Author: Ryan Grace

July 11, 2025

Good morning my tasty friends, I hope you all have a wonderful start to your weekend.

I hope you’re all basking in the orange glow. I hope you’re feeling the highs. It feels good now, doesn’t it?

Bitcoin hit a new all-time high yesterday, which I hope is not its last, but as we all know, hope is not a strategy here in the cave. Survival is our strategy. Taking profits, managing risk, trying not to lose our souls in the process.

To reach the stars, you must survive the journey.

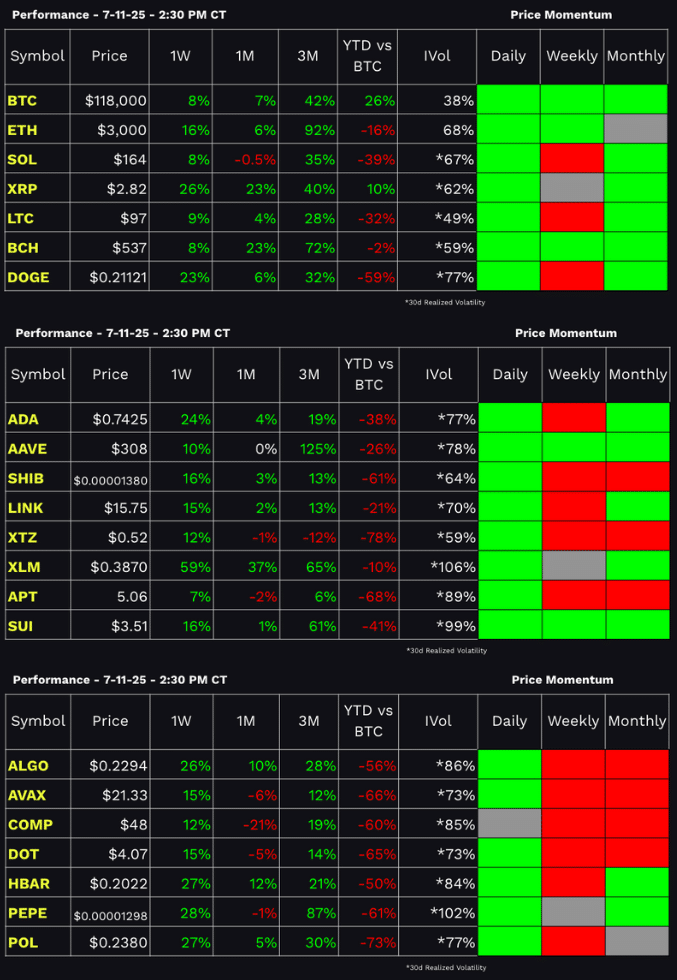

Performance Dashboard

BTC has been on a sustained grind higher, resilient, along with the rest of the market. An asset you want to be long in this environment. The stock market is at an all time high too. When I look under the surface at sector performance, there seems to be a bid for inflation proxies. Look at Tech, Materials, Industrials, and Energy over the last month.

If the market is signaling a reaccelerating inflation dynamic, these exposures should keep working, and I think you want to own bitcoin in this environment. Until of course it all changes. We need to keep an eye on it in real-time, but the macro picture is supportive.

