Author: Ryan Grace

November 7, 2025

Hello my tasty friends. I hope you’re all having a wonderful start to your weekend.

Let’s jump right in. Is this the end? Is the cycle over?

For starters, if the cycle is over, it’s an uncharacteristic end compared to what typically happens. No alt-season, no irrational exuberance, no real retail participation. Leveraged positions have been washed out, but there’s no credit crisis, no exchange blowup. And, all at a time when the Fed is cutting rates and ending quantitative tightening. Prices are correcting right now as liquidity is seemingly about to enter the financial system. There could be something else at play, but we’re not seeing the signals you typically get during cycle tops. Or, maybe we are, and it was digital asset treasury companies in place of retail this time.

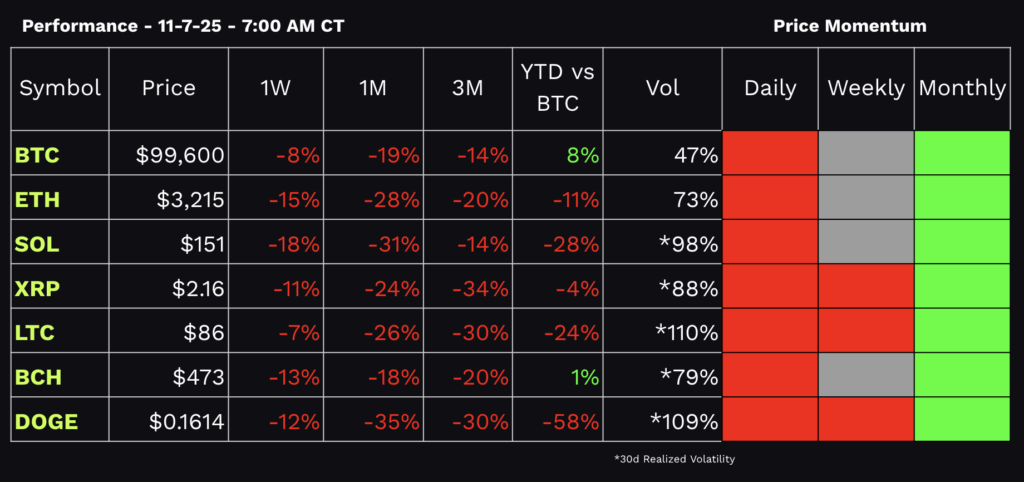

If you’re feeling the FUD and own BTC and ETH much lower, there’s nothing wrong with booking some gains. Short-term, price momentum is certainly bearish and sentiment is worse.

Personally, I’m giving it a little more time before I make any sudden changes to my portfolio. On one hand, $100k BTC is holding at the time of writing. To calm my nerves we need to get back to 110k-115k, and fast. If we keep chopping here I think the highest probability path is lower, possibly to the levels Dan is targeting. ETH also needs to recover $3,500 ETH in short-order.

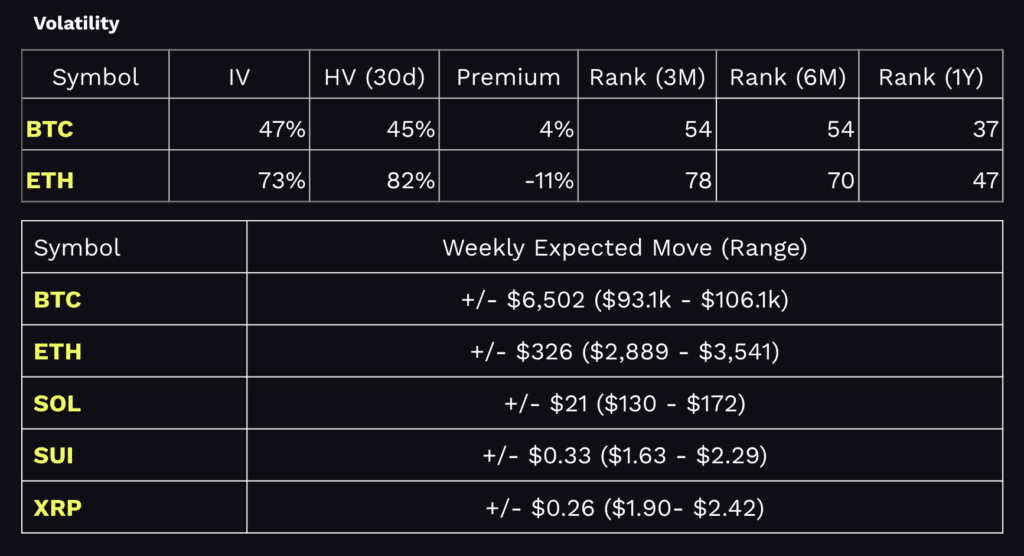

I’m hanging on over the weekend, but if I see my weekly BTC momentum signal flip from neutral to bearish I’ll likely change my mind. Please find momentum and volatility ranges below.

Where is Risk Hiding

In the midst of the spike lower on Tuesday, I asked Dan to jump on a call to discuss what he’s seeing in the market, and whether there’s any hidden risks to be worried about.

WATCH NOW 👇

Notes From the Episode - The Chop Fest Continues

Hidden Leverage

Recent DeFi exploits have grabbed attention, but the heavier issue is looped collateral inside lending markets (e.g., Morpho-style vaults). Synthetic “stable” assets get borrowed, re-deposited, borrowed again. This becomes a relevant risk if it’s suspected this is being done against low quality pools of collateral. If we get further de-risking, these loops could start to unwind, driving higher volatility and further liquidations via negative feedback loops.

Exchange Microstructure Jitters

Binance order-flow led the latest flush and rumors of MM disputes that got swatted down, but the perception of market-making friction matters during deleveraging. Keep a side-eye on Tier-3, high-leverage exchanges that are offering 50x-100x leverage.

FOMC Whiplash

We got the recent 25 bps cut, but the probability of a further cut in December was talked down. Currently, Polymarket is pricing odds at 75%. There’s not a lot of data to go off with the Government shut-down, but I’d bet on a cut. As we’ve also highlighted the bigger macro lever is the pause of QT runoff which is liquidity-positive but on a longer 3-12 month timeframe.

Levels We’re Watching

100K BTC is the big psychological level; 90K, then 85-82-80K are the next real magnets if deleveraging persists. Near $75k was the bottom in April.

Why we don’t think this is 2022

In my opinion, the recent selling pressure is not being driven by obvious systemic fraud or cross-venue “holes,” and the macro liquidity backdrop is actually improving on a 6–12m view. There could be hidden risks across defi, but this appears to be largely driven by the massive liquidations and resulting deleveraging following the move last month.

BEANS

🔥 Fridays are for BEANS. This week Shelley and Dan dove back into Virtuals and used AI agents live on air. Watch the full episode below.

Jump in our Discord and X Community for more info. Don’t forget to claim your roles (click the coin for tastycrypto of course) for the corresponding notifications.

🍒 Highlights

Keep your head on a swivel.

Stay tasty,

Ryan