Author: Ryan Grace

August 29, 2025

Hello my tasty friends, I hope you’re all having a wonderful start to your weekend.

Crypto Market Update

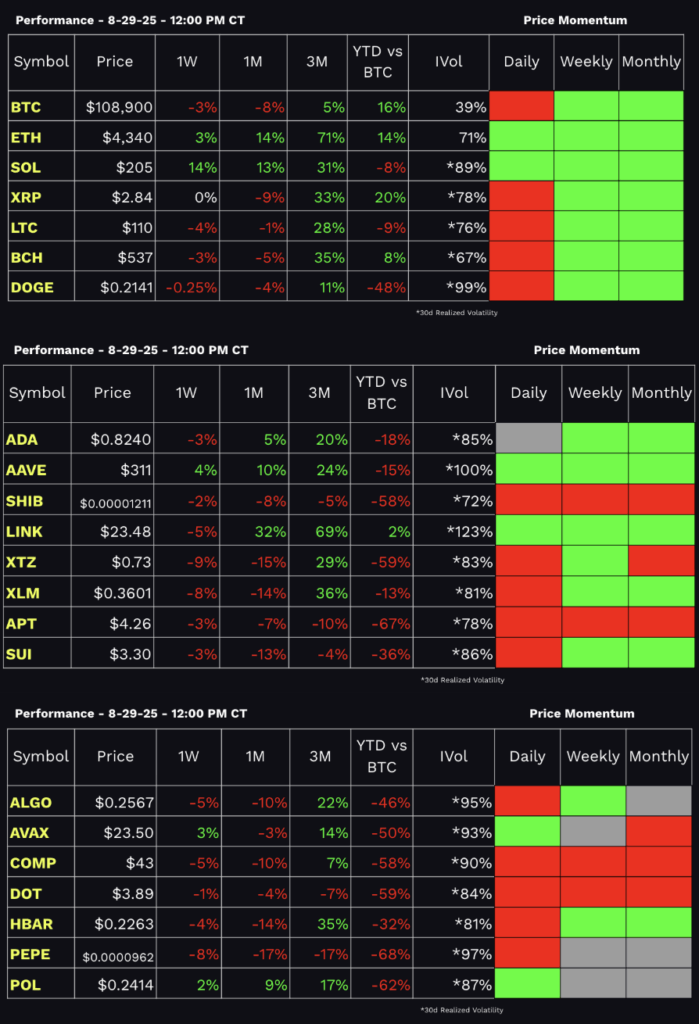

Quick check of the markets and we see BTC lower on the week while ETH and SOL are outperforming. Right now it’s ETH and SOL over BTC, given BTC’s bearish momentum. Until this signal changes, I’m less interested in buying dips here compared to ETH and SOL.

I’m keeping an eye on SOL here. For a trade, I’m looking to add near $200 with a profit target of $225. The SOL/ETH ratio looks to be bottoming and SOL is trading well against BTC.

Beyond short-term trades, from everything I observe and read, the macro picture looks supportive. We’re seeing evidence of inflation re-accelerating at the margin, signs of economic growth from capital-goods orders to retail sales, and a strong market signal in the on-going yield curve steepening. – These are all signs of the rate of growth and inflation accelerating.

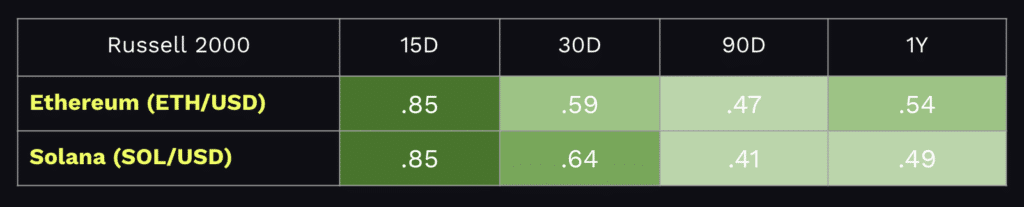

This environment is usually positive for crypto assets, tech stocks, and can be a boost to small/mid-cap companies.

If we’re in a market where small/mid caps will do well, it’s worth noting the strong positive correlations between the Russell 2000 and ETH, SOL too.

