Author: Ryan Grace

October 31, 2025

Hello my tasty friends. I hope you’re all having a wonderful start to your weekend.

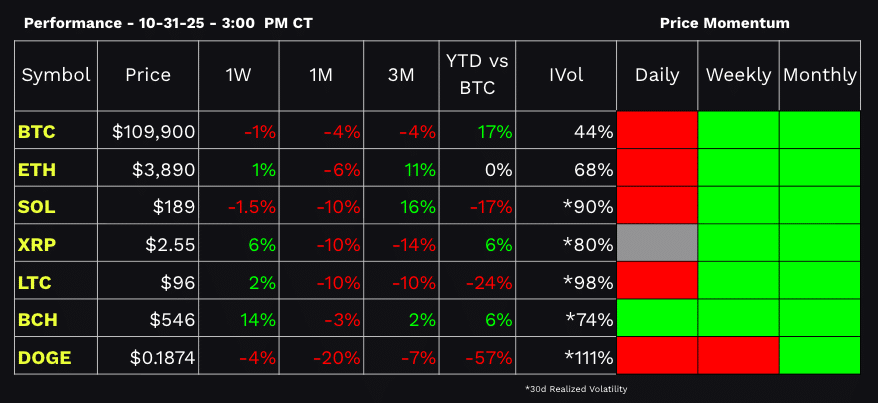

It’s a chop fest out there, and sadly, we didn’t get the “Uptober” we were dreaming of this year. Well, we did for a brief moment at the start of the month, but for the most part, it’s been challenging for both bulls and bears as we’ve been bouncing between 105 and 115. Currently BTC is down about -5% over the past month, with ETH down closer to -8%.

Regardless of the lackluster performance this past month, my view remains the same. I think market conditions support higher prices into the year-end. I’m still bullish. We didn’t get fireworks from US-China trade talks and the Fed didn’t guarantee a December rate cut, but the market seems to be overlooking the liquidity coming from the end of QT and the pause in the trade war. These developments, coupled with the eventual end to the government shut-down, should support bullish flows in the near-term.

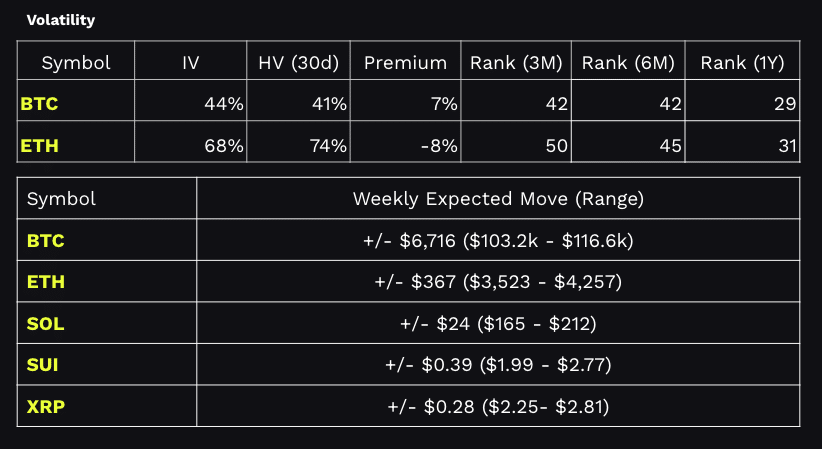

Our updated market performance dashboard and trading ranges are below. More importantly, check out the tasty crypto shows we did this week with Kyle Samani from the publicly traded SOL treasury company Forward Industries (FORD), and of course our deep dive on crypto options with Greg Magadini from Amberdata.

We’ve got big plans for more content going forward, so make sure you’re subscribed to tastycrypto on YouTube.

Is Solana the Future of Finance?

This week we put the spotlight on Solana and a timely convo Dan had with Kyle Samani, chair of Forward Industries (FORD), the newly minted, publicly traded Solana treasury company.

Kyle’s core claim is simple: blockchains are, first and foremost, trading systems and Solana’s design (high throughput, low latency, low fees) makes it the best venue to build what he calls “internet capital markets”: anyone, anywhere, trading any asset from a phone, with finance embedded directly into the apps and media we already use. From that lens, FORD’s model which includes staking SOL, deploying into DeFi vaults, and pushing real corporate actions on-chain (governance, dividends, M&A, collateralization) goes beyond basic treasury management and is potentially a proof-of-concept for on-chain capital markets at scale.

Beyond the discussion, we’re also seeing more evidence of growing Solana network adoption. This week Western Union announced plans to launch a dollar stablecoin on Solana, via Anchorage Digital, with the aim of faster, cheaper remittances across its global footprint. Meanwhile, Bitwise CIO Matt Hougan has been publicly pounding the table that Solana could capture the largest share of the booming stablecoin & tokenization flow, arguing it offers “two ways to win” (payments/assets) and comparing the setup to early Bitcoin in terms of asymmetric upside.

WATCH NOW 👇

The Grind-Up Playbook: Long Delta, Short Vol

Greg Magadini from Amberdata was back on the tastycrypto show this week to calm our nerves and give his take on the recent chop fest in markets. Post-FOMC, Greg’s view is straightforward: the 25 bp cut was priced, but the bigger story is the Fed pausing its balance sheet reduction. Recycling maturities instead of shrinking the balance sheet eases some of the recent funding tightness and is liquidity-positive for hard assets, crypto included. Pair that with a tentative tariff de-escalation backdrop and broad global easing, and the macro skew looks constructive into year-end.

From the options lens, the crash on October 10th spiked vol, but the structural trend is of lower realized/imp vol since IBIT options went live remains in place, so it’s most likely we still see a grind higher with occasional air-pockets.

This structure favors long-delta / short-vol expressions while owning a bit of the right-tail (call options). During the show, one trade idea he walked through was on IBIT into year-end. A broken-wing call fly (long 70 call, short 2× 80 calls, and long a farther OTM call like 110) that benefits if price drifts up and term structure softens.

On single names, Greg also flagged unusual call buying in Circle (CRCL) and shared a long-dated barbell he likes conceptually. Selling a deep OTM put (e.g., 55 strike, Jan ’27) to help finance a wide call spread (e.g., 300/445). This gives you equity-like upside with defined risk. A compelling way to participate in the stablecoin growth theme without chasing price here.

Elsewhere, he’s cautious on the DAT/treasury-company complex beyond the blue chips. In high-vol assets, balance-sheet leverage and refi risk can create a sort of death spiral dynamic on a sharp drawdown. This can negatively impact treasury companies like MSTR, which he expects to generally underperform against BTC over time.

Into year-end, Greg still sees Bitcoin dominance, while ETH and alts lag. Also, don’t sleep on big upside tails. These might be low probability events, but there is the possibility of bullish policy shocks and increased sovereign adoption, so it might make sense to own cheap upside calls for this reason.

WATCH NOW 👇

BEANS

🔥 Fridays are for BEANS.

Jump in the Discord or X Community for more info. Don’t forget to claim your roles (click the coin for tastycrypto of course) for the corresponding notifications.

HAPPY HALLOWEEN! 🎃

— tastycrypto (@tastycrypto) October 31, 2025

BEANS Ep 42: Trick or Treat

TOKENS INSIDE!

RT | ❤️ | follow | tag friend

for a chance to win $USDC and other prizeshttps://t.co/qZstj441bH

🍒 Highlights

🍒 Are you in the $TC X Community?!

🍒 Bet on ANYTHING.

🍒 Trick or Treat?

Keep your head on a swivel.

Stay tasty,

Ryan