Author: Ryan Grace

August 22, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

Crypto Market Update

Per the nature of cryptocurrency assets, after going straight up for two weeks, we get a sudden sharp correction. At the time of writing, Big Jerome just delivered at the hole, so we’ve got a bit of a pop, but for the super bulls, we’re still well off of the highs from this month.

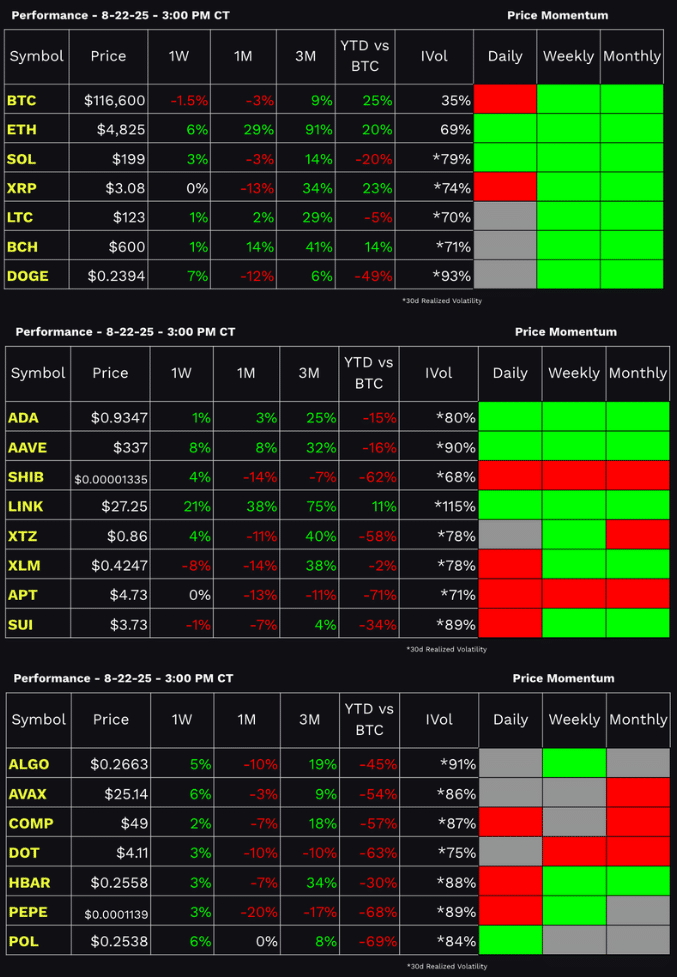

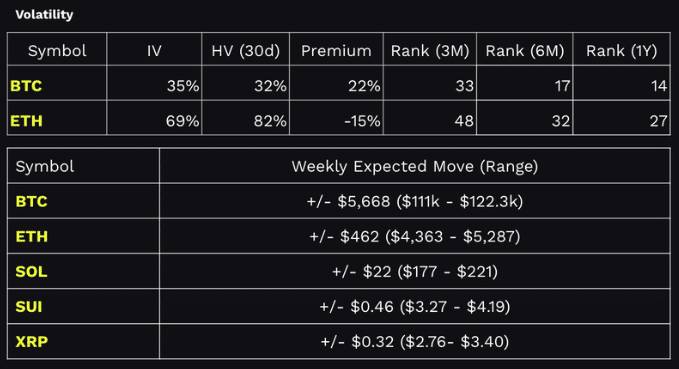

BTC and ETH have recovered some of their early week losses, and 112k has been holding up throughout the month. Not to scare anyone, but if it breaks we could see a quick flush to 100k. This isn’t my base case, but if you are suddenly fearful, IBIT 30 day implied vol is 40% with 30d realized vol of 36%. Long puts or put spreads could offer a decent risk/reward on a big downside move. BTC expected move is +/- $5.6k (110.4k – 121.6k). Also, it’s worth noting BTC short-term price momentum has flipped from bullish to bearish on Wednesday. Daily momentum is still bearish at the time of writing. The weekly/monthly bullish trend is intact. I’m trading the ranges short-term, but also anticipating any break of the 124k ATH could see us run to 130k, especially if it corresponds to an expansion in implied volatility.

Elsewhere, ETH has been trading much better, +27% vs BTC over the past month and +75% over the past-three months. Price momentum remains bullish across all time-frames we track (daily, weekly, monthly) and ETH/BTC ratio is trading the same way. ETH is outperforming Solana too.

Force me to choose today, I’d pick ETH.

Current ETH expected move is +/- $440 (4,211 – 5,089). I’ve been getting my DCA on from $4,400 down to $4,150 over the past week days and will likely look to add more if we get back into 4,200.

