Author: Ryan Grace

Uptober 17, 2025

Hello my tasty friends. I hope you’re all having a wonderful start to your weekend.

We’re mid way through October and everyone’s starting to wonder if it’s all over. Has the cycle peaked? Is seasonality dead? Should you be scared?

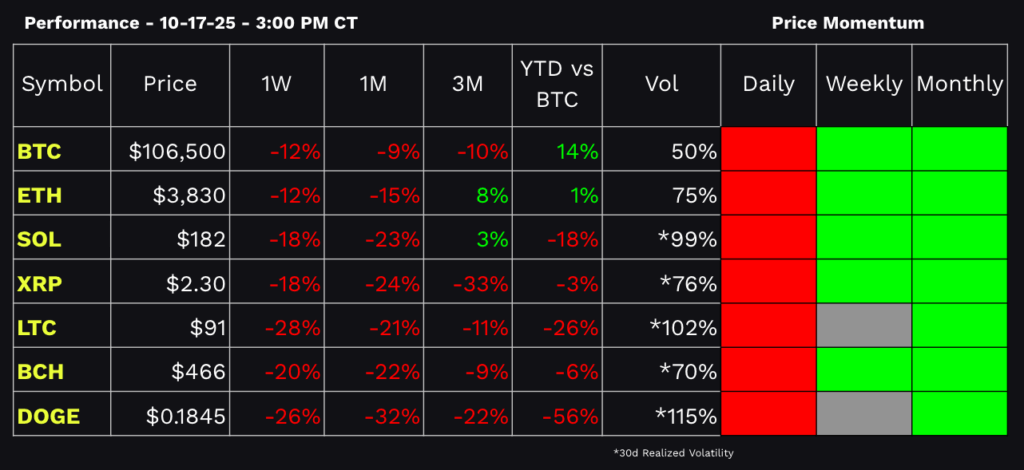

Personally, I’ve added a bit more to my BTC, ETH, and SOL positions, especially ETH at $3,800. I’m long both spot crypto, and a lot of ETHA delta. You know where I stand.

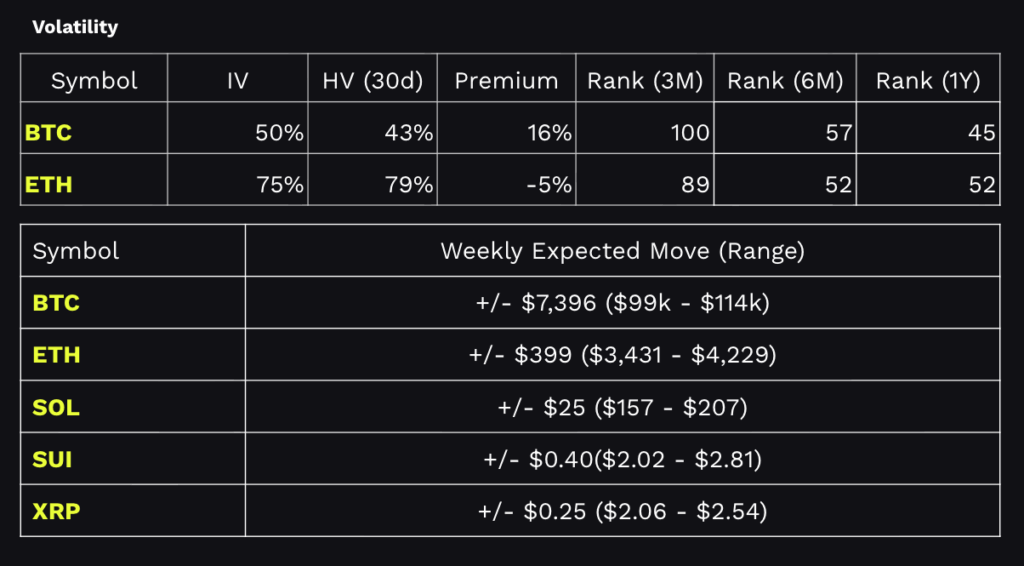

Sticking with ETH, we’re now trading at the low end of the one-standard deviation range from the beginning of the week and buyers have shown up at this level a few times this month, so I’m looking for the market to hang on here. If it doesn’t, a further break down under $3,500 and any change in weekly price momentum from bullish to neutral will have me rethinking the trade, at least short-term. On the upside, I think we go on to hit a new ATH in ETH by year-end.