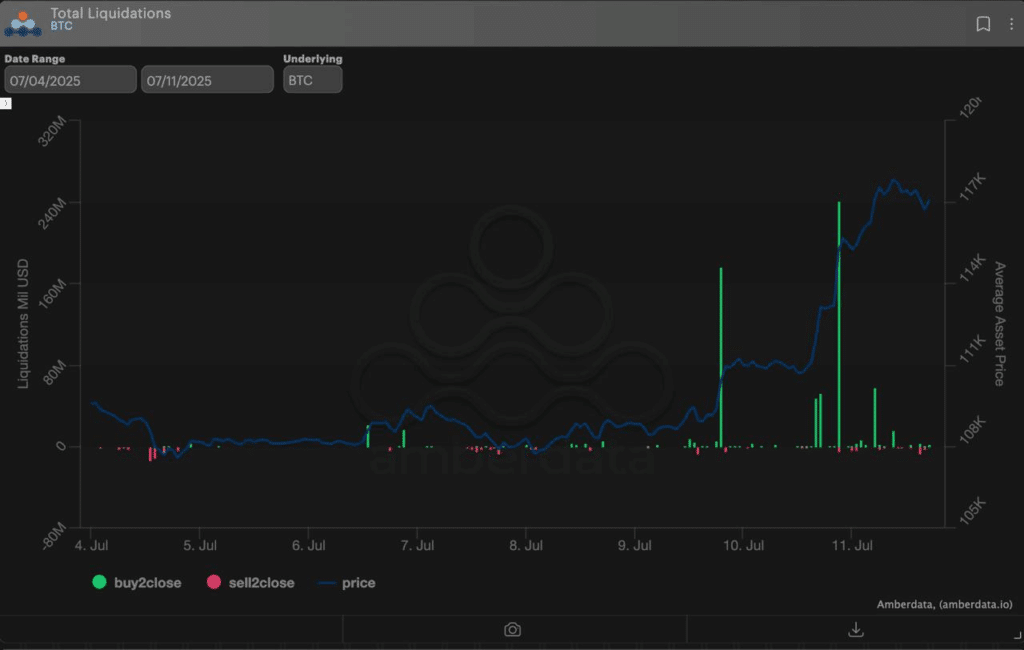

Within this macro crypto conducive setup, ETFs took in monster flows and shorts covered to the tune of $1 billion. Often the velocity of these moves defies expectations as shorts violently blow out under the surface.

To reach the stars, It’s never a straight line.

I think we go higher, but I hope we correct first. The new highs always leave you questioning if you own enough crypto. “Will there be a dip?”.

I hope the market grinds higher for another 6-12 months on moderate volatility. My preferred route, but again, hope is not a strategy.

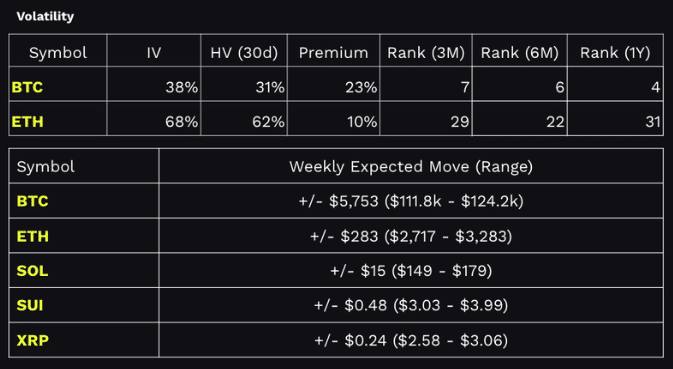

The BTC implied volatility estimated weekly range is $111.7k – $124k. I want to ride this break out and will look to load up some buys back into $110k. Assuming we get there. Remember, this can get violent.

