Author: Ryan Grace

June 7, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

Megalomaniacs Moving Markets

Well, we experienced a little bit of turbulence on Twitter which created an opportunity to step up to the plate and BTFD in BTC near the low end of our implied vol expected weekly range. Similar trades to be had elsewhere, but I still think you want to lean heavier on bitcoin for the time being.

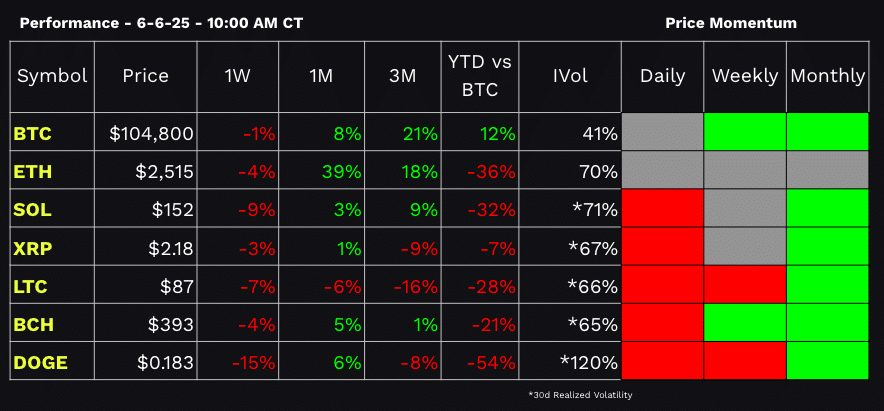

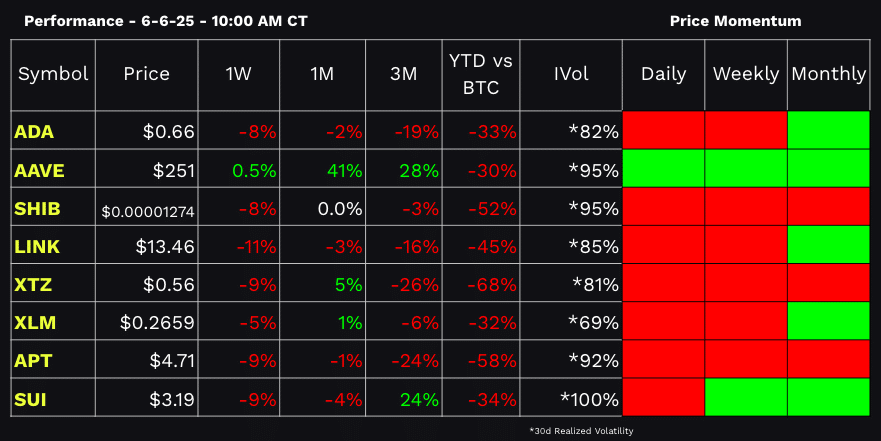

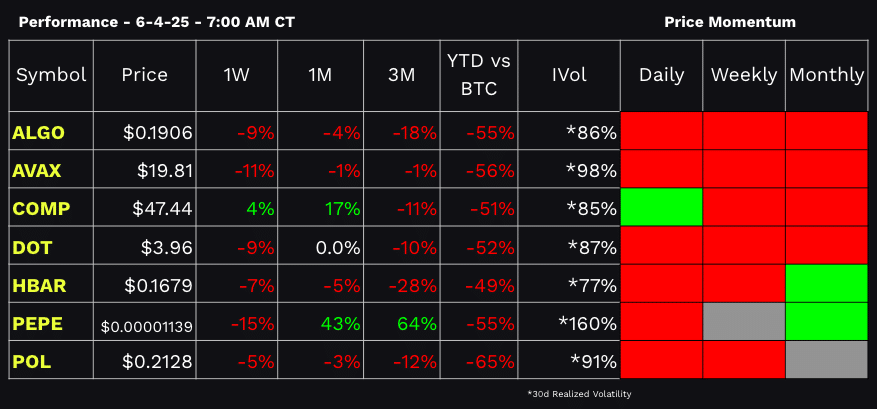

BTC market cap dominance is still pinned in the mid-60s, and while we’ve seen its daily momentum shift from bullish to neutral (along with ETH), bitcoin is still outperforming the rest of the tokens we track year-to-date. Dare I say… Most alts look trashy.