Big Picture Macro Stuff

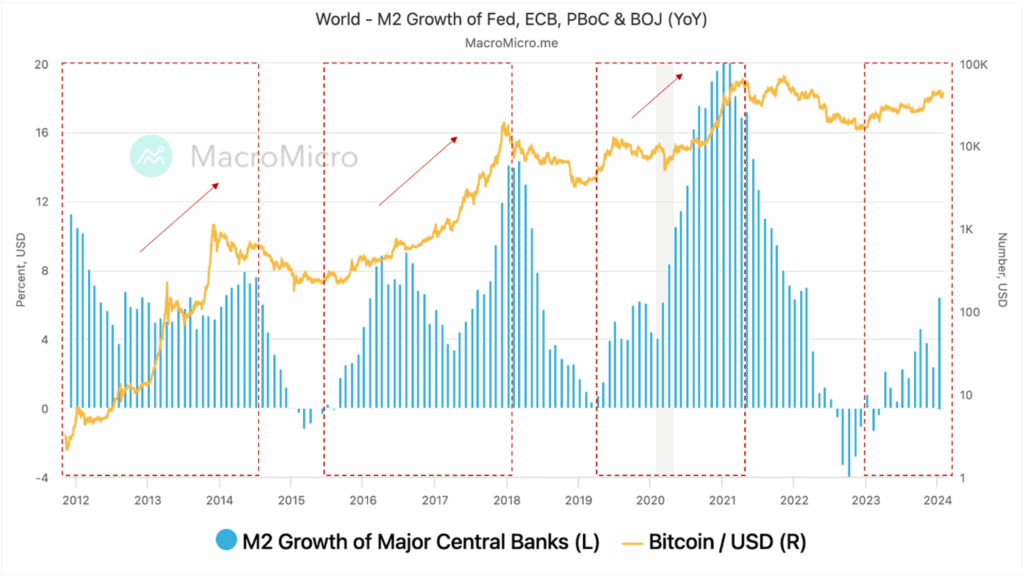

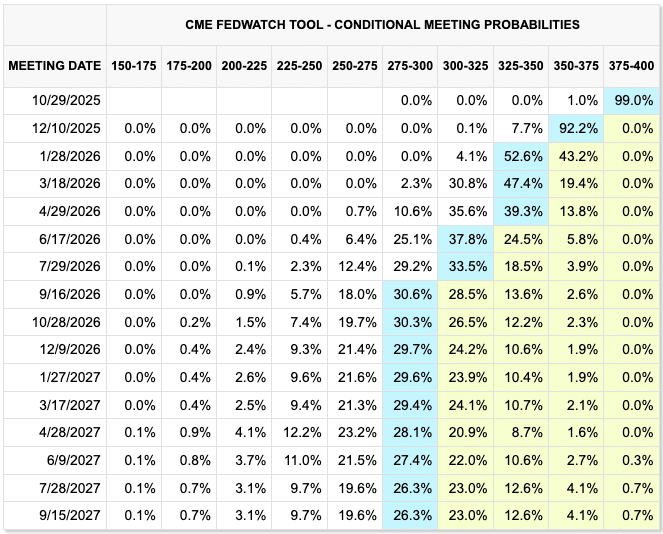

Crypto loves liquidity and generally benefits from loose financial conditions (low interest rates, Fed balance sheet expansion, credit creation, etc.), and the Fed seems to be teeing up more easing. The market is currently pricing in a 100% chance of another 25 basis point rate cut at the next meeting on 10/29. There’s a 92% probability being priced in for another cut in December too.

Lower rates reduce opportunity costs for holding non-yielding assets like BTC/ETH. Gold is a good example of this as well. The rally in gold shouldn’t be all that surprising given the way 2- and 10-year treasury yields have been trading.

Beyond rates, The Fed’s balance sheet has shrunk to $6.6 trillion as its QT program has been reducing the balance sheet by roughly $100 billion a month since 2022. On Tuesday, Powell signaled an end to quantitative tightening, hinting at a timeframe “within months,” potentially as early as Q1 2026 or sooner if funding pressures mount (there’s been some concern over recent stress in the repo market). In my opinion, ending the balance sheet reduction and possibly even reverting to expansion is more impactful for crypto/asset prices, versus interest rate cuts.

Quantitative Tightening is the process of reducing the Fed’s balance sheet by not reinvesting in new Treasury bonds when the existing bonds it holds mature. Instead, the Fed lets the bonds “roll off” without reinvesting in new debt issued by the US Treasury. This matters on the margin as the process drains excess reserves from the banking system, which reduces liquidity and tightens financial conditions.

