Author: Ryan Grace

November 21, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to the weekend.

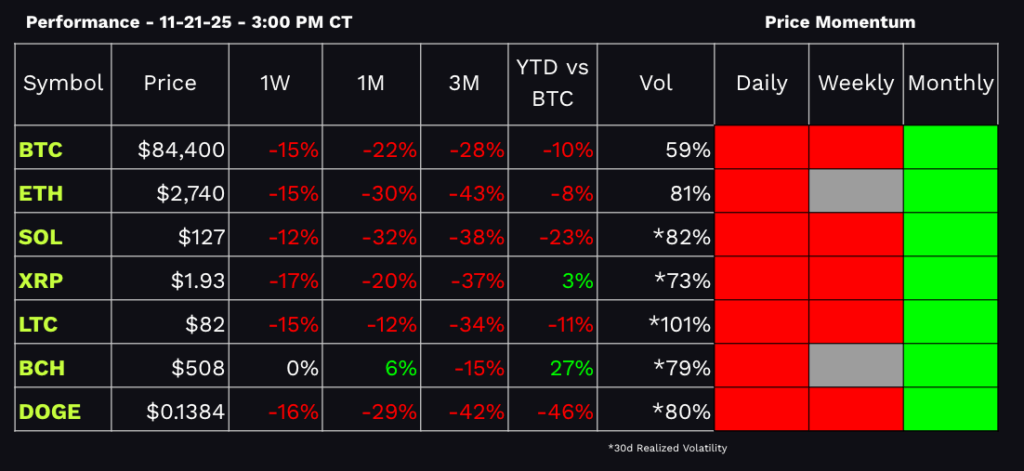

We’ve had a very quick and deep correction over the past month, with BTC and ETH down -35% and -45% off their all-time high. To say sentiment is bombed out, would be an understatement.

The CoinMarketCap Fear and Greed Index is flashing “Extreme Fear”.

BTC weekly price momentum is now bearish while volatility hits a multi-month high. We’re deep into oversold territory, and short-term price action is very bearish.

We tagged $80k on Friday and we could certainly see the April lows of $75k. As a reminder the last time we had this type of price action, BTC corrected 32% from $109k to $74k between Jan-20 and April-7 earlier this year.

If you’re trading this market in the short-term, I think you want to sell rips and be very patient/tactical buying any dips. We could trade at levels that present value long-term, but short-term the market is very bearish.

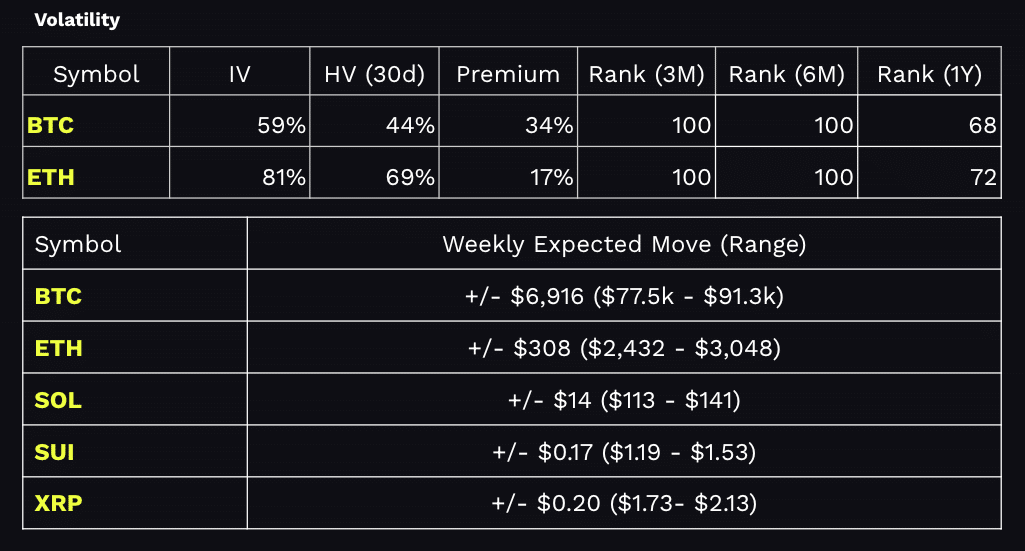

Bitcoin’s implied volatility is now pricing in a weekly one-standard deviation trading range of 77-91k while ETH is pricing in 2,400-3,000.