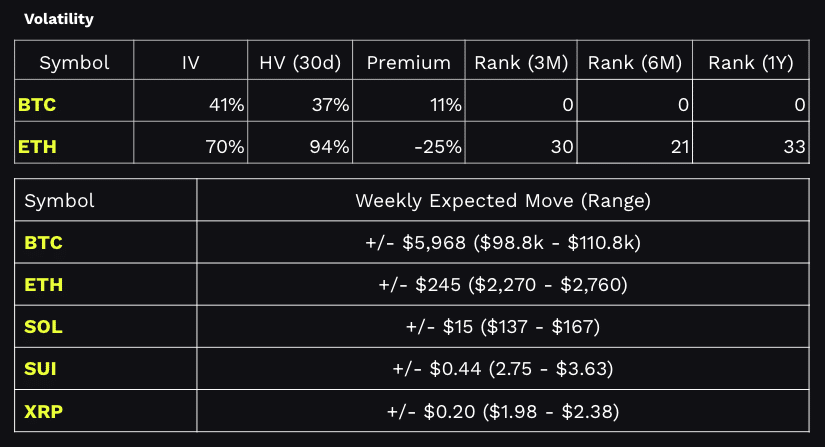

On the volatility front, bitcoin’s IV is low, given its IV Rank of 0. Implied volatility can go lower from here, but when measuring the current level against its yearly range, it’s the lowest it’s been during this time. This means options are relatively cheap, at least when measuring against historical levels of volatility.

As a trade idea, I bought the 95 strike IBIT call in the Nov 2025 expiration. It has a current implied volatility of 56%, so if we get a vol expansion back towards the top of the range, this could work out nicely.

You can see details of this trade and others on the tastytrade Follow page.

Our performance dashboard and volatility derived trading ranges are below.

While you were trading - What happened in crypto this week?

Big Tech Eyes Stablecoins

According to an article from The Block, several of the world’s largest tech firms such as Apple, Google, Airbnb, and X, are reportedly in early talks with crypto companies about integrating stablecoins into their platforms.

They’re not the only ones either, as Meta and Uber are also actively exploring stablecoin integration, with Meta evaluating their use for creator payments and Uber studying how they could lower ride payment costs across borders.

If stablecoin payments are eventually used on these platforms it could be a massive catalyst for mainstream crypto adoption.

As we’ve discussed previously, stablecoins have never been more widely used. On-chain stablecoin volumes hit $1.42 trillion in May, and the regulatory environment is finally thawing.

With Circle (the company behind USDC) now public and USDC responsible for over 40% of stablecoin volume on Ethereum last month, confidence in the sector is rising.

Circle Nails the IPO Landing

Speaking of Circle, they just pulled off one of the most talked-about IPOs in recent memory. After pricing at $31, the stock surged as high as $103 before closing the day around $83. A move of about 160%. The offering was reportedly 20x oversubscribed, with demand coming from the likes of Cathie Wood’s ARK, who reportedly went big and bought nearly 4.5 million shares worth more than $370 million. BAF ALERT!

The listing gives investors direct exposure to the exploding stablecoin sector, especially as legislation looms that could finally give the industry a clear regulatory framework. Circle is now the “pure-play” stablecoin bet, with Coinbase (a key partner in USDC) offering the broader crypto suite.

The Institutional Party Never Ends

I’m sick of writing about institutional adoption every week, but it’s NON-STOP!

This week brought more data to support what we’ve been watching unfold for months: institutional adoption of Bitcoin is no longer a concept, it’s an objective reality, and I think it’s likely here permanently.

According to data from CME, the number of large open interest holders in Bitcoin futures has surged to an all-time high of 217, a 36% increase since the start of the year. This isn’t just fast money chasing headlines. It’s a reflection of positioning from asset managers, hedge funds, and corporate treasuries who are beginning to treat Bitcoin less like a trade and more like a strategic reserve.

The growth in participation is especially notable against the backdrop of geopolitical instability and renewed trade tensions. When policy risk rears its head, capital flows toward assets that can sidestep the traditional system. Enter Bitcoin: decentralized, censorship-resistant, and increasingly seen as a hedge by institutions looking to reduce exposure to fiat volatility. The world is very slowly diversifying away from purely dollar based collateral and BTC should benefit from this reflexive narrative.

The $ isn’t going to collapse, but the flows from the narrative fracture are just getting started.

