Author: Ryan Grace

May 9, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

Per usual, we’ve been busy, and this week we gave the cave walls a fresh set of paint.

What color, you ask? My favorite color, a beautiful bright green. Not a dark forest green, something better, brighter. The cave now has a bright electric glow. Radiating with warmth, and the color of freedom.

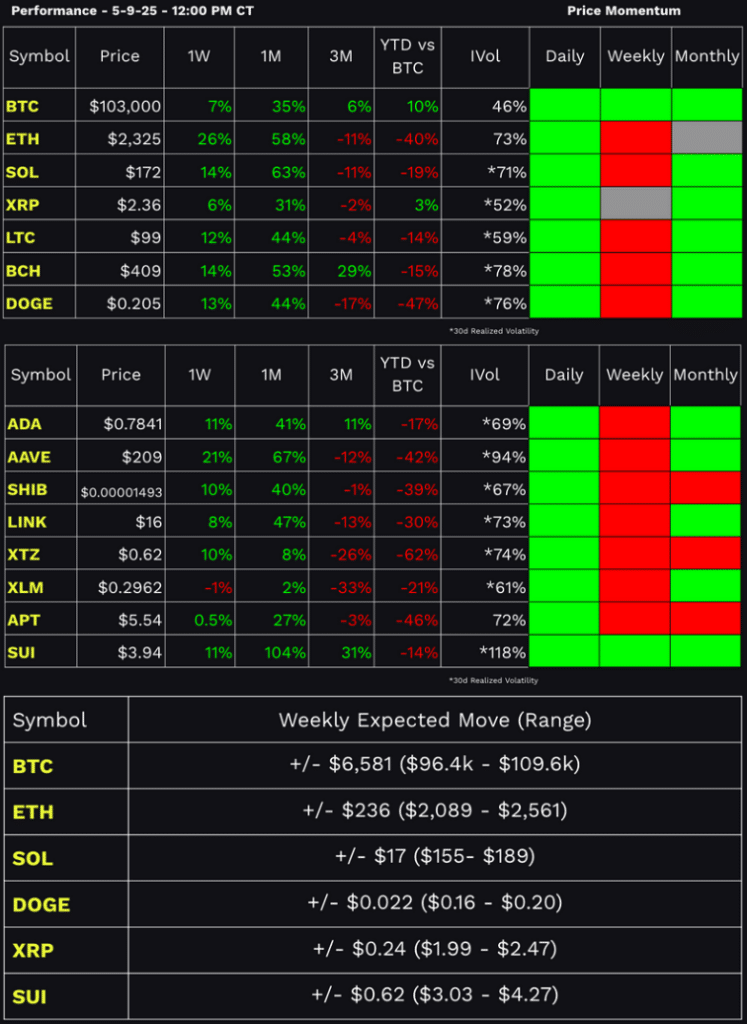

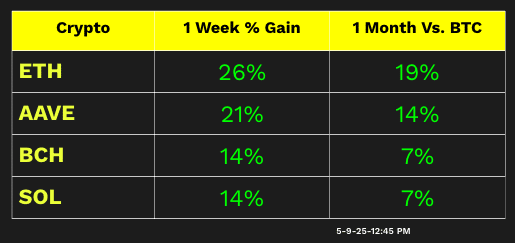

Performance Dashboard & Biggest Movers

So, we’re back at 100k, we’re pumping, we’re feeling good, but will we break out? Remember, we’ve been here before and it’s only just a number. At a spot price of $103,000 and a current implied volatility of 46%, bitcoin’s one standard deviation weekly move is approximately $6,500, giving us an estimated trading range of basically 109 to 96. A dip back below 100k is well within the realm of possibilities, while the range is not yet pricing in a new ATH.

I should caution that both implied and realized volatilities for BTC are relatively low. Bitcoin’s implied volatility is near the low-end of its yearly range. For what it’s worth, when we first traded at the 100k level in November 2024, BTC IV was closer to 60%.

Price momentum remains in favor of the bulls and I’m looking for BTC to take another look at 110k. Maybe it breaks higher this time.

Some Reasons Why I Think Bitcoin Might Break Higher

Massive ETF inflows have resumed. Institutional adoption through spot BTC ETFs keeps growing, with approximately $9.9 billion in inflows since November 2024.

Global liquidity is improving. We’re seeing rising M2 money supply across major economies and this has been supportive of BTC during past cycles.

Rates are still at 4%. The Fed has room to cut further if needed.

Recession fears are overblown, the labor market is showing signs of strength, while the global economy is in decent shape.

And on tariffs, there still might be some storm clouds on the horizon, but we’re not in the hurricane anymore. We just had a big UK-US trade deal, expect more to come and a softening of tariff policies as discussions with other countries progress.

What else are we seeing?

Bitcoin market cap dominance has pulled back from its recent high, but the trend is still bullish. There’s no sign of alt coin season just yet.