This is against bearish daily and weekly price momentum, which would need to move back above $103k BTC and $3,500 ETH to reclaim the bullish trend.

Volatility has picked up outside of crypto markets too, with the Nasdaq -10% and the S&P 500 -6% from ATHs over the past month. There’s a relatively strong short-term correlation between BTC and QQQ/SPY (0.60), so I think we want to see equity volatility come down before there’s any sustainable bounce in crypto. VIX under 21.5 and VVIX (vol of vol) holding below 118 need to happen before it gets remotely comfortable again.

Performance Dashboard

Everyone is convinced it’s all over. I’m not so sure.

Value in the App Layer

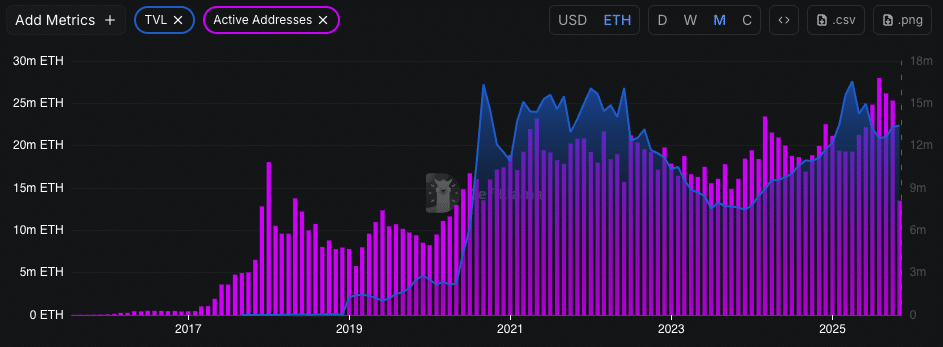

Amidst the carnage in the market, blockchain based financial applications offer very real use cases, with very real revenue, and I think the current disconnect in the market presents an opportunity if you have a 6-12 month investment timeframe. Regardless of recent price action, we see continued signs of crypto adoption as protocols are growing users and revenues like never before. Fundamentally, app revenue can only keep growing for so long before the market reprices much higher than current valuations.

