Author: Ryan Grace

April 25, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

The cave has been a little short-staffed this week, Shelley is out hunting Sasquatch and Laurence is wandering the desert. In their absence, Dan and I have been scheming. We’ve been conducting some research, talking trade ideas, and trying to figure out how to hook a pressure washer up to a gas can.

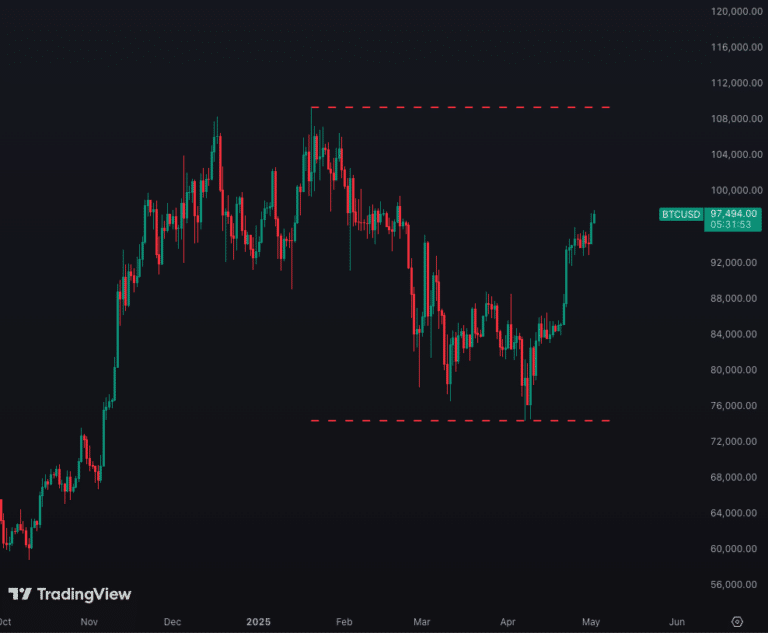

We are 377 days in and 100k is back in the cross-hairs. Let’s go.

Biggest Weekly Gainers

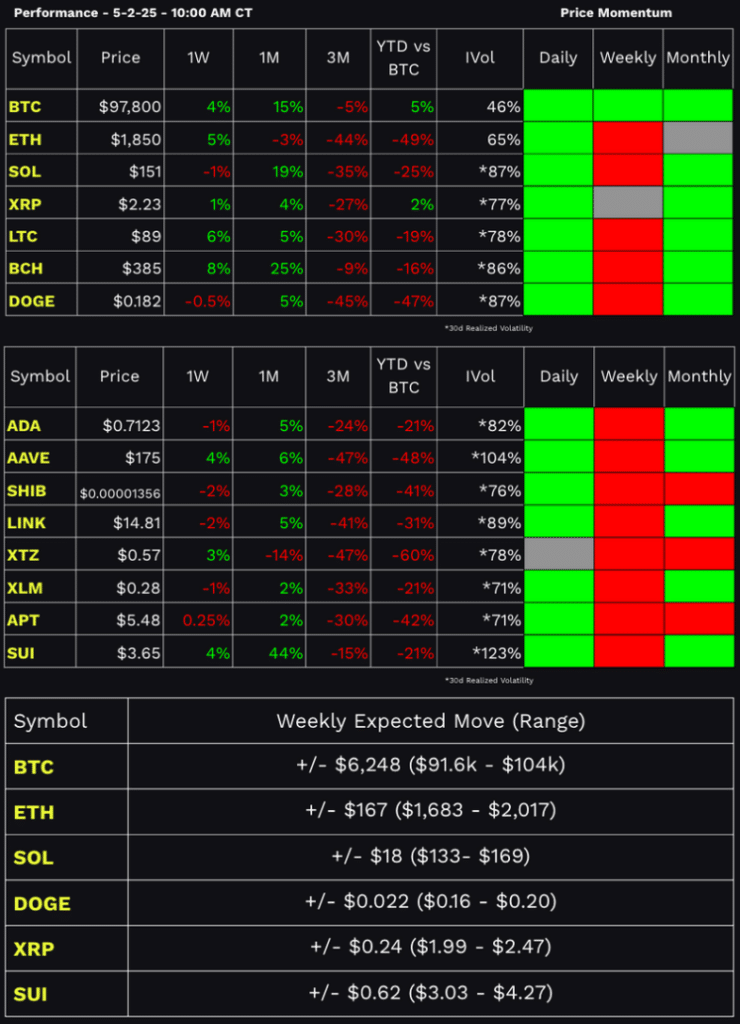

*As of 10:00 AM, 5-2-25

Available at tastytrade

BCH +8%

LTC +6%

ETH +5%

Decentralized Exchange – (Available through tastycrypto)

VIRTUAL + 96%

LAYER +30%

PENGU +27%

It feels better out there.