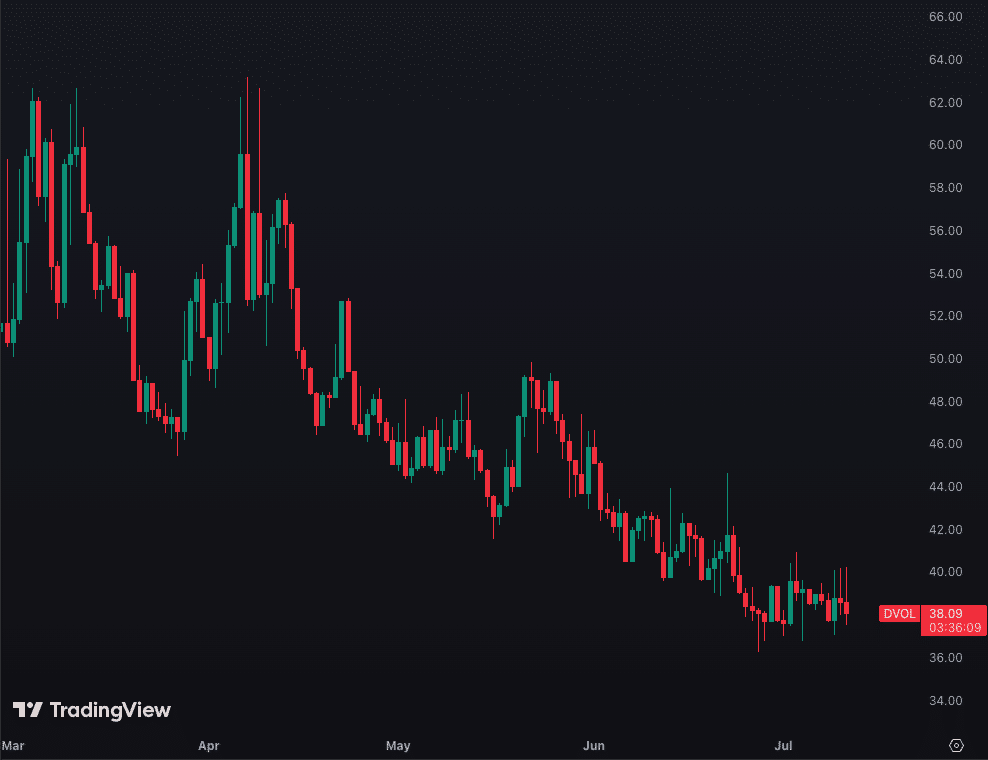

BTC implied vol isn’t getting very excited. A 38% 30-day implied vol is basically at the yearly low. Will the giant wake up?