When this ends, the Fed will begin to absorb more of the new debt issued by the Treasury, meaning less debt will need to be sold to the private sector. If banks no longer have to plug the hole created by the Fed’s QT process, it should lead to more liquidity in the banking system which often makes its way into financial assets. Historically crypto benefits as the money supply grows.

Is there another banking crisis?

Elsewhere in the banking system, there are some concerning cracks emerging, at least initially. If you haven’t been following “the regional bank crisis” a couple of banks (Zions, Western Alliance) recently disclosed some large loan losses due to failures by the auto parts maker First Brands and auto lender Tricolor. This has spooked the market, due to the possibility more bad loans are out there and could lead to additional losses. How many other banks might reveal similar issues? This seems isolated at the moment, but there’s a sense there’s another shoe to drop given what we’re seeing in the repo market. Banks have been tapping the Fed’s standing repo facility unusually hard this week, which is a signal cash is scarce and there could be some short-term stress in money markets.

Now what exactly does this have to do with crypto? Well, should things get worse, the likely response might actually be bullish for crypto. At least it was the last time this happened. More stress probably forces the Fed’s hand and we get more liquidity sooner (e.g., QT slowdown/stop, more repo support). Remember March 2023? We saw a version of this during the 2023 regional-bank episode when the Fed rolled out the Bank Term Funding Program (BTFP) and markets rallied as conditions loosened. We’re facing slightly different issues today, but my point is simply that the Fed will not just sit back and watch a banking crisis materialize, and their likely response will ultimately be net positive for liquidity and prices, beyond any short-term volatility.

It’s not my base case, but if anything happens short-term to force the Fed to restart quantitative easing, then we probably find ourselves in full blown blast off mode in crypto. More likely, we see the Fed push an emergency rate cut or immediate halt to QT. – Also bullish for crypto.

Trump, Tariffs, Tweets

Almost forgot about this, but clearly there will be a short-term reaction to any tariff related headlines and US/China trade policy. Don’t let the scary tweets shake you out of good positions. We’ve watched this movie on repeat: tariff bomb, tweet storm, timeline panic… then a walk-back or a “deal.” It’s a negotiation tactic, not a new macro regime. If anything, I think this sort of volatility creates opportunities to add to positions in BTC and ETH. If policy actually changes, the market will tell you and I think you’ll see it very clearly across major asset classes, not just crypto volatility.

Respect the Dip

We’re still licking our wounds from the massive leverage unwind this time last week, but I don’t think the price action we’ve witnessed is out of the ordinary or enough to get me to think much differently about my position. Yes, the move was fast and violent, but at the time of writing, BTC is about 20% off the ATH (10/6) and ETH is down about 25% from its all-time high (8/24). The pull-back hurts, but the price action is relatively normal. Throughout historical bull markets in BTC, we quite often get average declines between 20-30%. Let’s keep an eye on current levels and if they hold and this doesn’t materialize into something worse, I think there’s a decent chance we reverse quite quickly. Crypto can crash fast, but sometimes it goes up even faster.

I’m not scared, yet. Regardless of the catalyst, I think we’re seeing textbook bull-market behavior: fast deleveraging, a jump in realized/implied vol, put skew richening as hedges get bid, and then prices stabilizing back inside the broader uptrend. In other words, this looked like a leverage rinse and a sentiment reset and not the start of a structural trend break.

I still think ETH goes on to hit a new ATH and that the broader crypto cycle is not over, but this game is not about being right, it’s about making money. If ETH breaks 3,500 and holds and BTC continues to trade lower, I’ll take some off the table and go elsewhere while waiting for better market conditions. After all, you can trade everything at tastytrade, and my brothers in the mines tell me Platinum futures is where the real money is.

Keep your head on a swivel.

Stay tasty,

Ryan

BEANS

🔥 Fridays are for fire.

Dan is back! Jump in the Discord or X Community for more info.

Bring your marshmallows. Stay for the chaos.

“UPtober” isn’t just a meme — it’s a nod to Bitcoin’s history of strong Q4 performance.

— tastytrade (@tastytrade) October 15, 2025

Remember: past performance ≠ future results.

See the data and why some investors view crypto as a small, potential diversifier: 🔗 https://t.co/yLppB1ODL5$BTC #Uptober pic.twitter.com/csYwHsDsy7

tasty Shows

🍒 Highlights

🍒 Are you in the $TC X Community?!

🍒 I like big charts and I cannot lie

🍒 Bitcoin TO ZERO?!