That said, while we’re seeing some green shoots, weekly price momentum is still bearish for many tokens beyond BTC.

As I wrote about Wednesday… BTC is trading much better than most of the market. Bitcoin Dominance is pushing new multi-year highs at 65%, with price momentum signaling potential for a move back to 100k and above.

After pulling back 30% from Jan -April, we’ve got a very nice bounce underway, and if this is a re-ignition of the rally, then it’s only just getting started. I’m sticking with what’s working. Leaning heavy on BTC, while I dream of higher ETH prices.

The Pipeline is Flowing

Yeah, that’s right. After what felt like forever, we just got a BAF alert. Big Ass Flows are back.

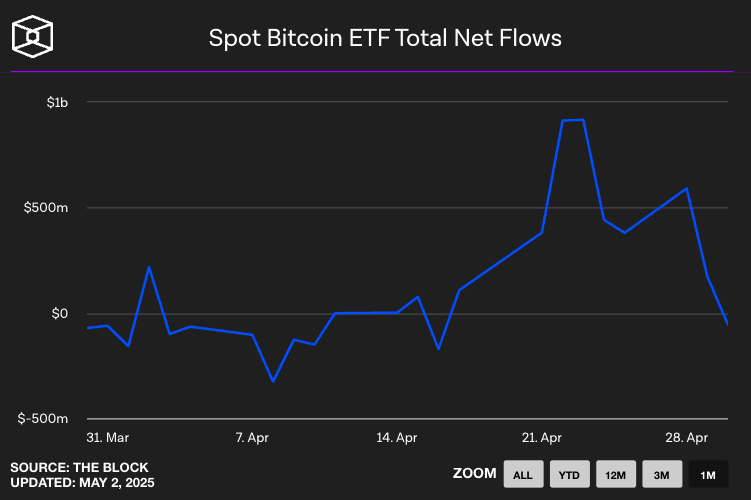

U.S. spot Bitcoin ETFs saw inflows of $917 million on April 22, 2025, marking the largest single-day inflow in 5-months.

Total spot BTC ETF AUM is now back at $118 billion, just shy of its $125 billion peak in January.

May the flows wash over you.

Dan's Stone Cold Crypto Pick of the Week

Each week we’re going to try and surface a new trade idea from the world of decentralized finance.

Dan’s pick for this week:

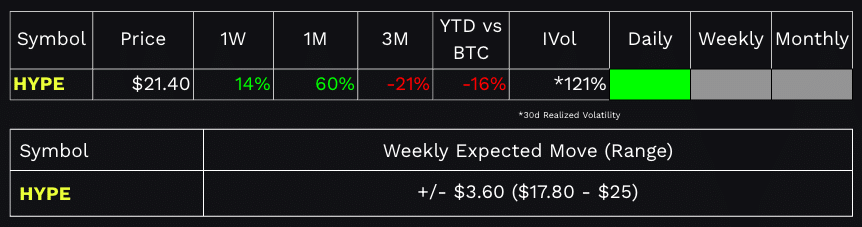

Hyperliquid is revolutionizing the decentralized exchange space with its high-performance Layer-1 blockchain, HyperEVM. By combining the speed of centralized systems with the transparency and security of decentralized solutions, Hyperliquid delivers near-instant trade settlements and unparalleled throughput. With impressive usage metrics and a growing reputation, this platform could redefine how traders engage with perpetual futures.

Some stats for your consideration:

Revenue & Usage Metrics

- 30 Day Active Users: 432.3K

- Total Value Locked: $827m

- 24 hr Revenue: $1.26m

- Total Exchange Volume: $181.8m

Pretty Charts

Trying something new here and just posting a few pictures I’ve come across in my internet travels.

A little sprinkle of brain food in the water.

NFA / DYOR

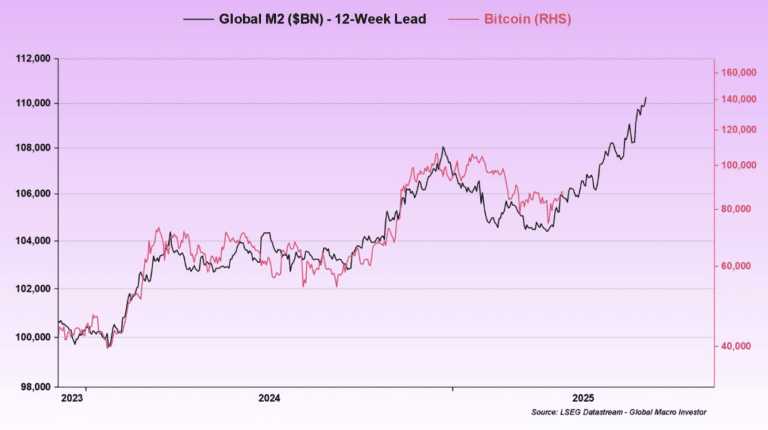

Liquidity as measured by global M2 appears to lead BTC on 12-week basis.

Source: https://x.com/RaoulGMI

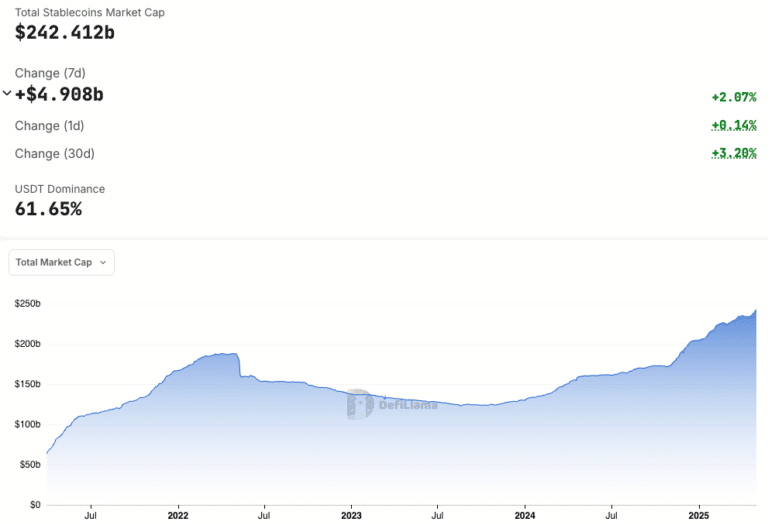

Fiat flowing onchain. Total stablecoin market cap is now at an all-time high.

Source: Defillama.com

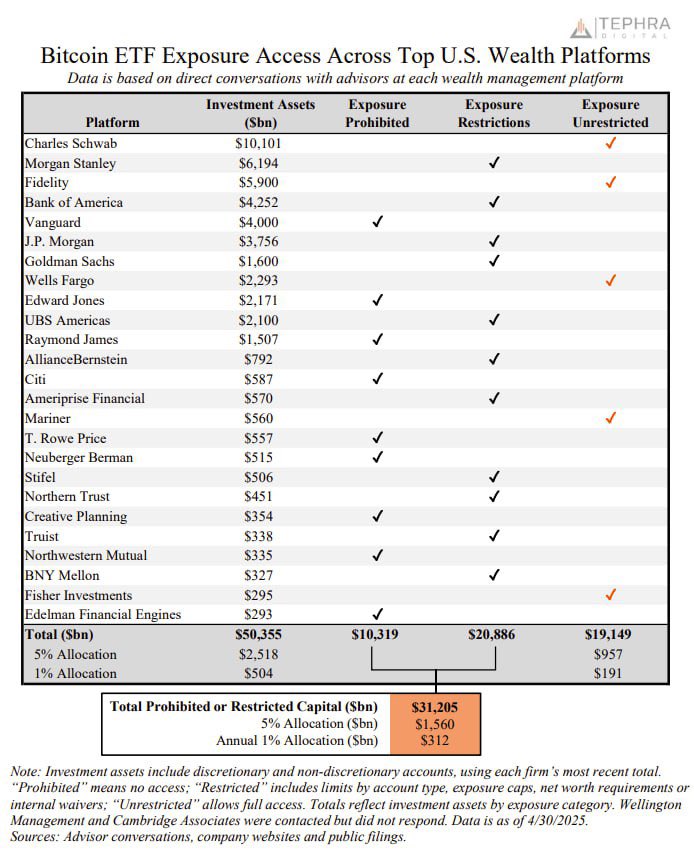

Reminder! Most large US wealth management platforms still aren’t permitted to offer BTC.