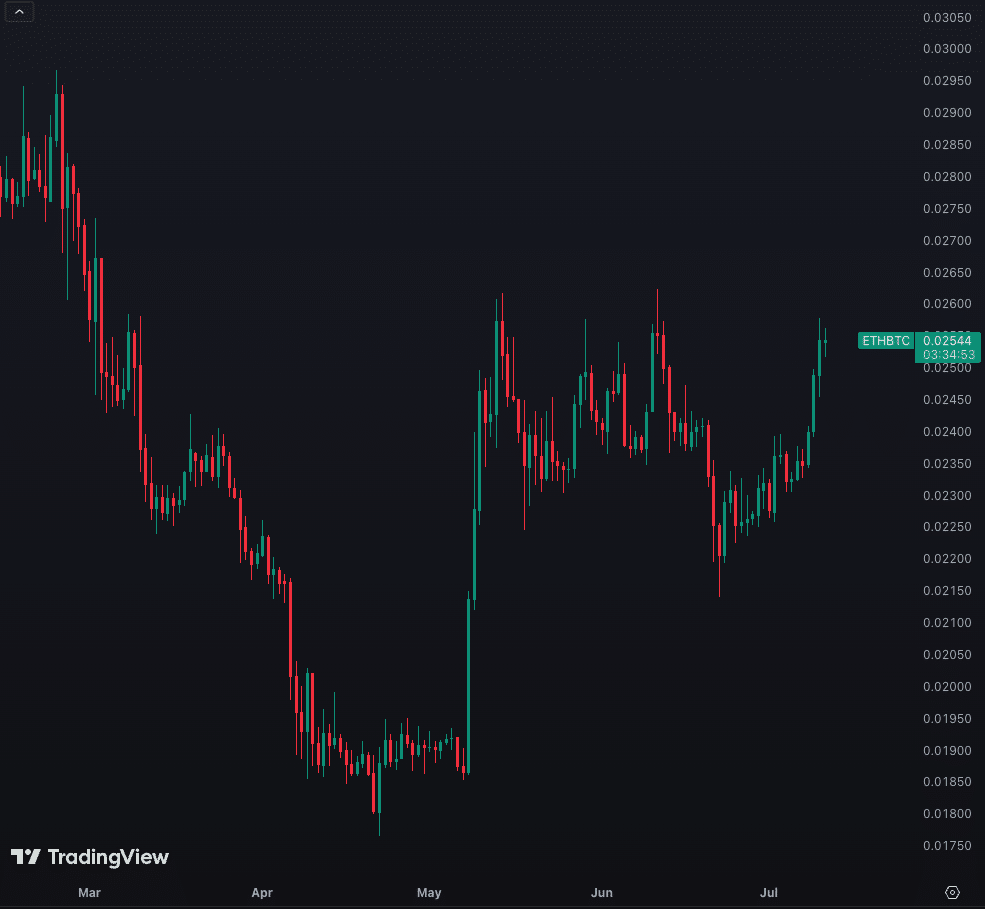

Bitcoin dominance has cracked and alts are starting to trade better. I think there’s a very high probability most big-cap alts have bottomed and we know what happens next. The question is “when?”

If it’s truly Alt Season, we should see this move lower quickly. I don’t assign a high probability to this today, especially given the flows BTC ETFs are still seeing. That said, ETH could eat into BTC dominance if this recent performance continues.

ETH is outperforming BTC on the week, but relative performance is still well behind year-to-date. We’ve been here before. I want to see a break above .26 before I get excited.

On the other hand, XRP is now outperforming BTC. That’s exciting.

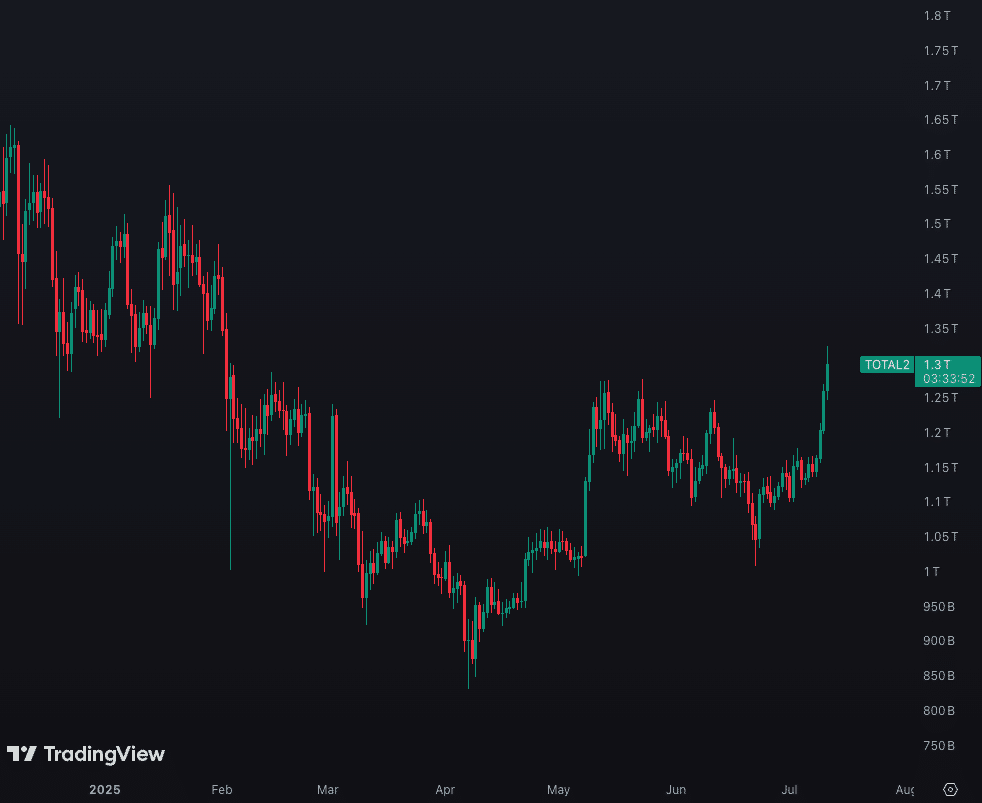

Also, from looking at total crypto market cap excluding BTC, there’s some real room to run. Can we get to $2 trillion? Remember, this can get violent.