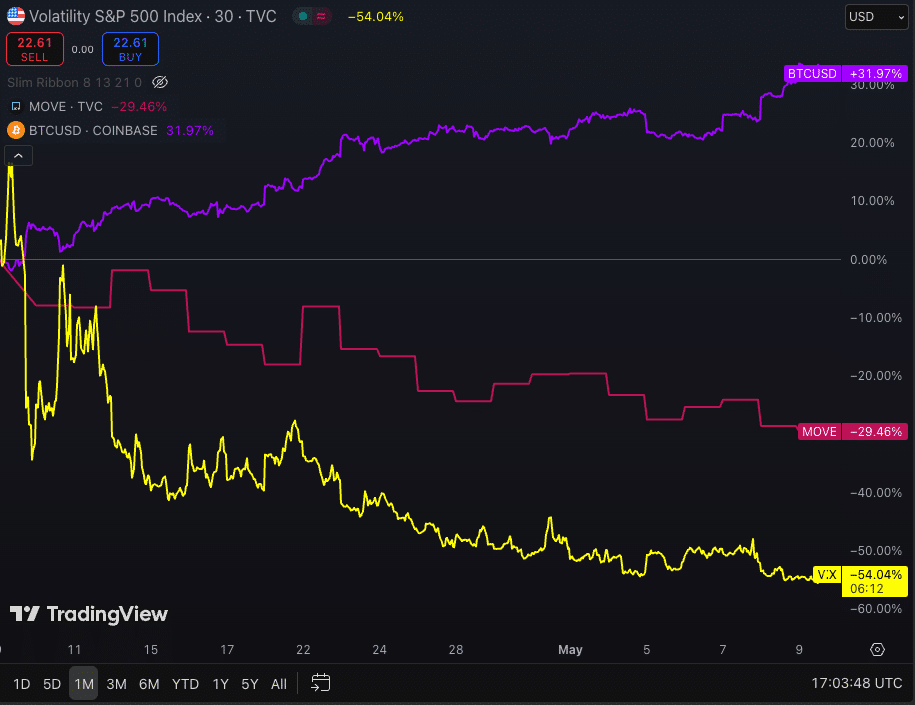

Falling equity and bond market volatility is good for BTC. Look at the relationship between the VIX, MOVE Index (bond market vol), and bitcoin.

ETH Signs

ETH/BTC daily price momentum just went bullish for the first time this year. That said, the trend is still trashy.

ETH implied vol is jumping.

Ethereum Just Got Upgraded - Pectra

This week, Ethereum just got a major upgrade called Pectra, its biggest update since the merge to proof-of-stake in 2022. Pectra introduces 11 improvements (called EIPs) that enhance how Ethereum handles transactions, staking, and user interactions.

Pectra is significant because it ultimately makes Ethereum faster, cheaper, and easier to use. Which should lead to further development activity, utility, and users over time.

Cheaper and Faster Transactions

Pectra doubles Ethereum’s capacity to process transactions through “blobs” (a tech introduced in 2024). This means Layer 2 solutions (like Arbitrum or Optimism), which make transactions faster and cheaper, can now handle twice as many transactions, potentially jumping from 210 to 420 transactions per second.

Easier-to-Use Wallets

Ethereum wallets will become smarter through “account abstraction” (EIP-7702). Soon, you’ll be able to pay transaction (gas) fees with tokens like USDC instead of ETH, batch multiple actions (like approving and swapping tokens) in one go, or even recover your wallet more easily if you lose access. If Ethereum becomes easier to use, it could attract more users on-chain.

Web3 Word of the Week (W3WOW)

Better Staking Opportunities

Validators can now stake more ETH (up to 2,048 ETH instead of 32 ETH) with less hassle. Pectra also speeds up the process of joining as a validator, and improves security for staked funds.

Dan's Stone Cold Crypto Pick of the Week

Each week we try to give you one new idea from the world of decentralized finance to take a look at.

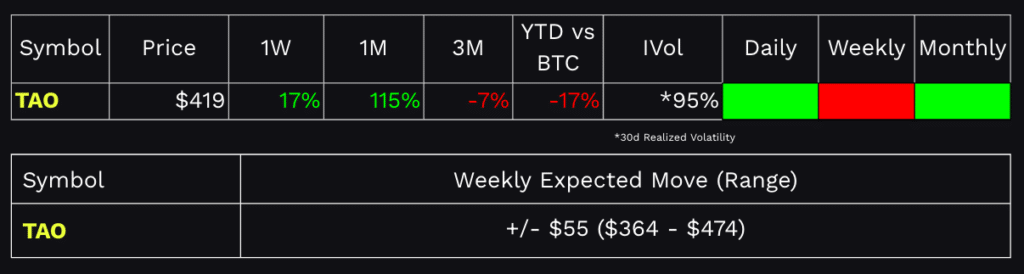

Dan’s pick for this week: Bittensor ($TAO)

Website: https://bittensor.com/

Bittensor is an open-source protocol powering a decentralized, blockchain-based machine learning network where AI models train collaboratively and are rewarded with TAO tokens based on their value. The platform creates a marketplace for AI, allowing developers and users to interact in a trustless, transparent environment while incentivizing the development of effective AI technologies through its tokenomic structure.

Network & Usage Metrics

- Staking Yield: 15-19% APY

- Token Holders: 104,000

- Subnet Ecosystem: Up from 32 in early 2024, there are now over 80 active subnets (specialized AI marketplaces).

- Celium Subnet, a GPU marketplace, generated over $1M in revenue in 5 months.

Links

TAO Explorer – https://www.tao.app/explorer

Documentation – https://docs.bittensor.com/

Trading View – https://www.tradingview.com/chart/PISdw9IP/?symbol=COINBASE%3ATAOUSD

Cave Quick Clips

Music is better on chain

Shelley is seeing hotdogs

Like home equity loans, but NFTs

That’s it for this week, hopefully this bullish price action continues.

We’re live on-air next Monday and then we’re off to Toronto for Consensus. Until then, good luck and of course, keep your head on a swivel.

Stay tasty,

Ryan