ETH TVL and Active Addresses

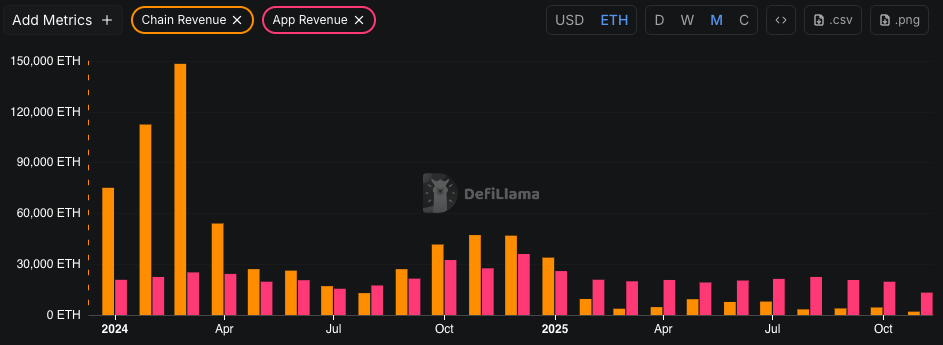

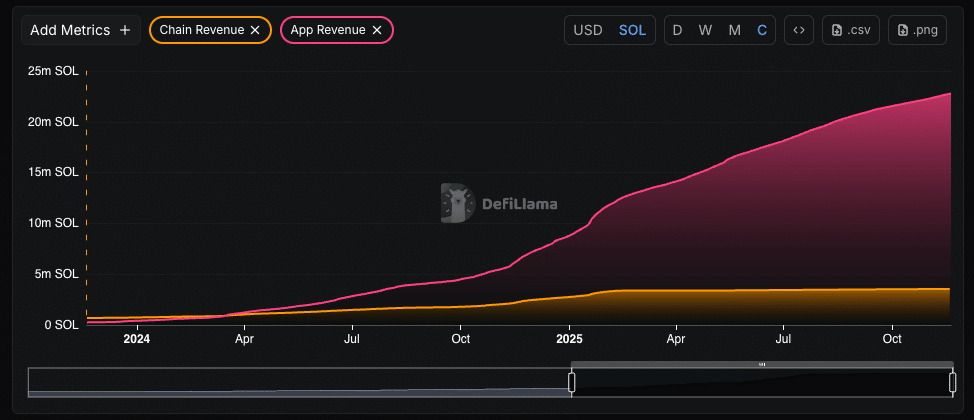

For starters, the app layer generates more revenue than the underlying chains. This wasn’t always the case prior to the Ethereum Decun Upgrade, but today, it’s clear the majority of revenue growth on-chain is being driven by the application layer and not the settlement/security layer. Underlying cryptocurrencies like ETH and SOL still represent the macro trade, but from a fundamental perspective, the app layer is where value is locked.

Ethereum

Solana

In the event token holders start to share in more protocol revenues (see Uniswap Fee Switch), there’s an argument that many app layer tokens are cheap today.

If we model app revenue, these tokens are priced at low multiples, as most of this revenue doesn’t actually accrue to the token holders. Instead it’s returned to users/LPs in the form of fee rewards. But, if this changes (e.g., UNI fee switch) and a % of revenue value then flows to tokenholders, it could meaningfully change how the market values these names, especially against a backdrop of growing users and app revenue.

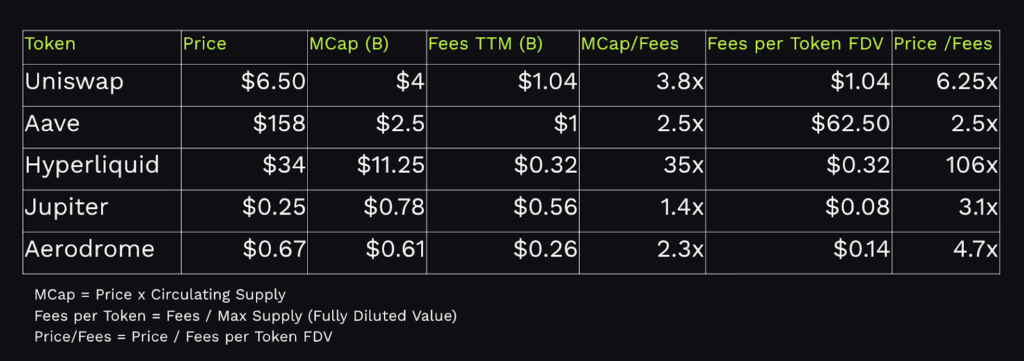

To further shine a light on fundamental valuations related to the app layer, I’ve pulled some data from DeFi Llama and TokenTerminal for a few apps below. These tokens represent a small sample size, but it’s illustrative of how the market is currently valuing the app layer vs the future potential growth story.

A quick way to gauge valuation is by looking at the value of the protocol compared to the fees it’s generating from user activity. In most instances, these protocols are only valued at 2-3x annual fee revenue. This seems like a very low multiple given how the industry is growing. For example, Aerodrome (the primary DEX on Base) has experienced a +400% increase in users and +1,100% increase in fee revenue year-over-year.

I want to be clear that fee revenue for most decentralized protocols goes primarily to users and not token holders, but if these apps capture a % of this activity going forward, I don’t think the market will continue to value them at only 2x fees, given how quickly the space is growing.

Another simple way to look at this is to apply a similar P/E ratio as we would when analyzing a stock. For this exercise I’ve used a fee per token value, calculated by dividing the fully diluted market cap (FDV) by trailing twelve month fees. These multiples are slightly higher, but still only trading at 3-6x, with the exception of Hyperliquid (HYPE). For context, Apple stock currently has a P/E ratio of 36x.

Now, valuations can get “cheaper” especially if we see a continued fall in crypto market prices, but I think at some point this disconnect snaps back and there’s a repricing higher. How much longer can this persist as users, revenue, and broader crypto adoption continues uninterrupted?

Personally, I own Uniswap and Aerodrome, and am keeping an eye on Aave on my watchlist.

Here are my current volatility adjusted trading ranges for these tokens.

UNI – $5.76 – $7.51

AAVE – $139 – $215

AERO – $0.58 – 40.96

That’s it for this week, and thanks for reading.

Keep your head on a swivel.

As always, stay tasty!

Ryan

BEANS - Our Web3 Variety Show

We dove into market feels, what’s happening in DeFi, and created another token on Zora during Episode 44 of BEANS.

Miss the live stream? Watch it here: