Author: Dan Cecilia & Shelley VanWitzenburg

Sept 19, 2025

Hello tasty fam! We hope you are having a great start to your weekend.

If you have been following along the last few weeks, I made a strong case for the start of altcoin season amidst several factors which serve as tailwinds to this narrative. First, we have the plethora of DAT companies launching (see DAT Tracker below) to buy up tokens other than ETH. Second, we had the rotation from BTC into ETH and now into SOL. Third, we have the altcoin marketcap (tokens other than BTC) which has reached an all-time high of over $1 trillion this past week.

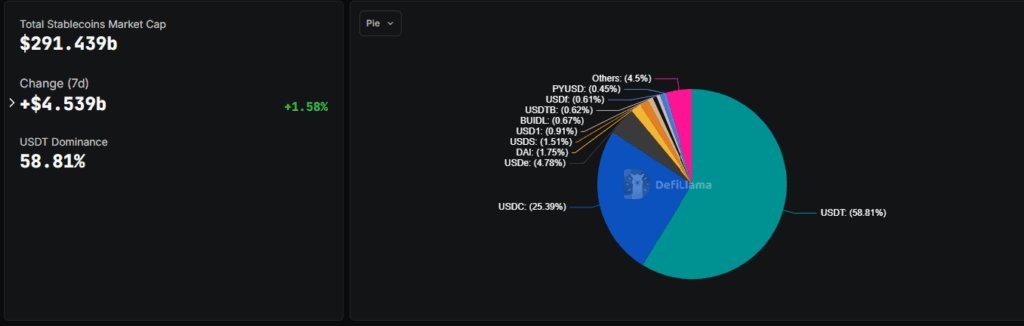

Finally, we have a record number of Stablecoins launching, which has pushed Stablecoin market cap to all-time highs.

All in all, it looks like altcoin season is in full swing. Buckle up!

Hyperliquid

This week I’d like to focus on a popular protocol among crypto natives – Hyperliquid.

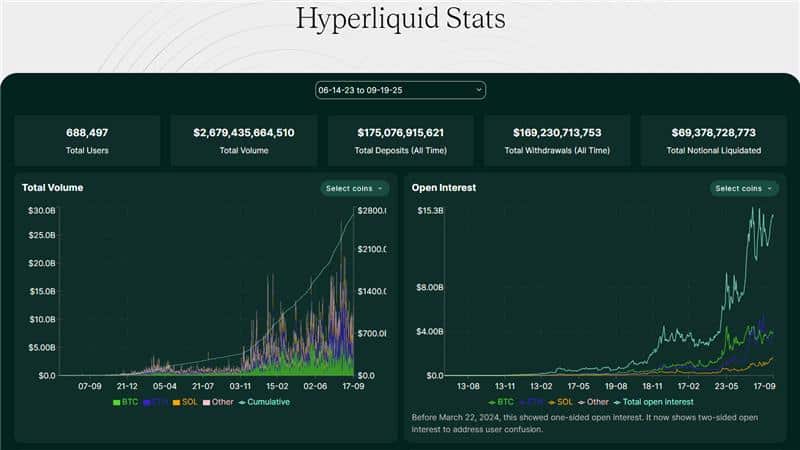

Hyperliquid, launched in July 2024, has grown to be one of the fastest growing Layer 1 Blockchains. Built from the ground up to create a fully on-chain open financial system, the protocol operates its own custom consensus algorithm and currently supports 200,000 orders per second with sub-second block finality, which supports fully on chain perpetual futures and spot order books.

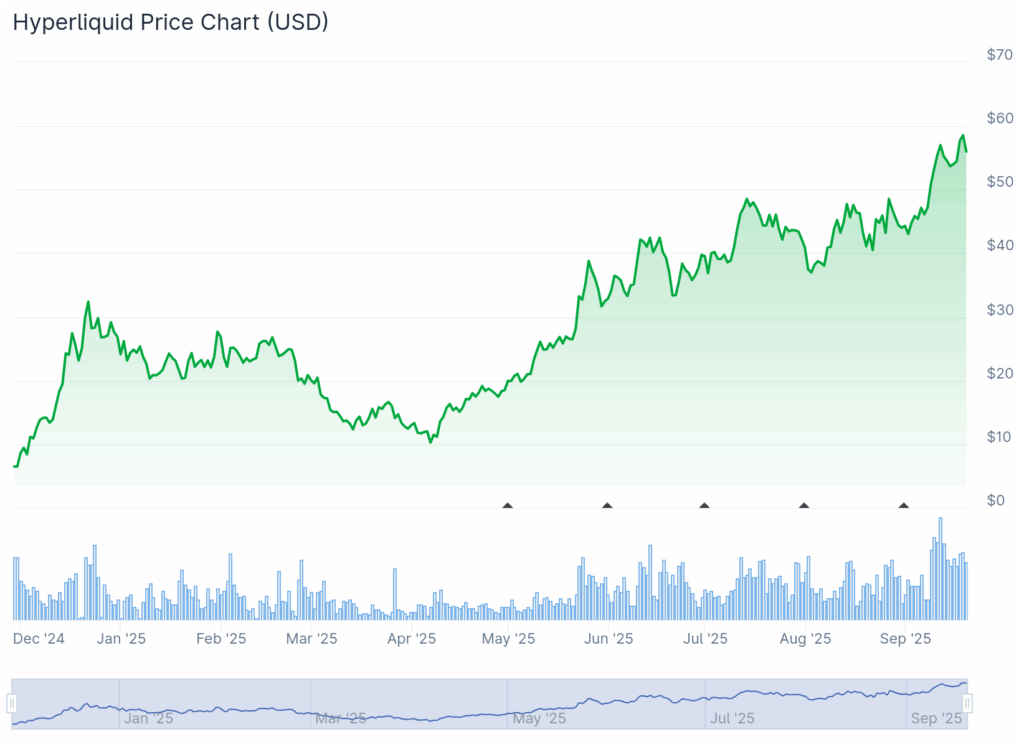

As of writing, the $HYPE token trades at $56-$57 with a $15.2 billion market cap. This ranks it in the top 15 cryptocurrencies by market cap.

Since its launch in November 2024, the $HYPE token has gained over 1,600%.

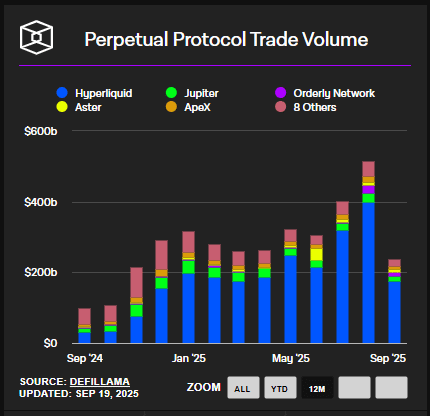

Its on-chain perpetual futures exchange processes over $10 billion in volume daily and accounts for over 70% of all on chain trading volume.

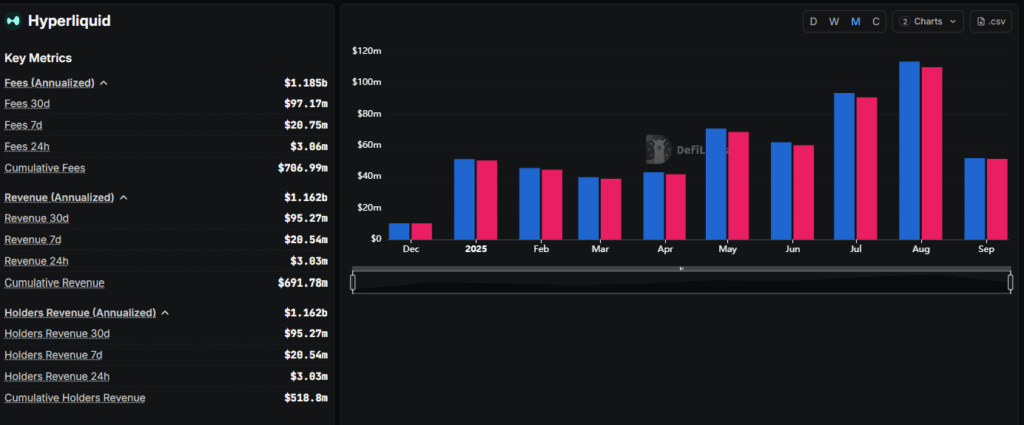

The protocol has an innovative revenue mechanic where 99% of trading fees go to a fund that buys back $HYPE tokens. This creates deflationary price pressure and drives significant token price appreciation.

Currently Hyperliquid earns over $3.0 million in daily revenue, surpassing Ethereum, Solana, and Binance Smart Chain.

The protocol has over 600,000 users and is adding between 3,000 and 4,000 new wallets per day, indicating sustained and steady growth.

Perhaps, what’s most impressive about Hyperliquid is that it has achieved this growth without any outside investors, choosing to take a community approach to growth without venture capital backing. With 70% of tokens allocated to users and all platform revenue redistributed back to the community.

Circle recently launched native USDC on Hyperliquid’s HyperEVM and HyperCore protocols, integrating its upgraded Cross-Chain Transfer Protocol (CCTP v2), to further support this growth. This move comes alongside Native Markets being tapped to issue USDH, a Hyperliquid-aligned USD stablecoin.

The stablecoin represents a way for Hyperliquid to capture more value from its ecosystem rather than paying that yield to external stablecoin issuers. Native Markets pledges to split all reserve yield equally between Hyperliquid’s Assistance Fund (which conducts HYPE buybacks) and ecosystem growth initiatives.

Every cycle we see a new protocol emerge that represents a significant advancement over previous cycles and Hyperliquid seems poised to claim that title this cycle. Its innovative technology stack, community-focused tokenomics, and ability to dominate on-chain trading volumes have set it apart from competitors. As more users and developers flock to Hyperliquid, its influence on the broader crypto landscape will likely continue to grow, solidifying its position as a key player in DeFi innovation.

I hope we can list $HYPE on the tastytrade platform soon.

DAT Tracker

| Symbol | Name | Exchg |

| MSTR | Strategy Inc Class A | NASDAQ |

| COIN | Coinbase Global Inc Ordinary Shares – Class A | NASDAQ |

| CRCL | Circle Internet Group Inc Ordinary Shares – Class A | NYSE |

| BLSH | Bullish | NYSE |

| BMNR | BitMine Immersion Technologies Inc | XASE |

| GLXY | Galaxy Digital Inc Ordinary Shares – Class A | NASDAQ |

| FORD | Forward Industries Inc | NASDAQ |

| GME | GameStop Corp Class A | NYSE |

| HSDT | Helius Medical Technologies Inc Class A | NASDAQ |

| OCTO | Eightco Holdings Inc | NASDAQ |

| SBET | SharpLink Gaming Inc Ordinary Shares | NASDAQ |

| DFDV | DeFi Development Corp | NASDAQ |

| STSS | Sharps Technology Inc | NASDAQ |

| UPXI | Upexi Inc | NASDAQ |

| SUIG | Sui Group Holdings Ltd | NASDAQ |

| BTBT | Bit Digital Inc Ordinary Shares | NASDAQ |

| TRON | Tron Inc | NASDAQ |

| BTCT | BTC Digital Ltd Ordinary Shares | NASDAQ |

| LGHL | Lion Group Holding Ltd ADR | NASDAQ |

| GAME | GameSquare Holdings Inc | NASDAQ |

Recurring Crypto Purchases at tastytrade

If you haven’t heard, tastytrade just added a really useful crypto investing feature to the platform, recurring purchases. You can now set up recurring purchases to buy any token on a regularly scheduled basis.

Personally, I like to try and time the markets and I like when it get’s a little crazy, but that’s just me. If you prefer to take a different approach and dollar cost average into an investment over time, this is an easy, automated way to do it, which can help smooth out your average entry price.

DeFi Highlights

We will highlight a few DeFi LP plays that you can check out for those of you deep in the trenches.

$TC/SOL on Meteora

If you haven’t been following along, we launched a token on our BEANS livestream and setup a liquidity pool on Meteora.

If you would like to follow along and provide liquidity, you can do so here.

Note: the $tc token is for entertainment and education purposes only. It’s not an investment.

BEANS

🔥 Fridays are for fire.

Each week on BEANS, Shelley and Dan torch some $TC—chipping away at a planned 300M token burn.

Want in? Send $TC to the burn wallet. Jump in the Discord or X Community for more info.

Bring your marshmallows. Stay for the chaos.

BEANS Ep 37: $TC $PNKSTR $ZORA + $USDC GIVEAWAYS https://t.co/uaSlPgXZYB

— tastycrypto (@tastycrypto) September 19, 2025

Miss the live tasty Shows?

🍒 Highlights:

Much love,

Dan and Shelley