— Ryan Grace (@RyanFredGrace) May 7, 2025

BTC +150%, Gold +72% since 2022.

Get the paradigm shifts right and you’ll survive.

Tales From The Cave

A couple of announcements from the crypto cave this week.

Crypto trades on the tastytrade Follow page

If you’re interested in seeing some of the trades I’m placing in my crypto account, you can now view these on the Follow page in the tastytrade platforms. I’ll be transparently placing trades and managing my portfolio with added comments for context. I’ll try to place a few trades per week, market conditions permitting, so head over to the follow page to check them out.

tastycrypto Takeover with Dan and Shelley

Shelley and Dan are crushing it with the crypto content per usual and this week they took over the tastycrypto show. Next week, they’ll be moving on to even bigger things and taking over Options Trading Concepts Live on Wednesday, while Mike, Nick, Katie, and I are in DC. Tune in next week.

Special Guest on BEANS

We sat down with the one and only DOCTORdripp – a multichain creator, digital identity architect, and walking alpha leak. From tricked-out cars to token-gated hoodies, dripp broke down how culture moves through crypto and dropped hot takes on where the markets (and your wallet) should be headed next.

tastylive in DC

As the crypto team takes over the tastylive show, other tasty cave members are bringing the live show to DC. I will be in the capital discussing how crypto fits in a traditional portfolio, alongside Katie, Mike, and Nick, as the Whiteboard Tour takes over Union Stage in DC Thursday evening. Doors open at 5 pm and admission is free, so stop by if you want to talk crypto, trading, and have a beer with me. So tasty!

Web3 Word of the Week (W3WOW)

Dan's Stone Cold Crypto Pick of the Week

Each week we try to give you one new idea from the world of decentralized finance to take a look at.

Dan’s pick for this week: Chainlink ($LINK)

Website: https://chain.link/

Chainlink is a decentralized oracle network that enables smart contracts to securely interact with external data feeds, events, and payment methods, serving as the bridge between blockchain applications and real-world data. Founded in 2017 by Sergey Nazarov and Steve Ellis, Chainlink has become the industry standard for oracle services, powering decentralized applications across multiple blockchain ecosystems with its native LINK token ($LINK) used for payments and staking within the network.

Key Info

Surpassed $20 trillion in total transaction value as of Q12025

CCIP (Cross-Chain Interoperability Protocol) has processed over $2.2 billion in total volume transferred without artificial incentives

Holds over 80% market share in the data oracle sector, with over 1500 partnerships and integrations

Chainlink Network supports over 50 blockchains total

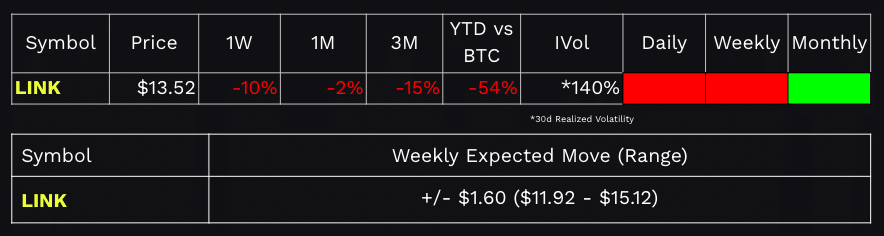

Key Trading Stats: (*As of 6/6/2025)

Market Cap | $8.9 B |

Fully Diluted Valuation | $13.6 B |

24-Hour Trading Volume | $520.8 M |

Circulating Supply | 657.1 M |

Total Supply | 1 Bil |

Total Holders | 765,422 |

Conclusion:

Chainlink has established itself as the dominant infrastructure layer connecting traditional finance with decentralized blockchain networks, evidenced by its commanding 80%+ market share in oracle services and partnerships with major financial institutions like JPMorgan, DTCC, and Swift. With over $20 trillion in total value enabled and integration across 50 blockchain networks, Chainlink demonstrates strong network effects and enterprise adoption momentum. The company’s strategic positioning at the intersection of traditional finance and DeFi, combined with recent breakthrough partnerships and expanding product suite including CCIP and Data Streams, positions LINK for continued growth as institutional blockchain adoption accelerates.

Documentation – https://chain.link/education

Use cases – https://chain.link/use-cases

Chart – https://www.tradingview.com/chart/PISdw9IP/?symbol=COINBASE%3ALINKUSD