Author: Dan Cecilia & Shelley VanWitzenburg

Sept 5, 2025

Hello tasty fam! We hope you are having a great start to your weekend.

Ryan, leader of the Crypto Cave, welcomed a beautiful baby boy this past week!

So, for the next few weeks, Shelley and I will be the captains of the Crypto Cave as Ryan adjusts to dad life. 🍼

Crypto Market Moves

September is here and the crypto markets continue to trade range bound. BTC is trading around $110K and ETH is testing $4K.

It’s too early to call for “altcoin season,” but the signs are there. We have seen a rotation into ETH and SOL with more crypto treasury companies established to buy up tokens other than BTC.

This trend was kicked off in July, led by BitMine Immersion Technologies ($BMNR), which has since accumulated over 1.5% of the total ETH in circulation. The company, led by our favorite “Tradfi” media talking head Tom Lee, aims to control over 5% of Ether’s supply, with Lee himself calling for a $60,000 price target on ETH. This has opened the door to more publicly listed companies established to buy alt coins, most notably SOL & SUI, and is bolstered by the rumors of a SOL ETF being approved soon.

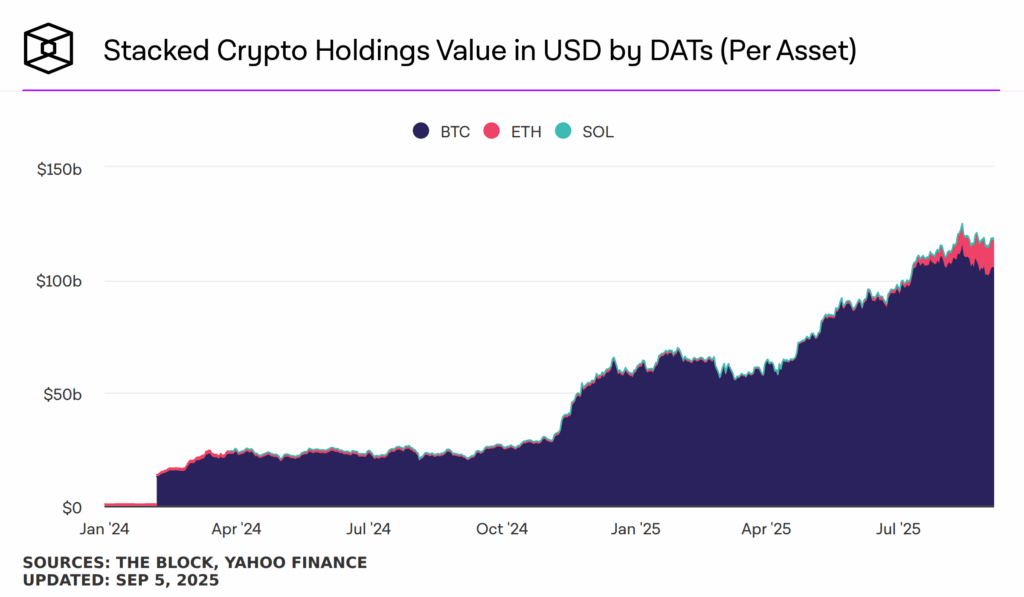

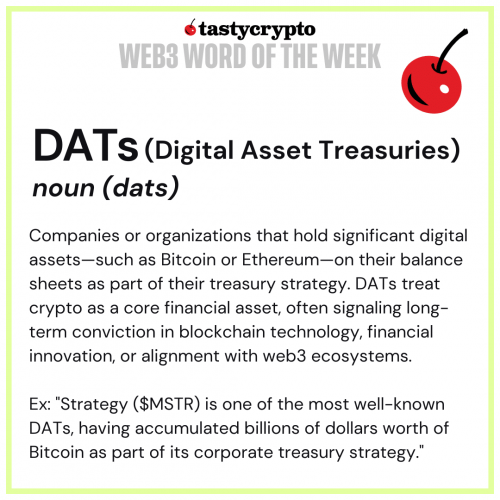

A simplified way to illustrate the rotation is to look at the trend of crypto holdings by DATs per asset.

You can see a shift in the beginning of July.

This trend is also supported by the YTD ETH/BTC Ratio, which continues to trend upwards and could reach its prior all-time high of 0.07.

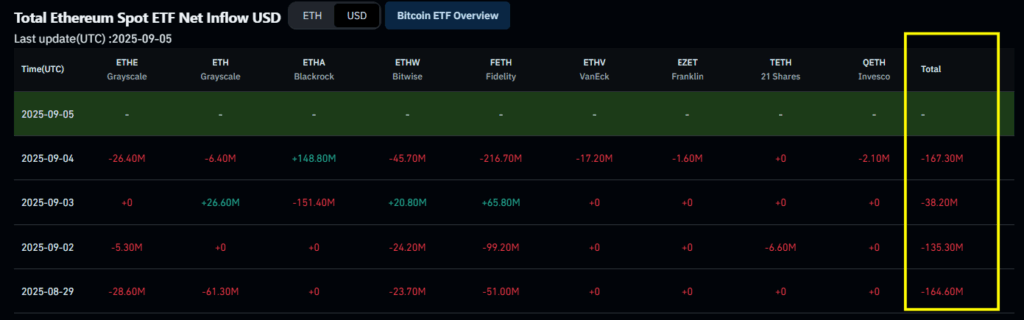

Despite the interest in altcoin treasury companies, we are seeing recent outflows in the ETH ETFs as the inflows from July and August have reversed for the time being. Over the first few days of September, we have seen combined outflows of roughly $500 million, reversing a two-month trend of heavy inflows. Price has followed these outflows as ETH has remained below $4,500 and could break below $4K if this trend continues. This is a short-term cool off from the run up of the last few months, and I would be looking to scoop some more ETH below $4,000.

SOL has continued to hold up well against ETH, and there are signs that a Solana comeback could be around the corner. I would be looking to buy up any SOL below $200.

Like we said, the signs are there. It’s interesting to note that “altcoin season” might kick off in the “TradFi” markets, ironically.

Recurring Crypto Purchases at tastytrade

If you haven’t heard, tastytrade just added a really useful crypto investing feature to the platform, recurring purchases. You can now set up recurring purchases to buy any token on a regularly scheduled basis.

Personally, I like to try and time the markets and I like when it get’s a little crazy, but that’s just me. If you prefer to take a different approach and dollar cost average into an investment over time, this is an easy, automated way to do it, which can help smooth out your average entry price.

DeFi Highlights

We will highlight a few DeFi LP plays that you can check out for those of you deep in the trenches.

$TC/SOL on Meteora

If you haven’t been following along, we launched a token on our BEANS livestream and setup a liquidity pool on Meteora.

If you would like to follow along and provide liquidity, you can do so here.

Note: the $tc token is for entertainment and education purposes only. It’s not an investment.

$CARDS / USDC on Raydium

Another interesting LP play that we came across is on Raydium in a newly launched token called $CARDS. It is currently yielding a 502.22% APR and is generating significant volume due to the launch of its tokenized Pokemon trading card marketplace.

You can LP this pool here.

BEANS

🔥 Fridays are for fire.

Each week on BEANS, Shelley and Dan torch some $TC—chipping away at a planned 300M token burn.

Want in? Send $TC to the burn wallet. Jump in the Discord or X Community for more info.

Bring your marshmallows. Stay for the chaos.

BEANS Ep 35: Predict, Play, Burn + GIVEAWAY https://t.co/UM2fPfuqw7

— tastycrypto (@tastycrypto) September 5, 2025

Miss the live tasty Shows?

🍒 Highlights:

Much love,

Dan and Shelley