We’ve had more volatility this week, which can create opportunities, but this doesn’t mean we should buy every dip in everything. For now, my attention is on alts which are outperforming, until we get the bullish BTC price momentum signal again.

Recurring Crypto Purchases at tastytrade

If you haven’t heard, tastytrade just added a really useful crypto investing feature to the platform, recurring purchases. You can now set up recurring purchases to buy any token on a regularly scheduled basis.

Personally, I like to try and time the markets and I like when it get’s a little crazy, but that’s just me. If you prefer to take a different approach and dollar cost average into an investment over time, this is an easy, automated way to do it, which can help smooth out your average entry price.

Selling Bitcoin Volatility to Buy ETH? Greg's Trade Idea

We had Greg Magadini, Pro Crypto Options trader and Head of Derivatives at Amberdata on the tastycrypto Show this week to discuss the current crypto market and give us a trade idea.

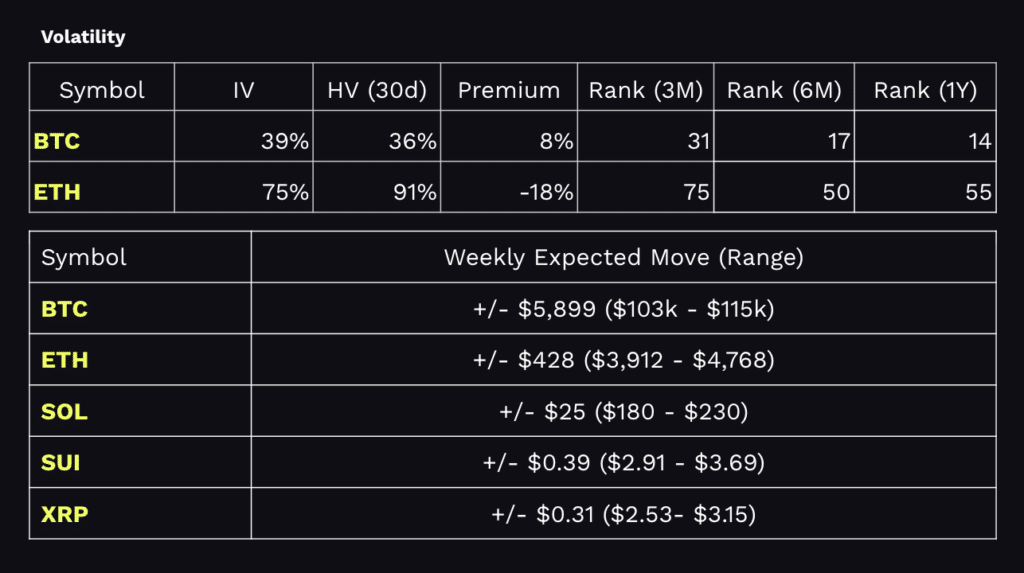

He points out that BTC realized volatility continues to drift lower, nearly reaching its 2023 lows, compared with ETH realized volatility which is gaining momentum. This volatility dynamic between BTC and ETH can be taken advantage of in the options of MSTR and ETHA.

Sell MSTR Premium to Finance ETHA Upside

- Sell the MSTR OCT $390 and buy the $400 call spread for a credit

- Buy the ETHA OCT $40 and sell the $45 call spread for a debit, financed by the MSTR call spread credit

- Since ETHA price is about 1/10th the price of MSTR you need to adjust the deltas on ETHA so it matches MSTR

BEANS

🔥 Fridays are for fire.

Each week on BEANS, Shelley and Dan torch some $TC—chipping away at a planned 300M token burn.

Want in? Send $TC to the burn wallet. Jump in the Discord or X Community for more info.

Bring your marshmallows. Stay for the chaos.

the $tc token is now officially verified on @JupiterExchange pic.twitter.com/jtt2SyiOy3

— tastycrypto (@tastycrypto) August 28, 2025

tasty Shows

🍒 Highlights:

🍒 We burned 3.1M $tc tokens

🍒 Are you in the $TC X Community?!

🍒 This cycle is cycling

🍒BEANS viewers are winning