Speaking of dollar cost averaging, tastytrade just launched a new recurring purchases feature. Now you can set up a weekly or monthly purchase of crypto on the tastytrade platform investments tab, and just let it run. If you want to stockpile a bunch of digital gold or any other crypto over time because you’re super bullish, this is an easy way to do it.

Looking at the big picture, following Jerome Powell’s Jackson Hole speech, we’re back to a 90% probability of a September rate cut. The macro environment remains bullish for crypto. ETF assets are growing, and we’re starting to see some dollar weakness alongside a drop in rates. It’s not about getting rich overnight, but we’re checking a lot of boxes that signal we go higher in due time.

Stablecoins

A lot going on in the stablecoin world.

For starters, you can now fund your tastytrade account with stablecoins now. 24/7, USDC, USDT, PYUS, and RLUSD across many chains. If you’ve got stablecoins, this funding mechanism gets you instant buying power, in seconds.

Crypto companies aren’t the only players in the stablecoin game.

In a dramatic shift from its 2021 crypto crackdown, China is reportedly looking at launching yuan-backed stablecoins. The move is another attempt to push international adoption of the renminbi and chip away at the dollar’s dominance. – We’ll see.

Meanwhile, Europe is accelerating its work on a digital euro, even exploring public chains like Ethereum or Solana to keep the euro relevant in the global digital economy.

I don’t suspect this will negatively impact the dollar by any means, but it’s certainly bullish for blockchain/crypto if these massive economies are embracing the technology. More fiat stablecoins on public blockchains = BULLISH.

Closer to home, Wyoming just rolled out FRNT, a state-issued stablecoin aimed at streamlining government payments and positioning the state as a hub for digital finance. The state of Wyoming stablecoin is not about competing with USDC for use in DeFi, but instead I think you should view this as Wyoming embracing blockchain technology to streamline its business. Think tax refunds, benefits, and vendor payments issued on-chain instead of through traditional rails. It’s fully backed 1:1 with U.S. dollars held at a state-chartered bank, FRNT is essentially a tokenized cash system that lives inside Wyoming’s financial framework.

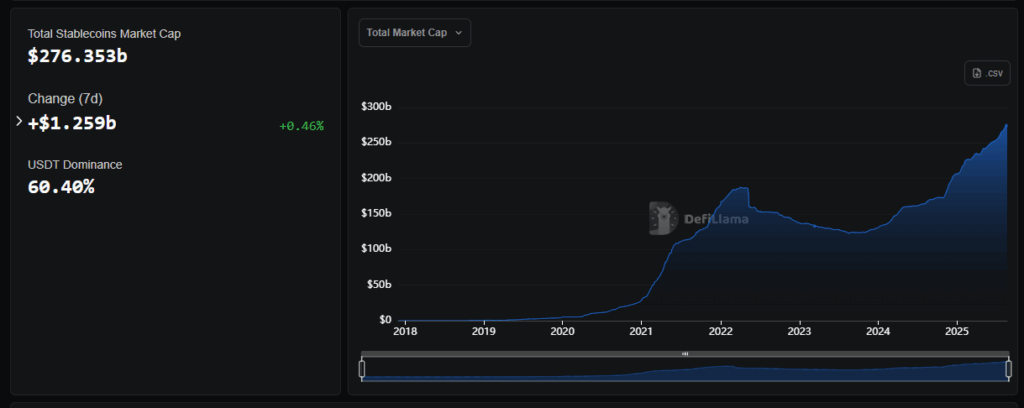

Also for context, the current stablecoin market cap is now $278 billion, up from $250 billion over the past month. A decent expansion, but tiny compared to where Coinbase thinks it could go.

Coinbase’s research arm is projecting a nearly 5x by 2028, giving us an estimated market cap near $1.2 trillion. Interestingly, if this happens, stablecoin issuers would need to absorb around $5.3 billion in U.S. Treasuries every week, which is a flow large enough to influence yields in the short-term debt market.

Finally, big things happening with tastycrypto on X…

INTRODUCING THE $TC TOKEN

— tastycrypto (@tastycrypto) August 22, 2025

Every week, we stream live on X to review popular crypto apps.

This week, we checked out the @BagsApp, and on a whim, we launched a token live during the show.

We didn’t expect anyone to buy it.

We weren’t even sure anyone would watch.

We were wrong.… pic.twitter.com/7Nhxu9eOVN

tasty Shows

🍒 Highlights:

🍒 We spilled over $600k in BEANS on accident

🍒 Are you in the $TC X Community?!

🍒 Sound advice…

🍒We interviewed the CIO of Mill City Ventures

🍒 Shelley singing Backstreet Boys was on NO ONES Bingo Card