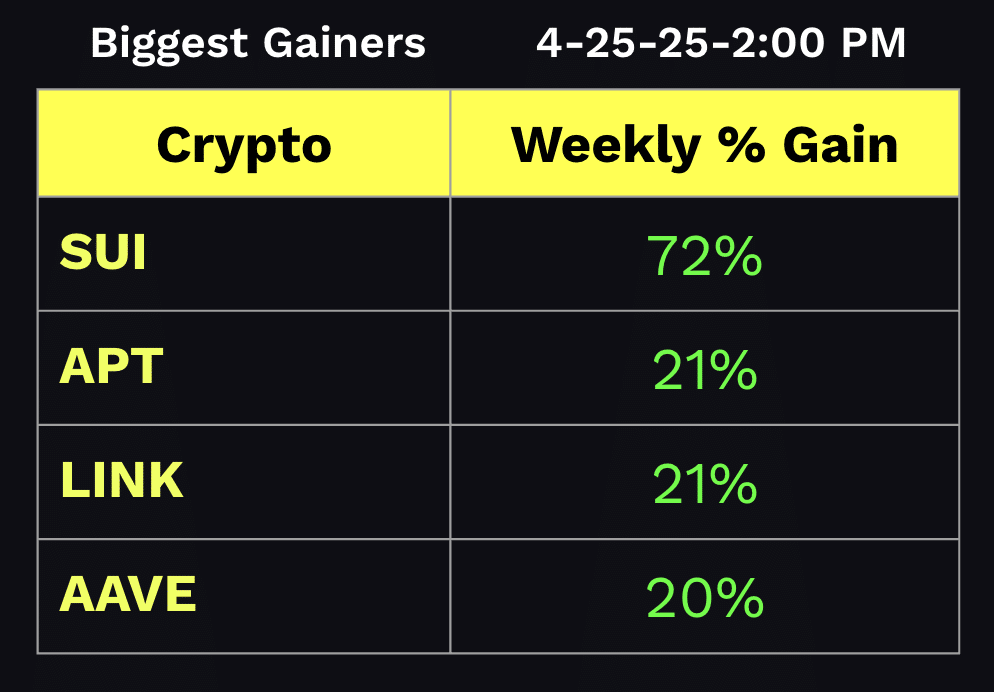

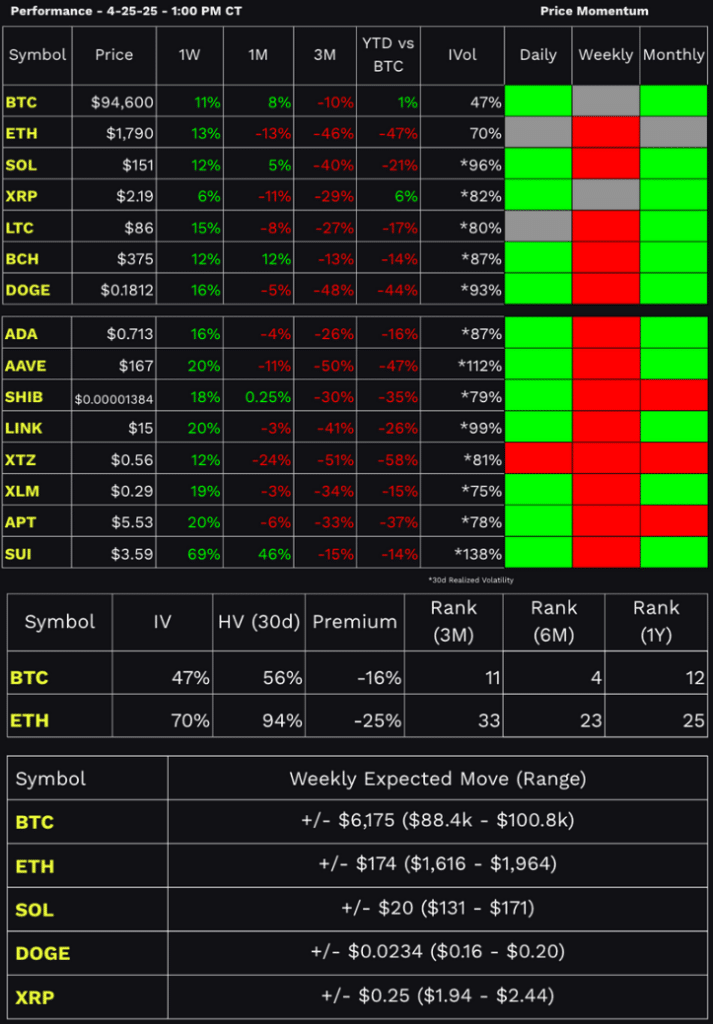

Big bullish moves on the board this week. Let’s take a look at what moved the most.