Speaking of violence. Look at the short-squeeze in BTC this week. Below we have total BTC liquidations from our friends over at Amberdata.

So, putting this all together. I think BTC has room to run higher and eventually alts will do some crazy shit. We have a macro environment that’s supportive, but we’re not seeing this reflected in volatility or many other areas of the market, just yet.

Let’s hope the macro holds up, let’s hope the ETFs keep buying, let’s hope the short squeezes are violent, and let’s hope alts go into blast off mode.

Keep your head on a swivel.

Stay tasty,

Ryan

🇺🇸 It’s #CryptoWeek on Capitol Hill.

— tastycrypto (@tastycrypto) July 11, 2025

We’re tracking it all and dropping some tasty nuggets to help you understand the BIG crypto policy moves happening this week. 🍒👇 pic.twitter.com/7ayaEwFB3W

Web3 Word of the Week (W3WOW)

Dan's Stone Cold Crypto Pick of the Week

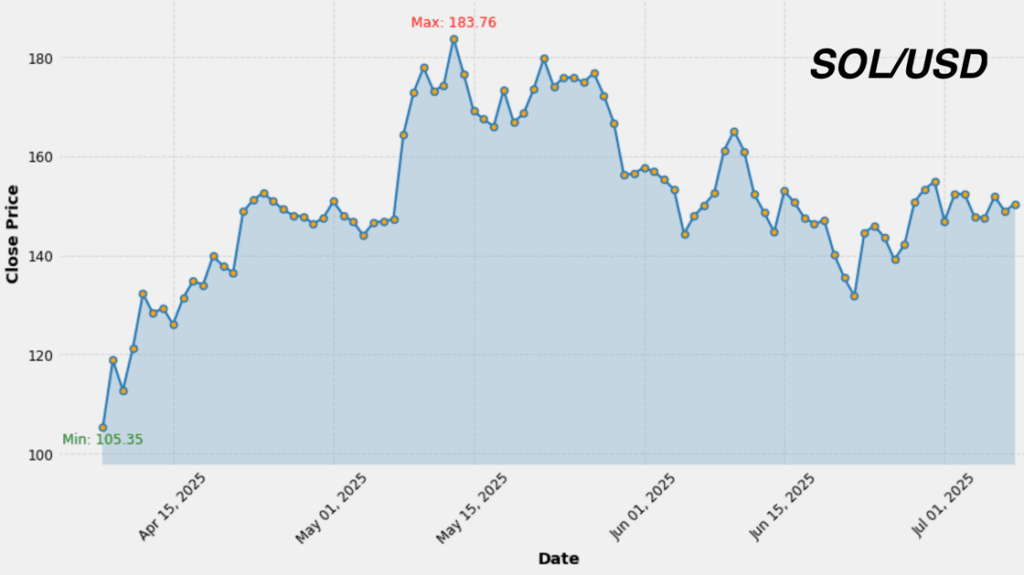

SOL/USD – Room to run?

Though XRP dominated last year with a +349.5% return from June 2024 to July 2025 versus BTC’s +59.6% benchmark—and delivered twice the volatility of BTC—crypto markets have entered a summer lull. During the same period, LTC returned +2.9% and SOL declined –9.5%, underscoring SOL’s position as last year’s weakest performer despite XRP’s outsized swings.

However, when we focus on the last three months (April 2025–June 2025), SOL has led the field with +40% returns, outpacing BTC’s +37% and overtaking XRP (+23%) and LTC (+21%). Based on this shift—from SOL’s annual underperformance to quarterly leadership—and given Solana’s active user base and network growth, we believe SOL is best positioned to outperform as volatility re-emerges. Meanwhile, we expect XRP may warrant profit-taking or hedging to manage its elevated risk profile.

tasty Shows

🍒 Highlights:

🍒 ____scan for on-chain receipts

🍒 Shelley + Caffeine = BEANS

🍒 HODL defined

🍒 Ryan: long diapers 🤭