Author: Ryan Grace

June 20, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

Last week we were a little light on the newsletter as I was in DC for the tastylive White Board tour, which by the way was awesome. It was great to see everyone in person and have the opportunity to present and pontificate about crypto, live on stage.

If you weren’t able to attend the event, I want to use this week’s email to cover some of the presentation points, and take an objective look at how bitcoin can fit within a traditional investment portfolio. By traditional, I mean the common 60% equity, 40% fixed income makeup that’s often touted as the starting point for portfolio construction. We’ll use this as our benchmark.

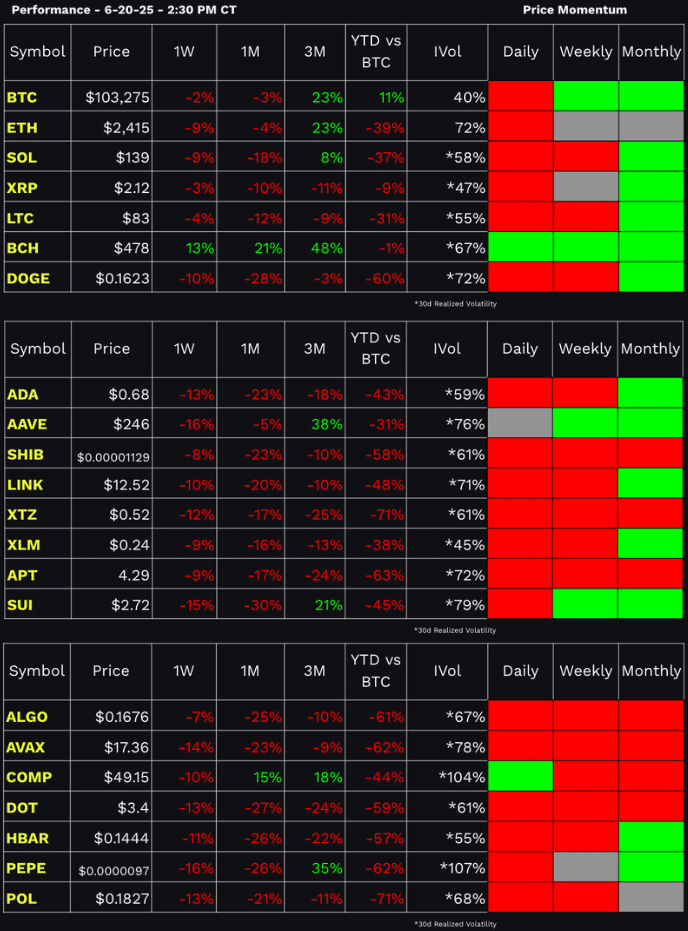

But first… Performance Dashboard below.

Performance Dashboard

I’ve previously discussed why I think bitcoin is a compelling investment, specifically against the backdrop of global fiat currency debasement, so today, let’s simply look at this as objectively as possible. No opinions, no arguments, just data around bitcoin in a portfolio.

Bitcoin Allocation Strategies

Historical Performance

To begin, let’s look at how an investment in BTC has historically performed.

Over the last 10 years, Bitcoin has delivered an average annual return of 84%. In the last five years, it’s clocked in at 65% annually. Looking at the past 12 months alone, BTC is up about 64%.

But let’s not sugarcoat it. To get the gains, you need to suffer through the pains… Well, sometimes. Bitcoin’s history can largely be characterized as a series of exponential returns over numerous boom-bust cycles. It’s become less volatile recently, but historically there have been multiple drawdowns of more than 60%.

If you can stomach the volatility…

2014: -59%

2018 -73%

2022: -64%

Adding BTC to a Portfolio

Owning bitcoin has been a decent investment over the long run, assuming you’re comfortable with some of the wild swings that can materialize at times. But, how does it impact a traditional portfolio?

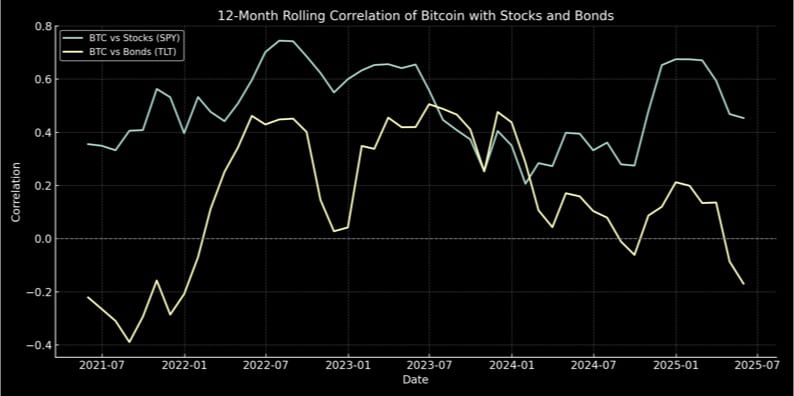

Historically, bitcoin’s returns are largely uncorrelated to both equities and bonds over the long-term. So, on one hand, it can act as a diversifying agent from the correlation perspective.

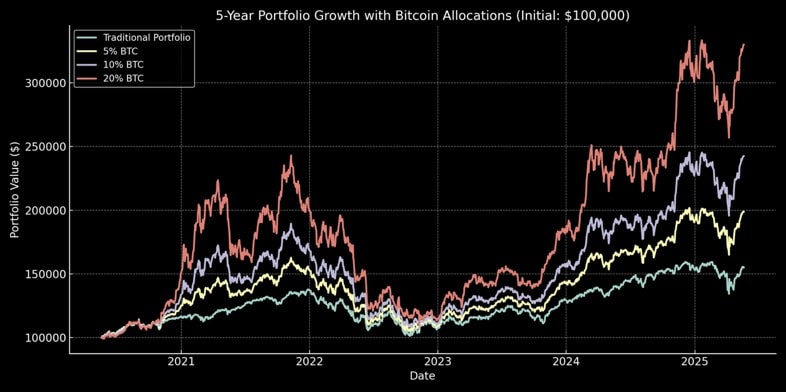

As you’ll see below, there’s also an argument for including in a portfolio given the resulting performance gain and impact on volatility.

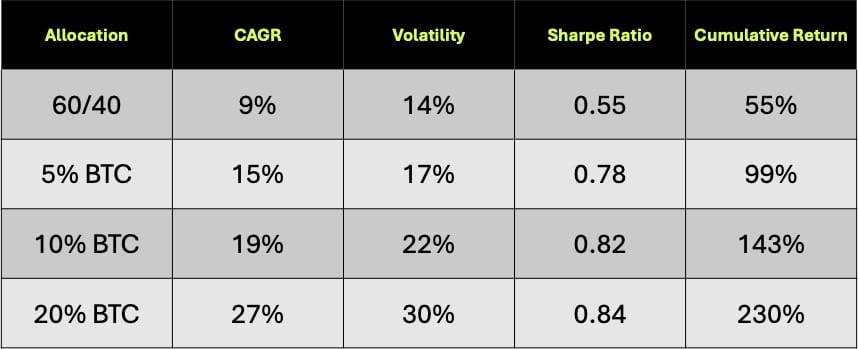

To understand the impact, I’ve backtested the performance of a traditional 60/40 portfolio vs portfolio which also includes varying allocations to BTC of 5%, 10%, and 20%. For this study I’ve looked at the past 5 years, as this eliminates some of the extreme upside returns from the early days of bitcoin.

Here are the results:

Adding even a small allocation to BTC (5%) had an overwhelmingly positive impact on performance. The compound annual growth rate (CAGR) of a portfolio with a 5% bitcoin allocation almost doubles the cumulative return from 55% to 99% compared to the non-BTC portfolio.

Over the long run, if you owned even more bitcoin, you did even better. A 20% allocation to BTC resulted in a 230% cumulative return at a 27% compound annual growth rate.

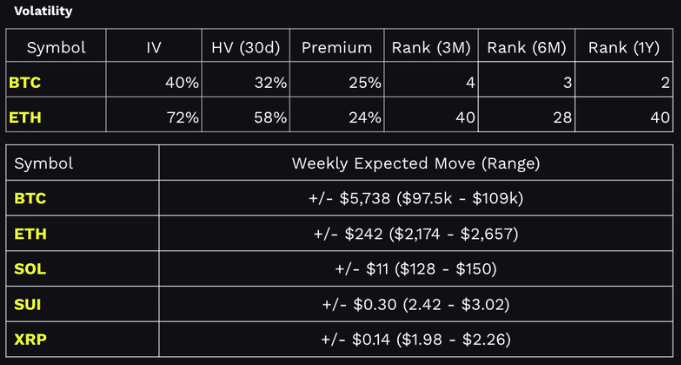

Portfolio Volatility

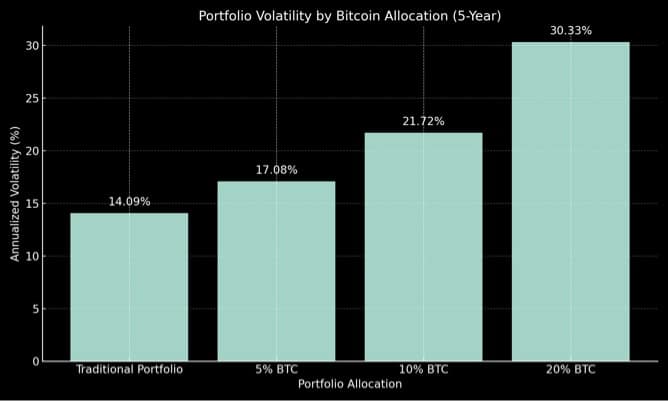

Again, BTC has been a good investment, but what’s the catch? Is there added risk to including BTC in a portfolio? Let’s now take a look at its impact on portfolio volatility.

Naturally, we’re likely to see an increase in vol when adding bitcoin to the mix, but what’s interesting is there’s not much of a change in volatility between the non-BTC portfolio and 5% allocation, at least over the past 5-years.