Source: https://x.com/Tephra_Digital

Is the AI Agent trade about to pop off again?

Source: TradingView

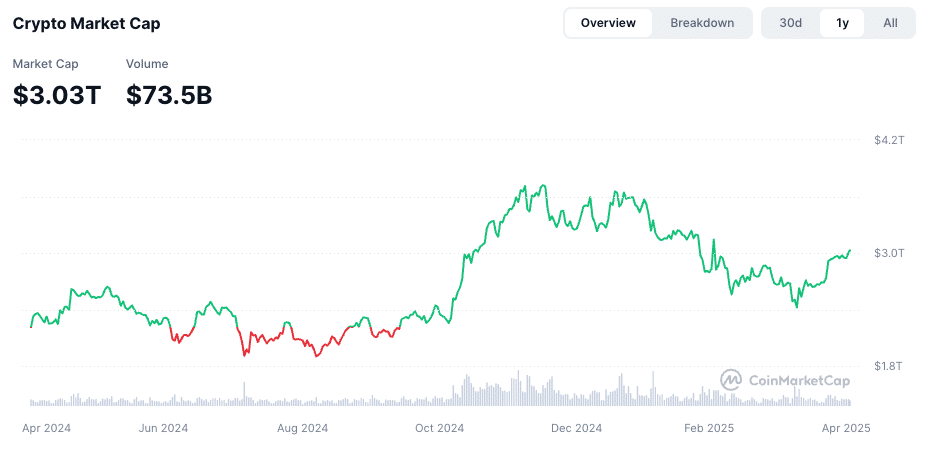

Total Crypto Market Cap back to $3T.

Source: CoinmarketCap

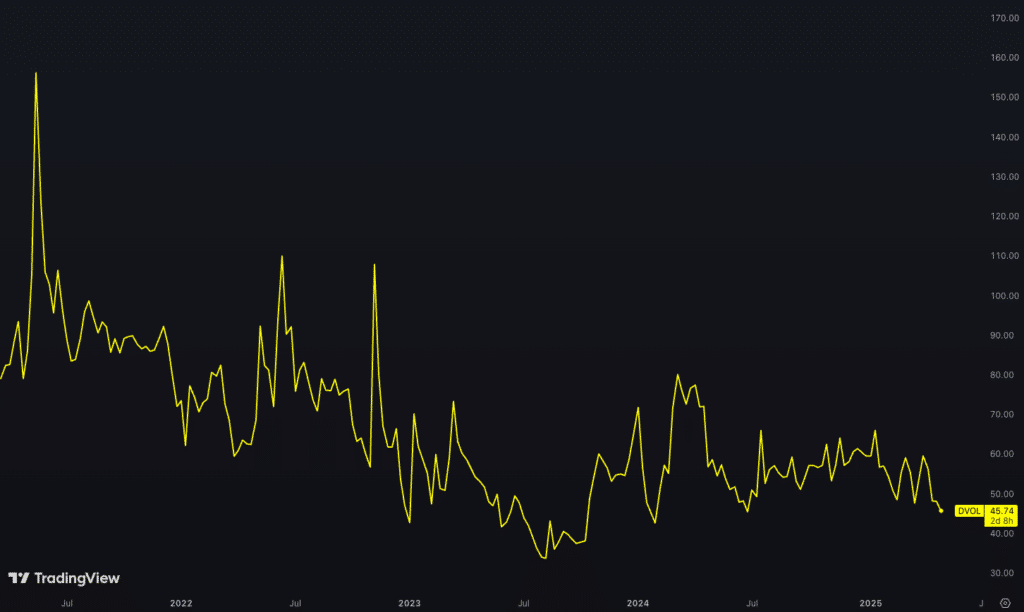

For the call option buyers, BTC IV is low-ish. Cheap-ish.

Source: TradingView

Looking Ahead

There’s an FOMC meeting and interest rate decision announcement scheduled for Wednesday (5/7) though it’s unlikely there’s any change to interest rate policy.

Both implied and realized volatility has come down following its early-April pop. As a result we have tighter estimated trading ranges for the next week, but don’t get complacent.

BTC is now pricing in a range of roughly 92k -104k, while ETH’s estimated trading range could take us back above 2k again. Daily price momentum is bullish and we’re clawing our way back into an environment where it might be a bit easier BTD within the implied volatility estimated trading range.

Zooming out the multi-moth range is basically 75k – 110k.

As always, keep your head on a swivel.

Stay tasty,

Ryan