Biggest Gainers

SUI is clearly in the lead when looking at the biggest gainers on tastytrade’s crypto watchlist. Up 72% for the week, partially being driven by rumors of a possible partnership brewing between the blockchain network and Pokemon.

Total stablecoin market cap on the SUI network has also increased by about 80% over the past few months, which is another positive sign.

XRP In Focus Again

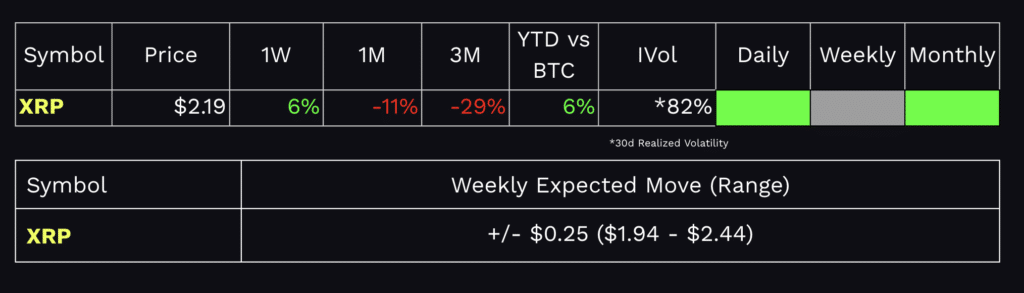

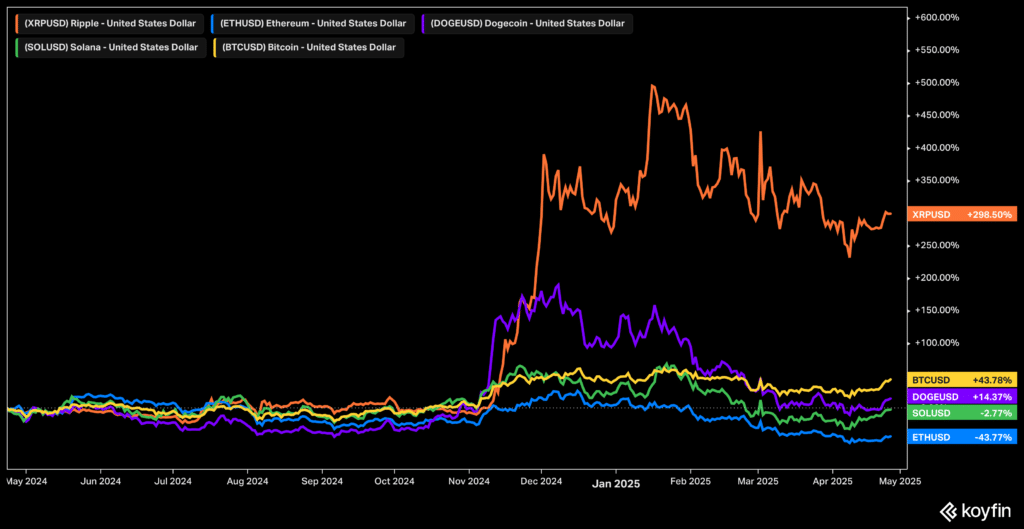

We’ve covered XRP previously and I’ll admit, I’ve been skeptical of its valuation. But, Ripple (the company behind XRP) is making some moves and it’s got my attention. The XRP daily price momentum signal just flipped back to bullish on my charts too.

Let’s start with Ripple’s $1.25 billion acquisition of Hidden Road.

Hidden Road is a global prime brokerage that provides services (trading, clearing settlement, and financing) to hundreds of global institutions across FX, digital assets, derivatives, and securities markets. Which seems to fit nicely into the company’s strategy of building institutional blockchain infrastructure to connect TradFi and DeFi.

Ripple’s ecosystem now includes a decentralized open-source blockchain network with its XRPL ledger. A dollar-pegged stablecoin in the form of RLUSD, and now a prime brokerage with Hidden Road.

Putting this all together, XRPL (blockchain network) provides the core infrastructure for payments, DeFi, and tokenized assets. RLUSD (stablecoin) acts as a stable asset for payments and collateral across the network.

All while the connection with Hidden Road creates an institutional gateway of prime brokerage services that are integrated with RLUSD and XRPL across trading and settlement.

Ripple is positioning itself to become a dominant venue for institutional blockchain solutions. This could lead to a reflexive system that increases demand for the XRP token. But, that’s not all.

XRP ETFs are pending approval

The first XRP ETF launched from Teucrium, which gives investors 2x leveraged long exposure to the price of XRP through futures, while applications for spot XRP ETFs are pending from the likes of Bitwise, Grayscale, and more.