Adding 5% BTC results in a 3% increase in annualized volatility but is more than offset by the 6% jump in annualized return. The more BTC you hold, the more volatility you get, but arguably a small allocation goes a long way.

In crypto, price and volatility can pump together. That’s rare and tradable.

— tastycrypto (@tastycrypto) June 19, 2025

You don’t need $BTC to double. You just need vol to jump. 🍒 @RyanFredGrace pic.twitter.com/VDp0YfTD7C

So… How Much Bitcoin Should You Own?

There’s no universal answer. But if you’re looking for a place to start, 5% is a reasonable allocation, especially if you have a longer time horizon and can handle short-term volatility.

If you’re managing a smaller account, say $10,000, that might mean starting with $500 or even less, and dollar-cost averaging your way in. You don’t need to buy a full coin (or even a tenth). Start small. Stay consistent. Stay curious.

Backtest Results

Final Thoughts

Adding Bitcoin to your portfolio isn’t about going full degen or replacing your core strategy. It’s about diversification, asymmetric upside, and taking a bet on the future of digital assets.

Just remember: use a small position size, be smart about your entries, and don’t forget that volatility cuts both ways.

Stay tasty,

Ryan

Web3 Word of the Week (W3WOW)

Dan's Stone Cold Crypto Pick of the Week

Each week we try to give you one new idea from the world of decentralized finance to take a look at.

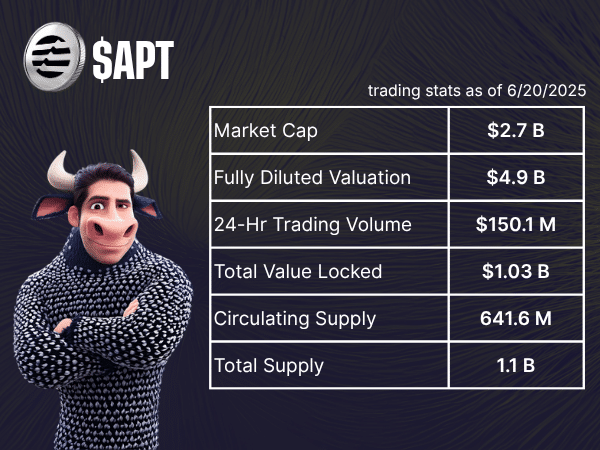

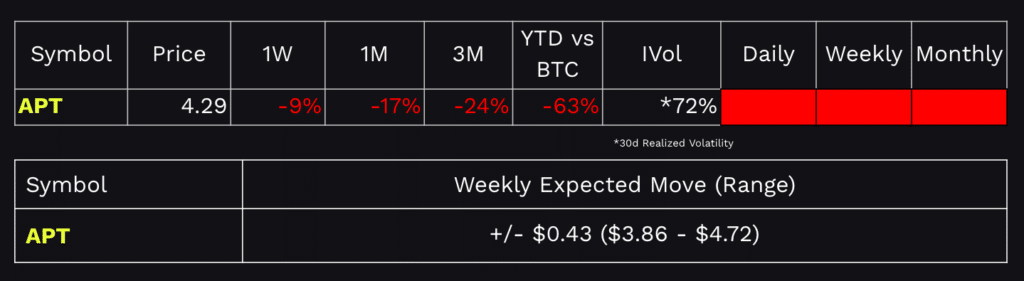

Dan’s pick for this week: Aptos ($APT)

Website: https://aptosfoundation.org/

Aptos is an independent Layer 1 blockchain platform, designed with scalability, safety, and reliability as key principles to enable mainstream Web3 adoption. Built using the Move programming language and featuring innovative parallel execution through Block-STM technology, Aptos can handle over 150,000 transactions per second while maintaining security through its AptosBFT consensus mechanism. The platform has rapidly emerged as one of the fastest-growing blockchain ecosystems, with over 330 projects currently building on the network.

Key Info

Aptos ranks 6th overall in daily active addresses among all Layer 1 blockchains and has processed over 2 billion transactions in 2024

As of Q1 2025, over 71 million wallets exist on the Aptos Network

In Q1 2025 alone, nearly 36.26 million monthly active users were seen, including 30 million new users

Stablecoin supply has grown from $97 million in Q1 2024 to over $1.2 billion in 2025

Conclusion:

Aptos has established itself as one of the fastest-growing Layer 1 blockchains. It has demonstrated remarkable traction across all key metrics with nearly 20x TVL growth, approaching 9 million monthly active users, and over $1 billion in stablecoin adoption. The platform’s technical innovations including Move programming language and parallel execution capabilities, combined with strong developer adoption (96% growth) and a robust ecosystem of 330+ projects, position it as a serious contender in the competitive Layer 1 landscape.

Further Links:

DeFi Llama dashboard – https://defillama.com/chain/aptos

Ecosystem Directory – https://aptosfoundation.org/ecosystem/projects

Chart – https://www.tradingview.com/chart/PISdw9IP/?symbol=COINBASE%3AAPTUSD

Available to trade at tastytrade – https://www.tastycrypto.com/tastytrade/