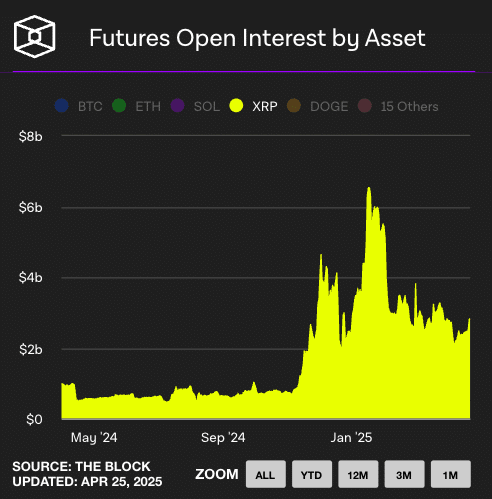

XRP futures are now trading

XRP futures trading is now available through Coinbase, with the CME planning to launch its own XRP futures contract in May. While the availability of futures trading is not necessarily bullish on its own, it enhances XRP’s liquidity and supports pending XRP ETF approvals, which could potentially support XRP’s price.

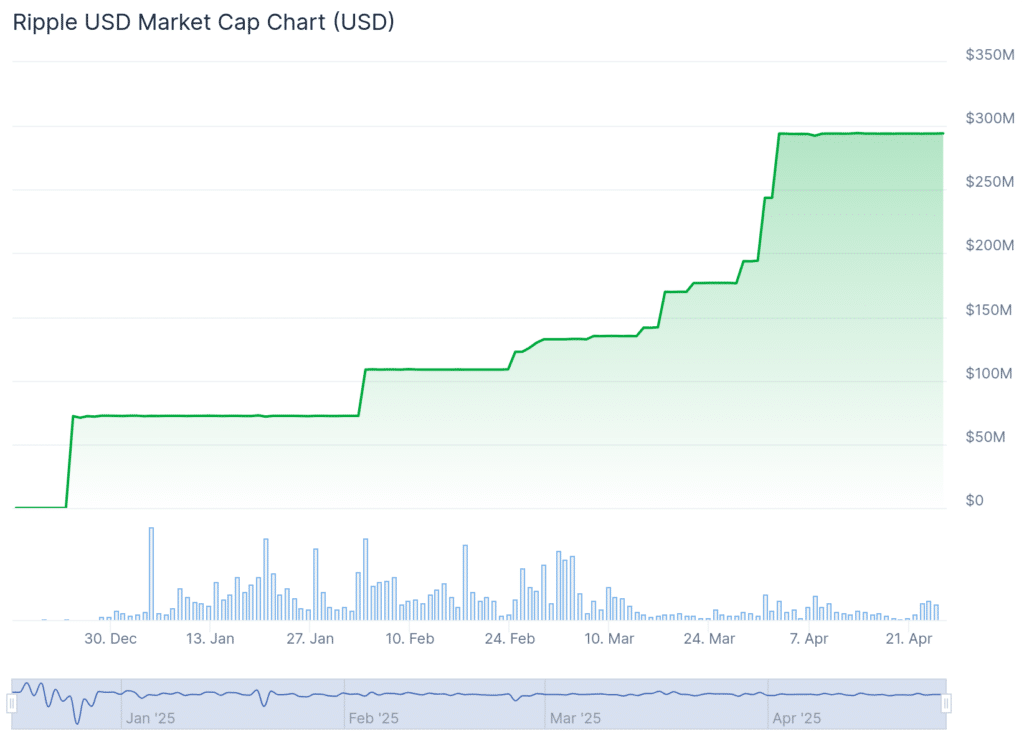

And, RLUSD adoption is growing

Ripple’s RLUSD stablecoin was integrated into Aave’s V3 Ethereum Core Market on April 21, 2025. Now, users can supply up to 50 million RLUSD and borrow up to 5 million RLUSD on Aave, the largest decentralized lending protocol by TVL.

This enhances RLUSD’s DeFi utility, enabling yield generation and borrowing while increasing XRP Ledger (XRPL) activity, as RLUSD transactions on XRPL require XRP fees.

What’s the End Game?

I don’t own XRP presently, but it’s hard to ignore Ripple’s progress towards building a blockchain based financial ecosystem where XRPL serves as the infrastructure, XRP as the native settlement asset, and RLUSD as a stable bridge between TradFi and DeFi.

I’ve been critical of XRP’s value before, but maybe the Hidden Road acquisition changes everything. Let’s keep an eye on RLUSD adoption going forward and eventual ETF flows, though I suspect price momentum will provide a signal well ahead of time.

Web3 Word of the Week (W3WOW)

Show Highlights

- Everyone wants USDC.

- We ride at dawn.

- It’s the little things.

- Shelley coined a dead cat as Furry, the first.